Describe and Prepare Closing Entries for a Business

Mitchell Franklin; Patty Graybeal; and Dixon Cooper

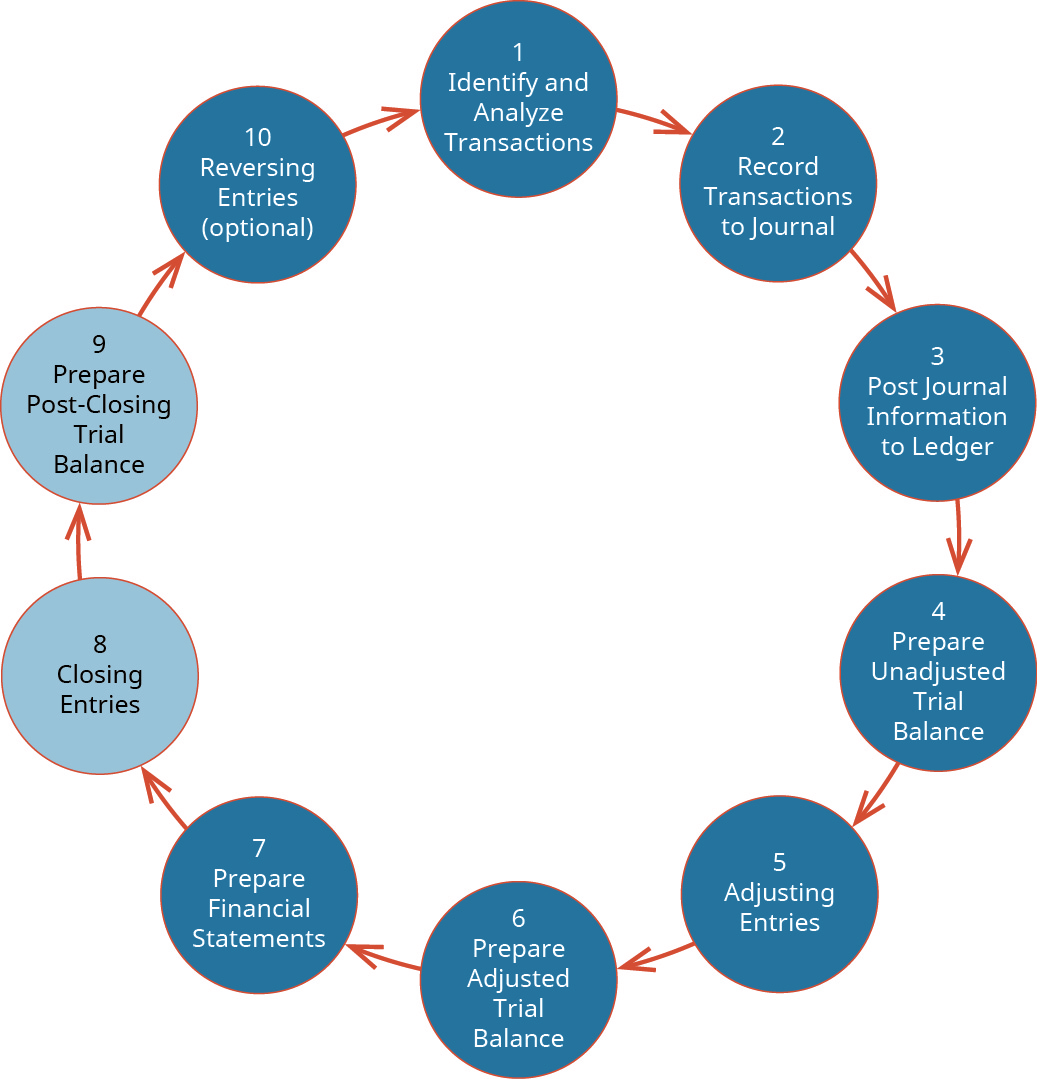

In this chapter, we complete the final steps (steps 8 and 9) of the accounting cycle, the closing process. You will notice that we do not cover step 10, reversing entries. This is an optional step in the accounting cycle that you will learn about in future courses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process.

Our discussion here begins with journalizing and posting the closing entries ((Figure)). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded.

You are an accountant for a small event-planning business. The business has been operating for several years but does not have the resources for accounting software. This means you are preparing all steps in the accounting cycle by hand.

It is the end of the month, and you have completed the post-closing trial balance. You notice that there is still a service revenue account balance listed on this trial balance. Why is it considered an error to have a revenue account on the post-closing trial balance? How do you fix this error?

Introduction to the Closing Entries

Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. However, most companies prepare monthly financial statements and close their books annually, so they have a clear picture of company performance during the year, and give users timely information to make decisions.

Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. Closing, or clearing the balances, means returning the account to a zero balance. Having a zero balance in these accounts is important so a company can compare performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings. Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption.

To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period. The revenue and expense accounts should start at zero each period, because we are measuring how much revenue is earned and expenses incurred during the period. However, the cash balances, as well as the other balance sheet accounts, are carried over from the end of a current period to the beginning of the next period.

For example, a store has an inventory account balance of $100,000. If the store closed at 11:59 p.m. on January 31, 2019, then the inventory balance when it reopened at 12:01 a.m. on February 1, 2019, would still be $100,000. The balance sheet accounts, such as inventory, would carry over into the next period, in this case February 2019.

The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. Zeroing January 2019 would then enable the store to calculate the income (profit or loss) for the next month (February 2019), instead of merging it into January’s income and thus providing invalid information solely for the month of February.

However, if the company also wanted to keep year-to-date information from month to month, a separate set of records could be kept as the company progresses through the remaining months in the year. For our purposes, assume that we are closing the books at the end of each month unless otherwise noted.

Let’s look at another example to illustrate the point. Assume you own a small landscaping business. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year. You see that you earned $120,000 this year in revenue and had expenses for rent, electricity, cable, internet, gas, and food that totaled $70,000.

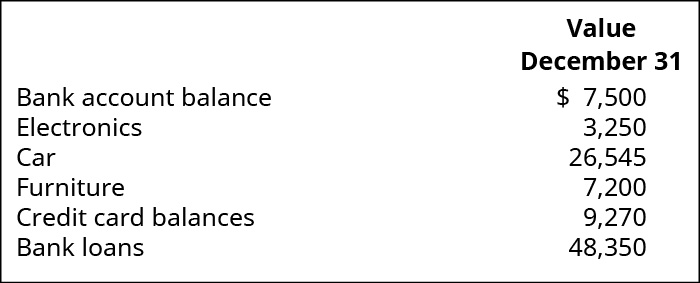

You also review the following information:

The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019. What are your year-to-date earnings? So far, you have not worked at all in the current year. What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year? You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period.

Next, you review your assets and liabilities. What is your current bank account balance? What is the current book value of your electronics, car, and furniture? What about your credit card balances and bank loans? Are the value of your assets and liabilities now zero because of the start of a new year? Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period.

This is no different from what will happen to a company at the end of an accounting period. A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance. Stockholders’ equity accounts will also maintain their balances. In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

Understanding the accounting cycle and preparing trial balances is a practice valued internationally. The Philippines Center for Entrepreneurship and the government of the Philippines hold regular seminars going over this cycle with small business owners. They are also transparent with their internal trial balances in several key government offices. Check out this article talking about the seminars on the accounting cycle and this public pre-closing trial balance presented by the Philippines Department of Health.

Temporary and Permanent Accounts

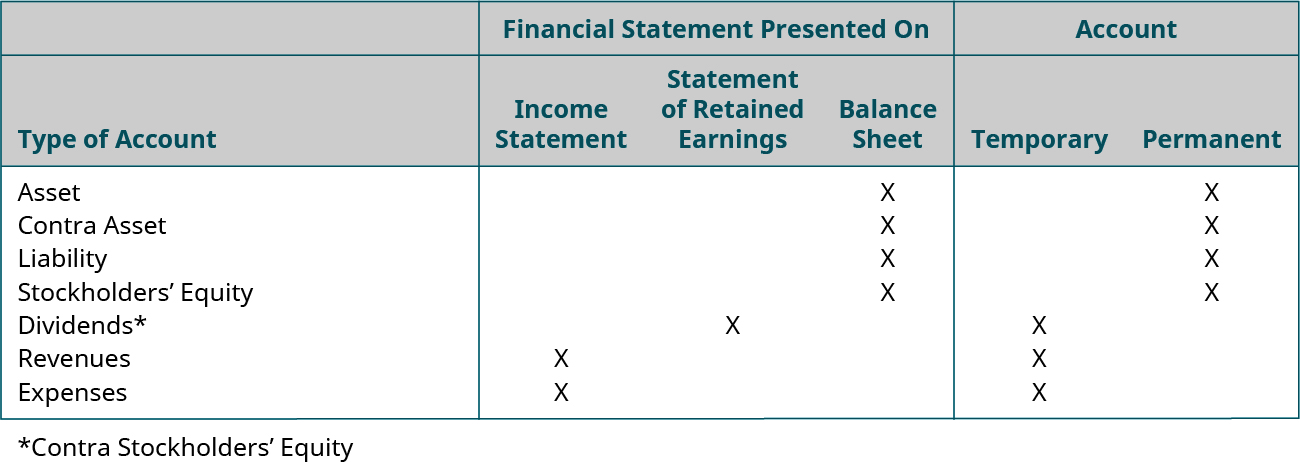

All accounts can be classified as either permanent (real) or temporary (nominal) ((Figure)).

Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity. These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. Permanent accounts are not part of the closing process.

Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. The new account, Income Summary, will be discussed shortly. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings.

The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account.

Income summary is a nondefined account category. This means that it is not an asset, liability, stockholders’ equity, revenue, or expense account. The account has a zero balance throughout the entire accounting period until the closing entries are prepared. Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements.

You might be asking yourself, “is the Income Summary account even necessary?” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained earnings.

Following is a list of accounts. State whether each account is a permanent or temporary account.

- rent expense

- unearned revenue

- accumulated depreciation, vehicle

- common stock

- fees revenue

- dividends

- prepaid insurance

- accounts payable

Solution

A, E, and F are temporary; B, C, D, G, and H are permanent.

Let’s now look at how to prepare closing entries.

Journalizing and Posting Closing Entries

The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

Four entries occur during the closing process. The first entry closes revenue accounts to the Income Summary account. The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings. The information needed to prepare closing entries comes from the adjusted trial balance.

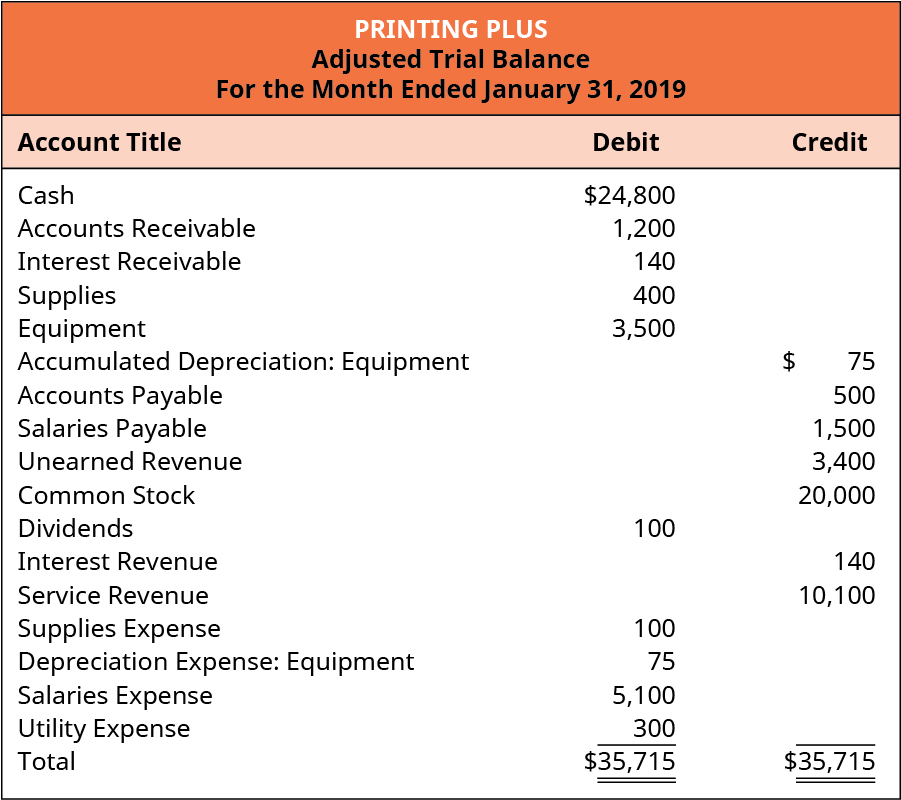

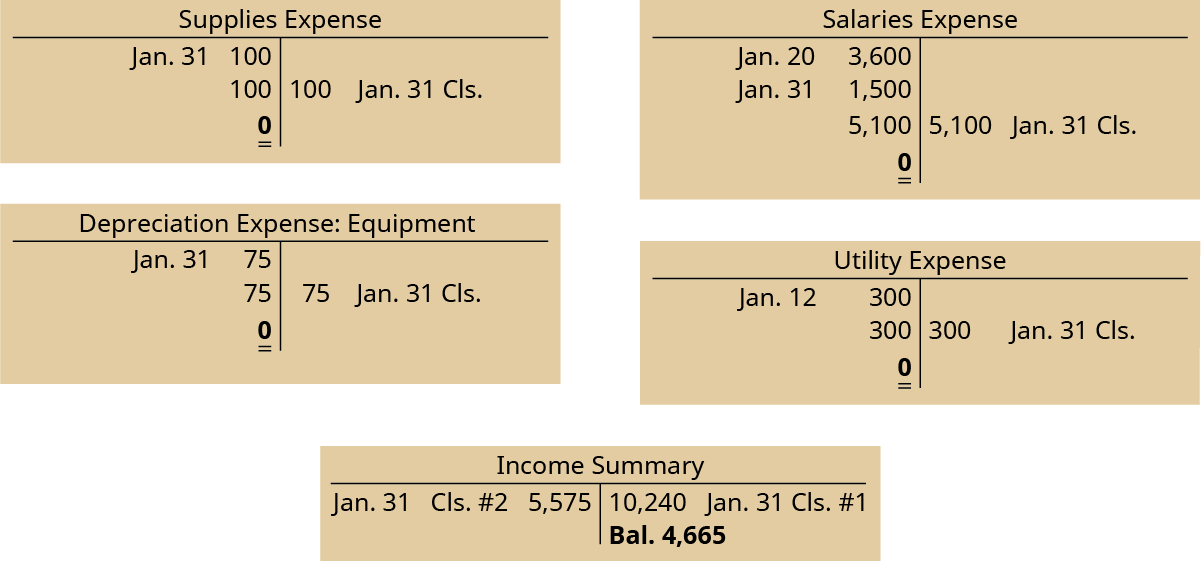

Let’s explore each entry in more detail using Printing Plus’s information from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plus adjusted trial balance for January 31, 2019, is presented in (Figure).

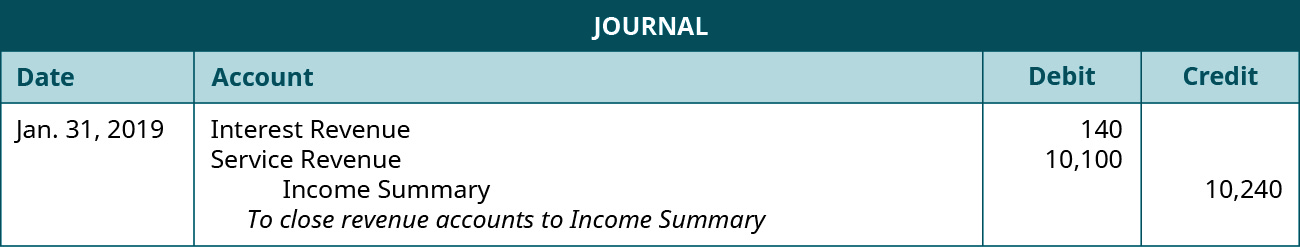

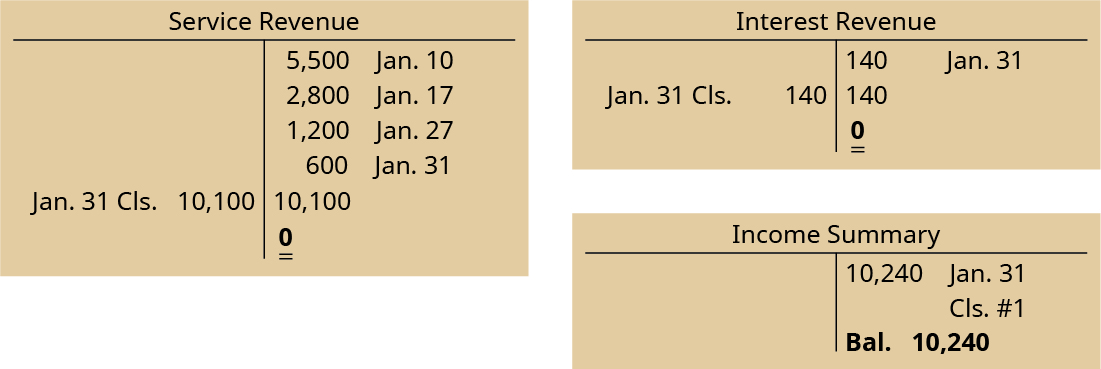

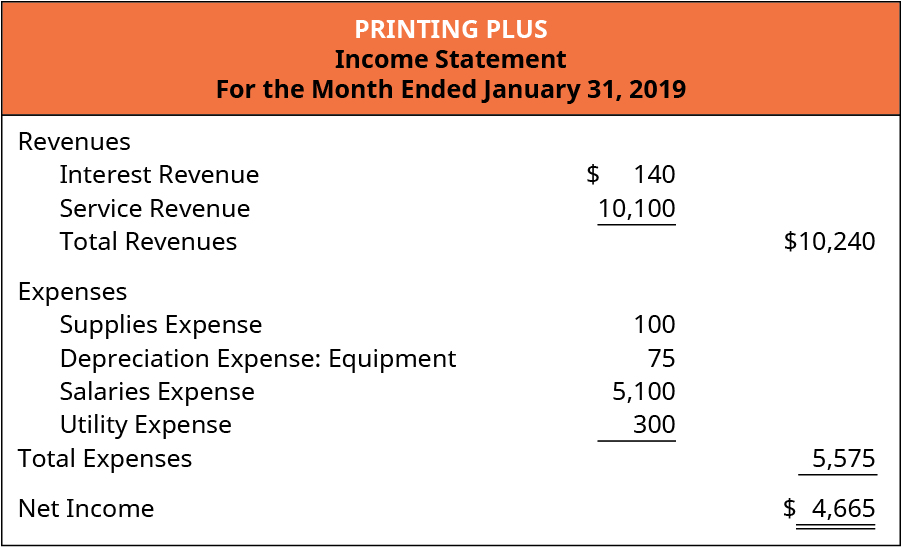

The first entry requires revenue accounts close to the Income Summary account. To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

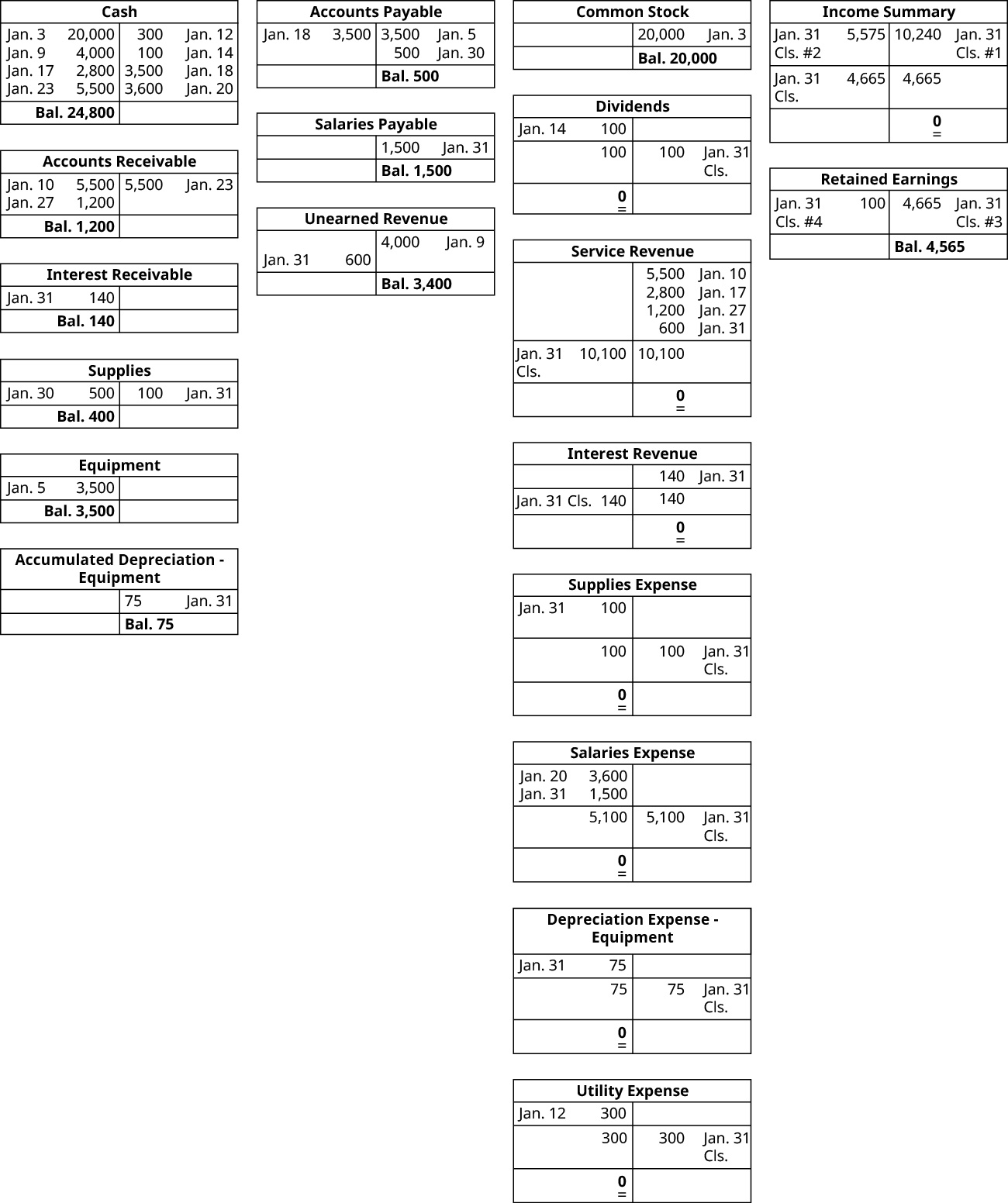

The T-accounts after this closing entry would look like the following.

Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period. The Income Summary account has a credit balance of $10,240 (the revenue sum).

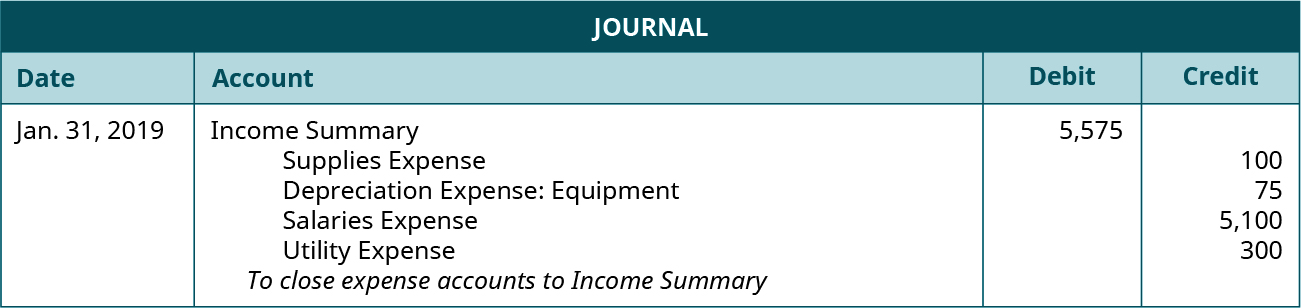

The second entry requires expense accounts close to the Income Summary account. To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance. The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary.

The T-accounts after this closing entry would look like the following.

Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period. The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses ((Figure)). The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement.

Why are these two figures the same? The income statement summarizes your income, as does income summary. If both summarize your income in the same period, then they must be equal. If they do not match, then you have an error.

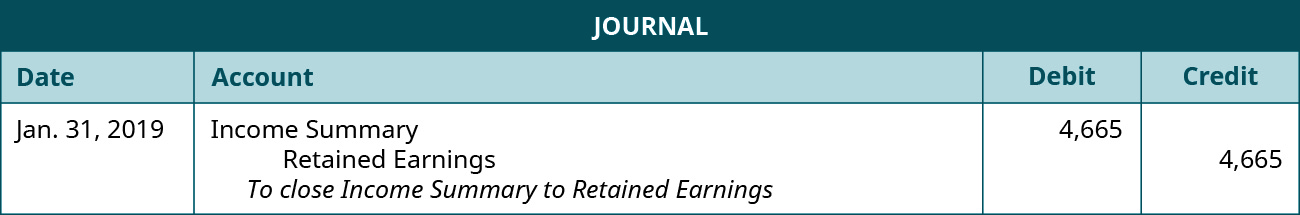

The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider.

- If the balance in Income Summary before closing is a credit balance, you will debit Income Summary and credit Retained Earnings in the closing entry. This situation occurs when a company has a net income.

- If the balance in Income Summary before closing is a debit balance, you will credit Income Summary and debit Retained Earnings in the closing entry. This situation occurs when a company has a net loss.

Remember that net income will increase retained earnings, and a net loss will decrease retained earnings. The Retained Earnings account increases on the credit side and decreases on the debit side.

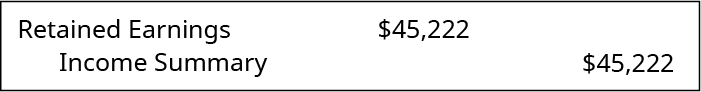

Printing Plus has a $4,665 credit balance in its Income Summary account before closing, so it will debit Income Summary and credit Retained Earnings.

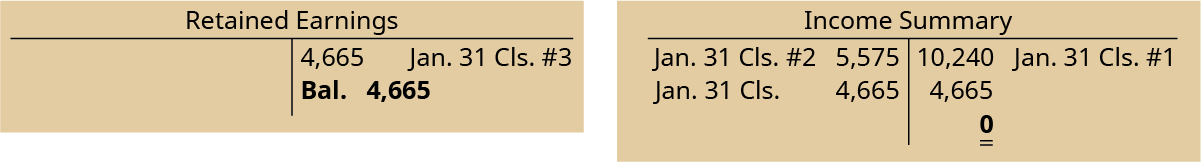

The T-accounts after this closing entry would look like the following.

Notice that the Income Summary account is now zero and is ready for use in the next period. The Retained Earnings account balance is currently a credit of $4,665.

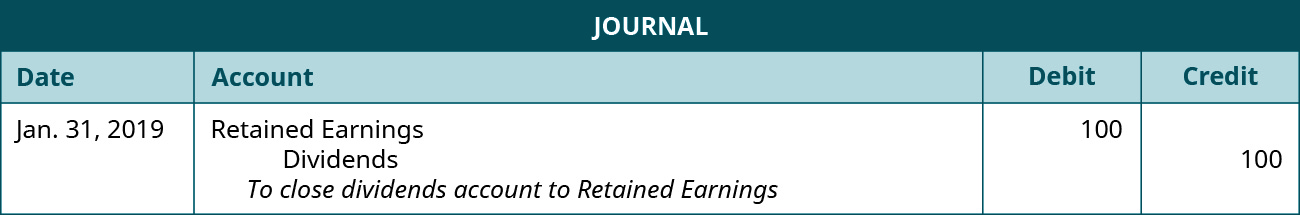

The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff. Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders.

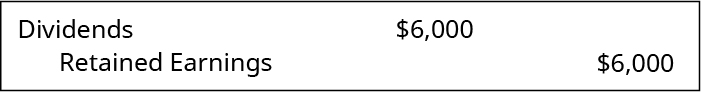

If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made. Printing Plus has $100 of dividends with a debit balance on the adjusted trial balance. The closing entry will credit Dividends and debit Retained Earnings.

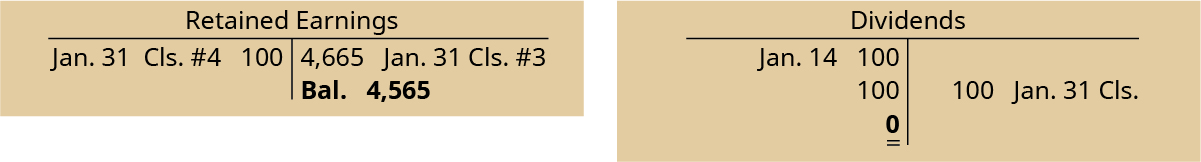

The T-accounts after this closing entry would look like the following.

Why was income summary not used in the dividends closing entry? Dividends are not an income statement account. Only income statement accounts help us summarize income, so only income statement accounts should go into income summary.

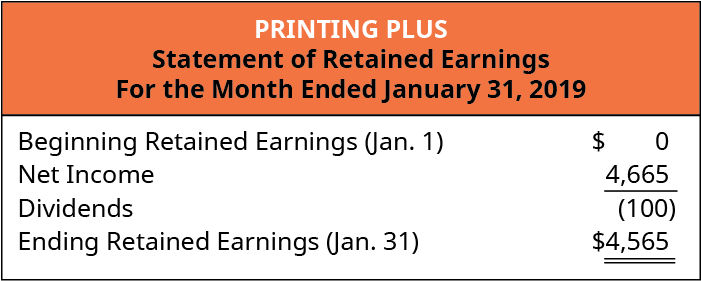

Remember, dividends are a contra stockholders’ equity account. It is contra to retained earnings. If we pay out dividends, it means retained earnings decreases. Retained earnings decreases on the debit side. The remaining balance in Retained Earnings is $4,565 ((Figure)). This is the same figure found on the statement of retained earnings.

The statement of retained earnings shows the period-ending retained earnings after the closing entries have been posted. When you compare the retained earnings ledger (T-account) to the statement of retained earnings, the figures must match. It is important to understand retained earnings is not closed out, it is only updated. Retained Earnings is the only account that appears in the closing entries that does not close. You should recall from your previous material that retained earnings are the earnings retained by the company over time—not cash flow but earnings. Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus.

T-Account Summary

The T-account summary for Printing Plus after closing entries are journalized is presented in (Figure).

Notice that revenues, expenses, dividends, and income summary all have zero balances. Retained earnings maintains a $4,565 credit balance. The post-closing T-accounts will be transferred to the post-closing trial balance, which is step 9 in the accounting cycle.

A company has revenue of $48,000 and total expenses of $52,000. What would the third closing entry be? Why?

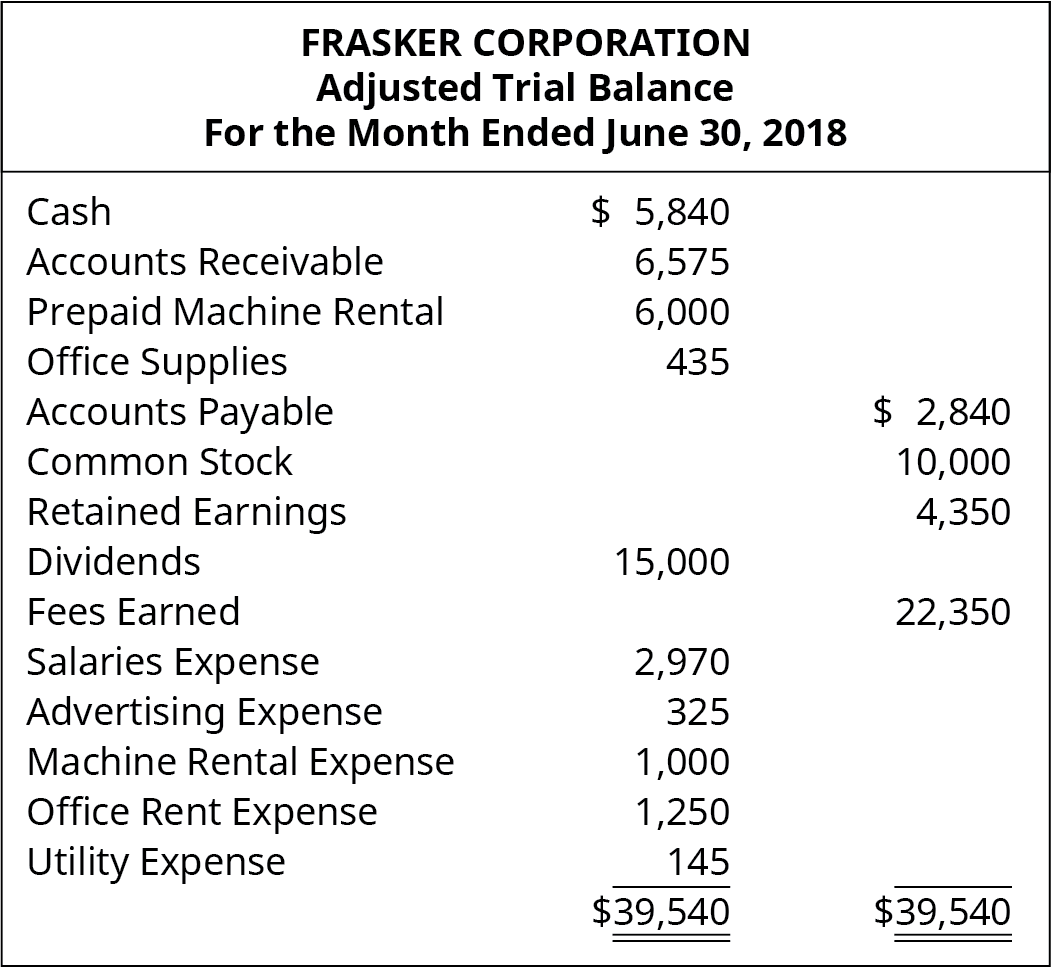

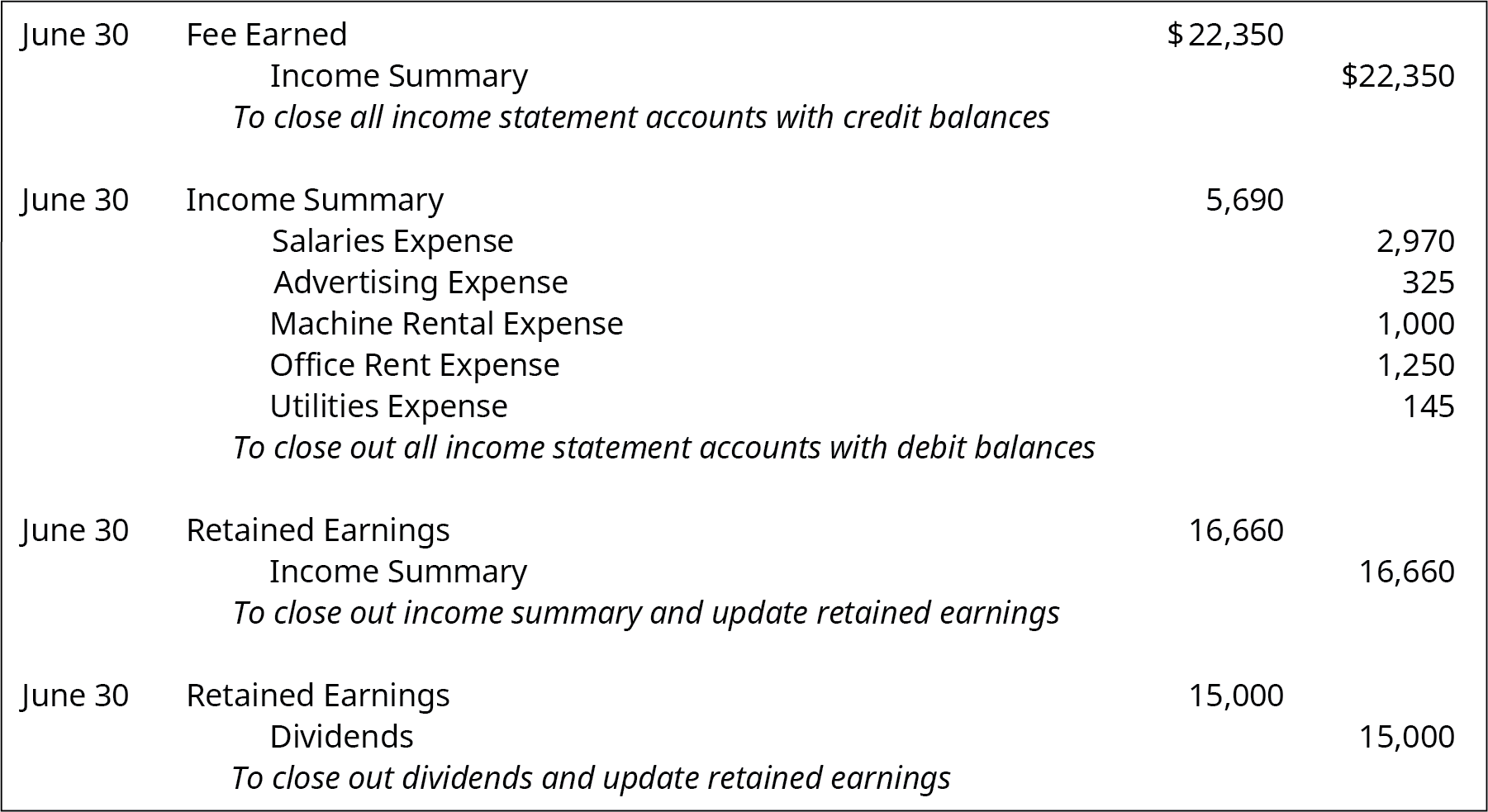

Prepare the closing entries for Frasker Corp. using the adjusted trial balance provided.

Solution

Key Concepts and Summary

- Closing entries: Closing entries prepare a company for the next period and zero out balance in temporary accounts.

- Purpose of closing entries: Closing entries are necessary because they help a company review income accumulation during a period, and verify data figures found on the adjusted trial balance.

- Permanent accounts: Permanent accounts do not close and are accounts that transfer balances to the next period. They include balance sheet accounts, such as assets, liabilities, and stockholder’s equity

- Temporary accounts: Temporary accounts are closed at the end of each accounting period and include income statement, dividends, and income summary accounts.

- Income Summary: The Income Summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period.

- Recording closing entries: There are four closing entries; closing revenues to income summary, closing expenses to income summary, closing income summary to retained earnings, and close dividends to retained earnings.

- Posting closing entries: Once all closing entries are complete, the information is transferred to the general ledger T-accounts. Balances in temporary accounts will show a zero balance.

Multiple Choice

(Figure)Which of the following accounts is considered a temporary or nominal account?

- Fees Earned Revenue

- Prepaid Advertising

- Unearned Service Revenue

- Prepaid Insurance

A

(Figure)Which of the following accounts is considered a permanent or real account?

- Interest Revenue

- Prepaid Insurance

- Insurance Expense

- Supplies Expense

(Figure)If a journal entry includes a debit or credit to the Cash account, it is most likely which of the following?

- a closing entry

- an adjusting entry

- an ordinary transaction entry

- outside of the accounting cycle

C

(Figure)If a journal entry includes a debit or credit to the Retained Earnings account, it is most likely which of the following?

- a closing entry

- an adjusting entry

- an ordinary transaction entry

- outside of the accounting cycle

(Figure)Which of these accounts would be present in the closing entries?

- Dividends

- Accounts Receivable

- Unearned Service Revenue

- Sales Tax Payable

A

(Figure)Which of these accounts would not be present in the closing entries?

- Utilities Expense

- Fees Earned Revenue

- Insurance Expense

- Dividends Payable

(Figure)Which of these accounts is never closed?

- Dividends

- Retained Earnings

- Service Fee Revenue

- Income Summary

B

(Figure)Which of these accounts is never closed?

- Prepaid Rent

- Income Summary

- Rent Revenue

- Rent Expense

(Figure)Which account would be credited when closing the account for fees earned for the year?

- Accounts Receivable

- Fees Earned Revenue

- Unearned Fee Revenue

- Income Summary

D

(Figure)Which account would be credited when closing the account for rent expense for the year?

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Unearned Rent Revenue

Questions

(Figure)Explain what is meant by the term real accounts (also known as permanent accounts).

Real/permanent accounts are those that carry over from one period to the next, with a continuing balance in the account. Examples are asset accounts, liability accounts, and equity accounts. In contrast, revenue accounts, expense accounts, and dividend accounts are not real/permanent accounts.

(Figure)Explain what is meant by the term nominal accounts (also known as temporary accounts).

(Figure)What is the purpose of the closing entries?

Closing entries are used to transfer the contents of the temporary accounts into the permanent account, Retained Earnings, which resets the temporary balances to zero, enabling tracking of revenues, expenses, and dividends in the next period.

(Figure)What would happen if the company failed to make closing entries at the end of the year?

(Figure)Which of these account types (Assets, Liabilities, Equity, Revenue, Expense, Dividend) are credited in the closing entries? Why?

Expense accounts and dividend accounts are credited during closing. This is because closing requires that the account balances be cleared, to prepare for the next accounting period.

(Figure)Which of these account types (Assets, Liabilities, Equity, Revenue, Expense, Dividend) are debited in the closing entries? Why?

(Figure)The account called Income Summary is often used in the closing entries. Explain this account’s purpose and how it is used.

Income Summary is a super-temporary account that is only used for closing. The revenue accounts are closed by a debit to each account and a corresponding credit to Income Summary. Then the expense accounts are closed by a credit to each account and a corresponding debit to Income Summary. Finally, the balance in Income Summary is cleared by an entry that transfers its balance to Retained Earnings. Thus, it is used in three journal entries, as part of the closing process, and has no other purpose in the accounting records.

(Figure)What are the four entries required for closing, assuming that the Income Summary account is used?

(Figure)After the first two closing entries are made, Income Summary has a credit balance of $125,500. What does this indicate about the company’s net income or loss?

The fact that Income Summary has a credit balance (of any size) after the first two closing entries are made indicates that the company made a net profit for the period. In this case, a credit of $125,500 reflects the fact that the company earned net income of $125,500 for the period.

(Figure)After the first two closing entries are made, Income Summary has a debit balance of $22,750. What does this indicate about the company’s net income or loss?

Exercise Set A

(Figure)Identify whether each of the following accounts is nominal/temporary or real/permanent.

- Accounts Receivable

- Fees Earned Revenue

- Utility Expense

- Prepaid Rent

(Figure)For each of the following accounts, identify whether it is nominal/temporary or real/permanent, and whether it is reported on the Balance Sheet or the Income Statement.

- Interest Expense

- Buildings

- Interest Payable

- Unearned Rent Revenue

(Figure)For each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement).

- Accounts Payable

- Accounts Receivable

- Cash

- Dividends

- Fees Earned Revenue

- Insurance Expense

- Prepaid Insurance

- Supplies

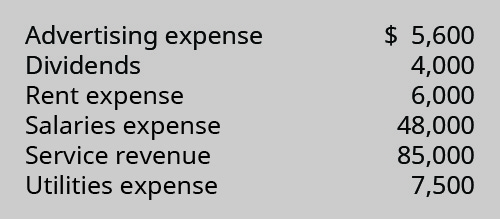

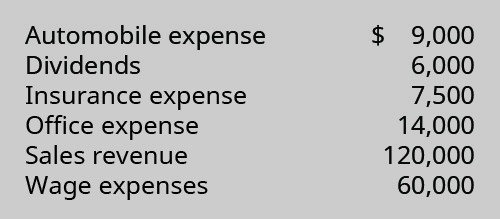

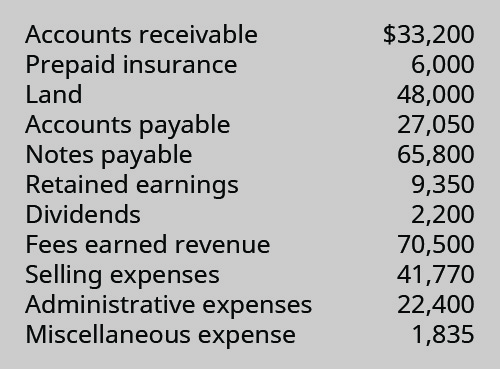

(Figure)The following accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

(Figure)The following accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

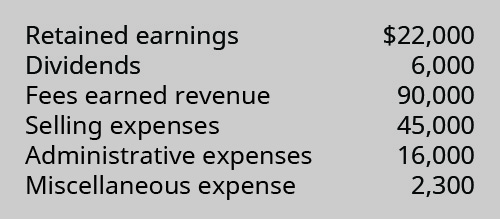

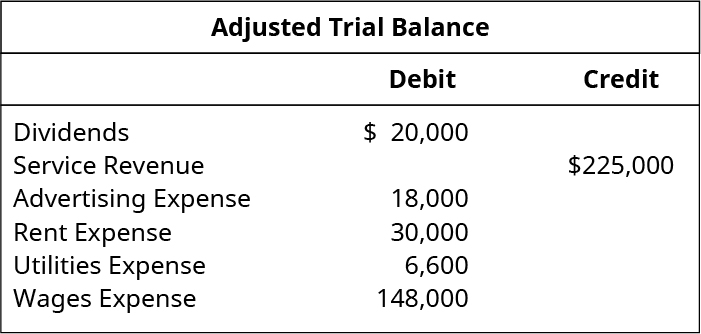

(Figure)Use the following excerpts from the year-end Adjusted Trial Balance to prepare the four journal entries required to close the books:

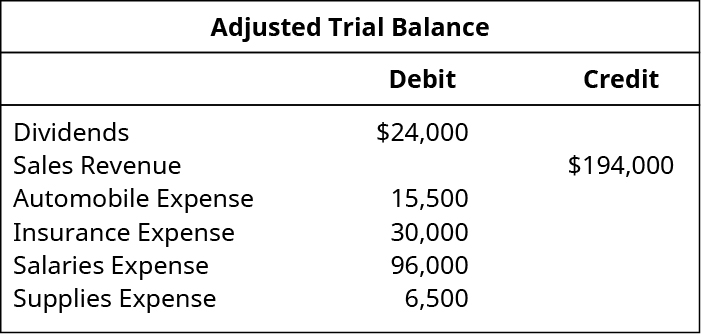

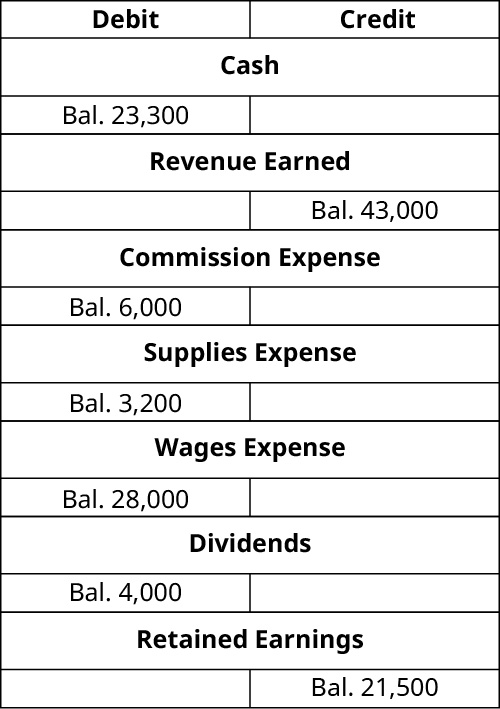

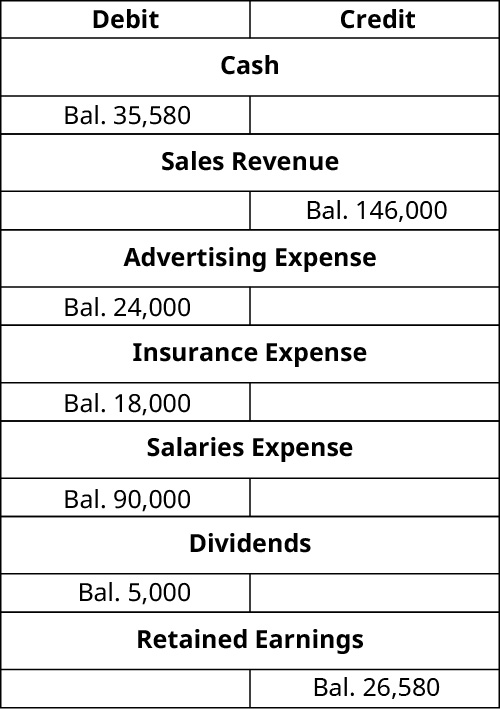

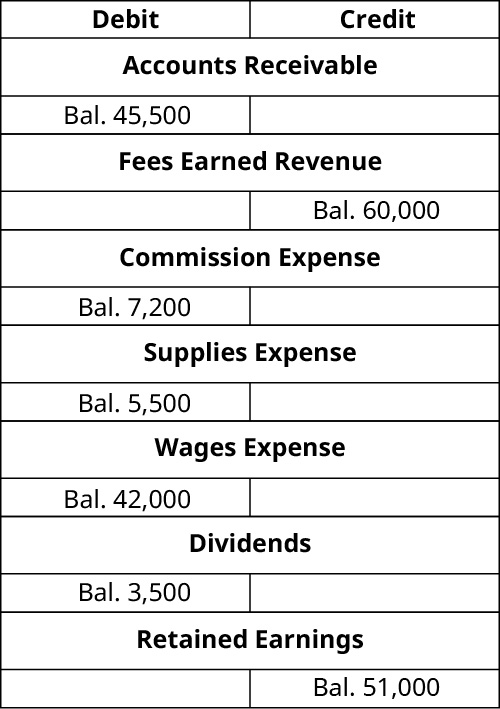

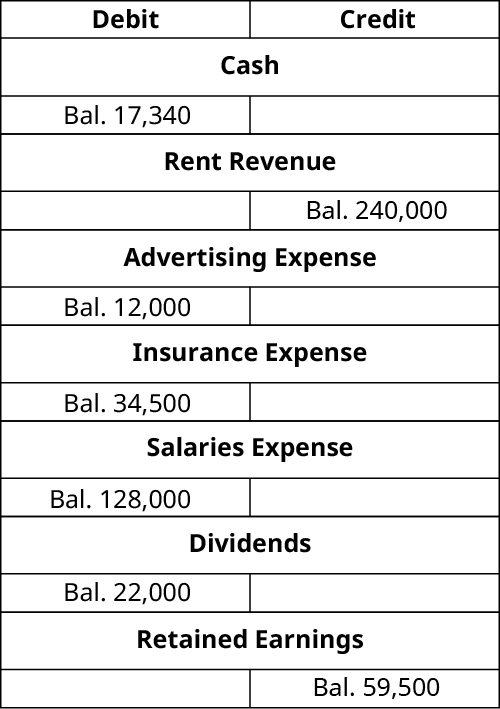

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

Exercise Set B

(Figure)Identify whether each of the following accounts are nominal/temporary or real/permanent.

- Rent Expense

- Unearned Service Fee Revenue

- Interest Revenue

- Accounts Payable

(Figure)For each of the following accounts, identify whether it is nominal/temporary or real/permanent, and whether it is reported on the Balance Sheet or the Income Statement.

- Salaries Payable

- Sales Revenue

- Salaries Expense

- Prepaid Insurance

(Figure)For each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement).

- Retained Earnings

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Salaries Expense

- Salaries Payable

- Supplies Expense

- Unearned Rent Revenue

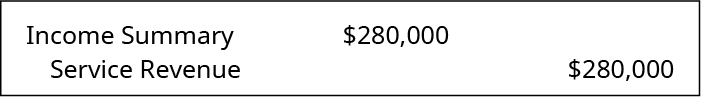

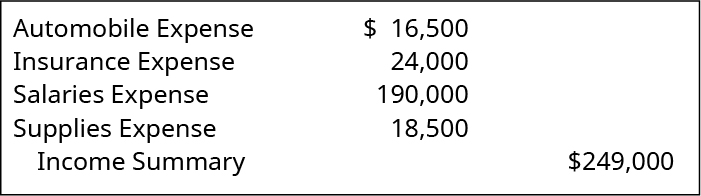

(Figure)The following accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

(Figure)The following accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

(Figure)Use the following excerpts from the year-end Adjusted Trial Balance to prepare the four journal entries required to close the books:

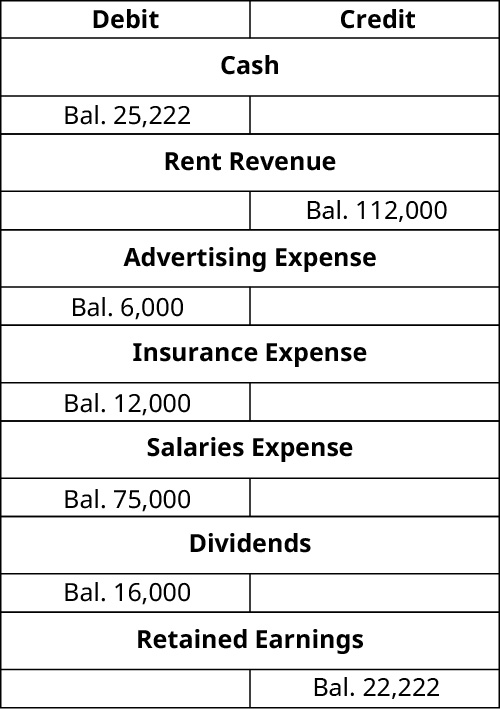

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

Problem Set A

(Figure)Identify whether each of the following accounts would be considered a permanent account (yes/no) and which financial statement it would be reported on (Balance Sheet, Income Statement, or Retained Earnings Statement).

- Accumulated Depreciation

- Buildings

- Depreciation Expense

- Equipment

- Fees Earned Revenue

- Insurance Expense

- Prepaid Insurance

- Supplies Expense

- Dividends

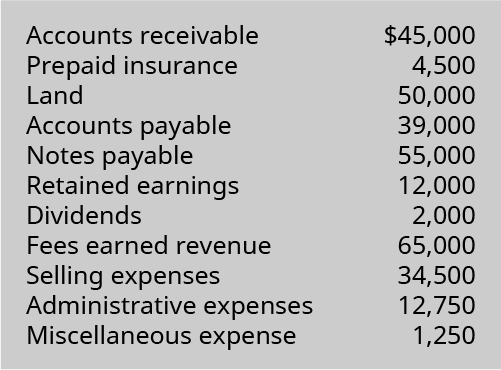

(Figure)The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

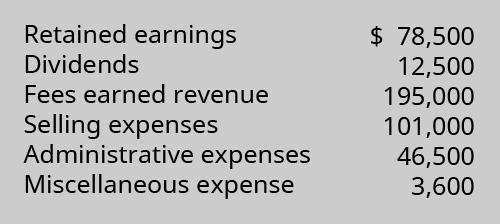

(Figure)The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books:

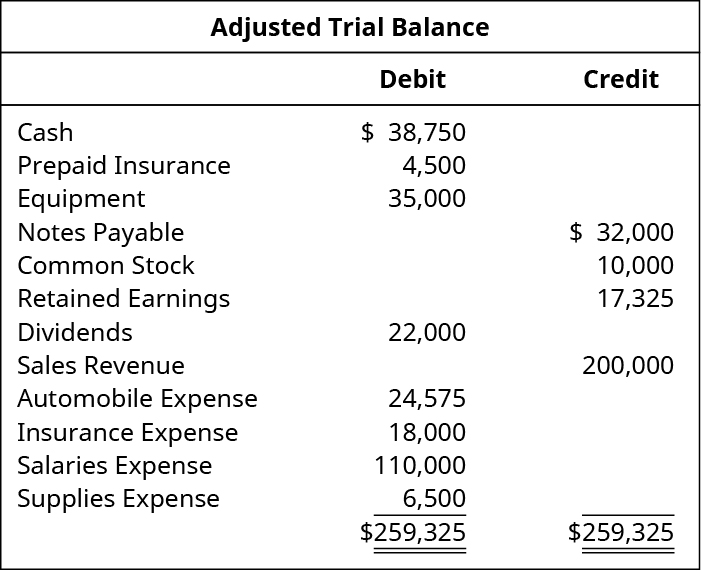

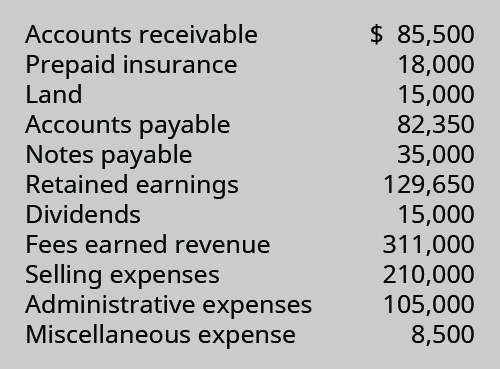

(Figure)Use the following Adjusted Trial Balance to prepare the four journal entries required to close the books:

(Figure)Use the following Adjusted Trial Balance to prepare the four journal entries required to close the books:

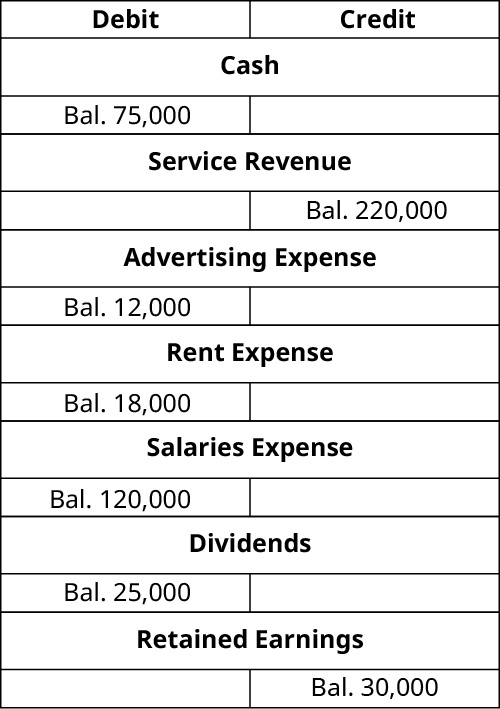

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

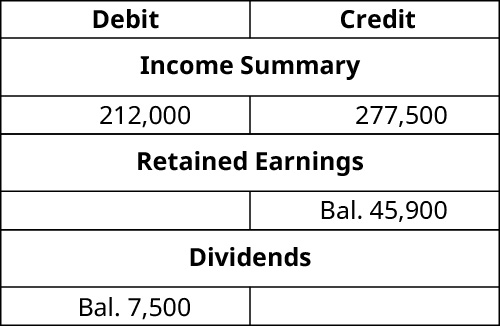

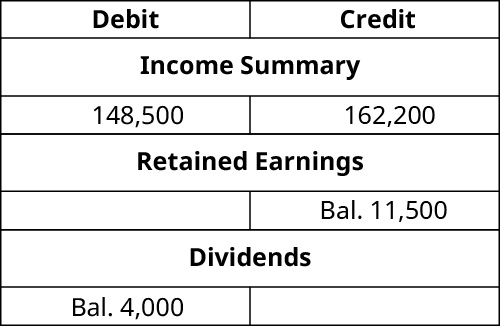

(Figure)Assume that the first two closing entries have been made and posted. Use the T-accounts provided as follows to:

- complete the closing entries

- determine the ending balance in the Retained Earnings account

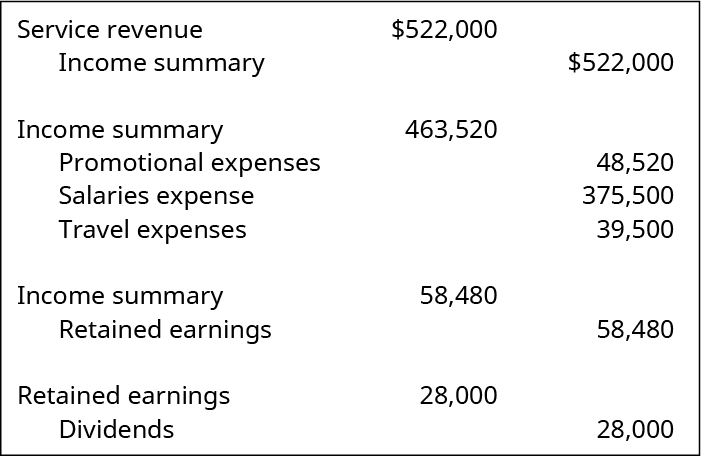

(Figure)Correct any obvious errors in the following closing entries by providing the four corrected closing entries. Assume all accounts held normal account balances in the Adjusted Trial Balance.

Problem Set B

(Figure)Identify whether each of the following accounts would be considered a permanent account (yes/no) and which financial statement it would be reported on (Balance Sheet, Income Statement, or Retained Earnings Statement).

- Common Stock

- Dividends

- Dividends Payable

- Equipment

- Income Tax Expense

- Income Tax Payable

- Service Revenue

- Unearned Service Revenue

- Net Income

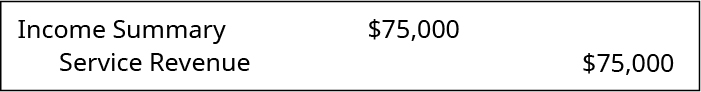

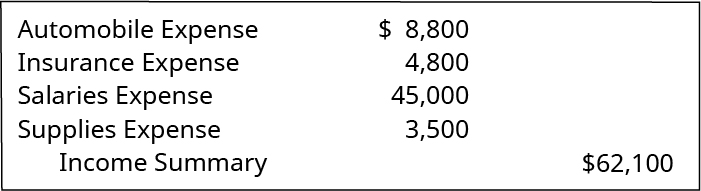

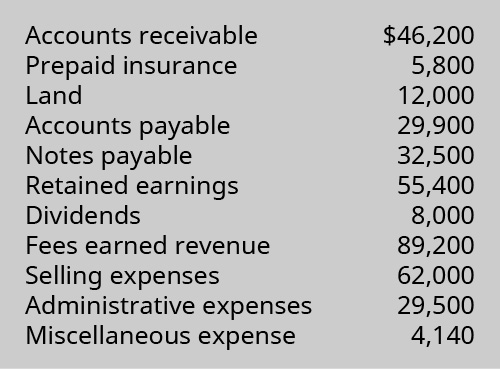

(Figure)The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:

(Figure)The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books:

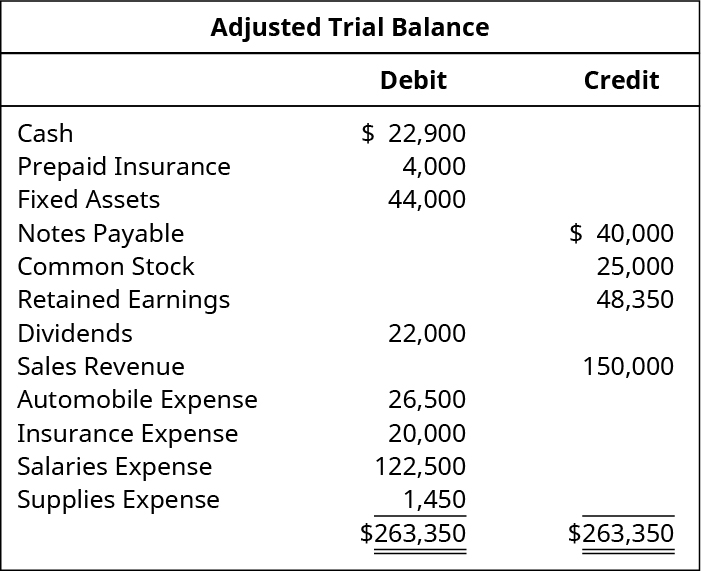

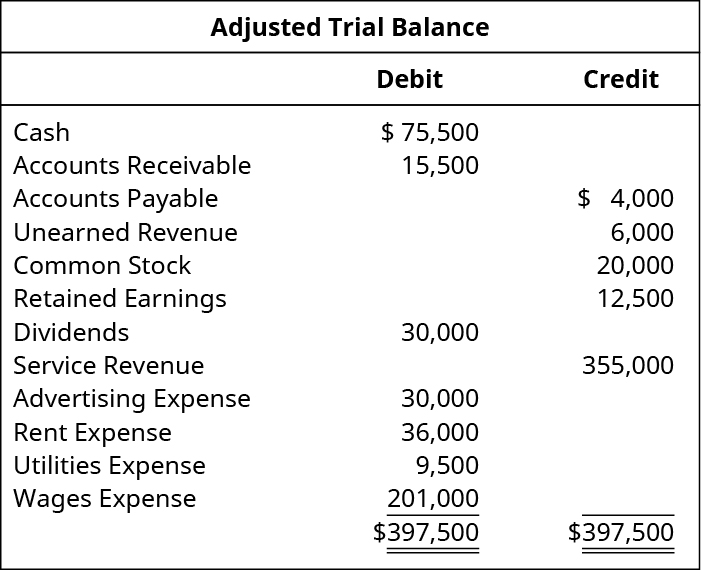

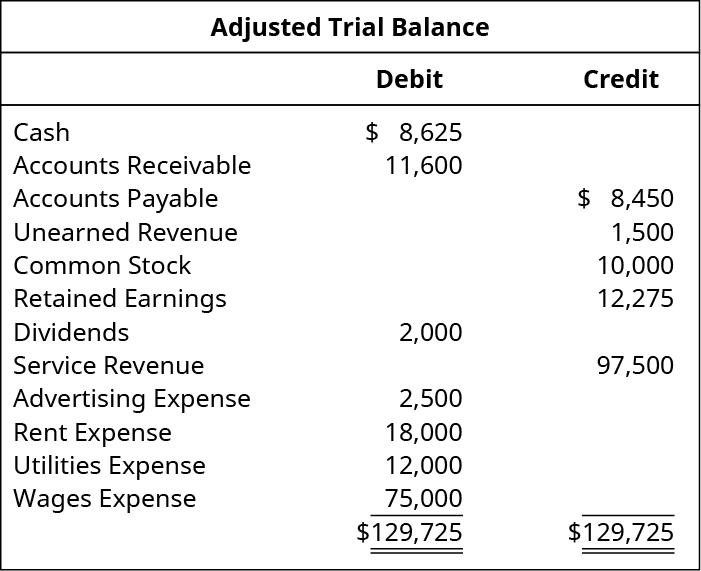

(Figure)Use the following Adjusted Trial Balance to prepare the four journal entries required to close the books:

(Figure)Use the following Adjusted Trial Balance to prepare the four journal entries required to close the books:

(Figure)Use the following T-accounts to prepare the four journal entries required to close the books:

(Figure)Assume that the first two closing entries have been made and posted. Use the T-accounts provided below to:

- complete the closing entries

- determine the ending balance in the Retained Earnings account

(Figure)Correct any obvious errors in the following closing entries by providing the four corrected closing entries. Assume all accounts held normal account balances in the Adjusted Trial Balance.

Thought Provokers

(Figure)Assume you are the controller of a large corporation, and the chief executive officer (CEO) has requested that you refrain from posting closing entries at 20X1 year-end, with the intention of combining the two years’ profits in year 20X2, in an effort to make that year’s profits appear stronger.

Write a memo to the CEO, to offer your response to the request to skip the closing entries for year 20X1.

(Figure)Search the Securities and Exchange Commission website (https://www.sec.gov/edgar/searchedgar/companysearch.html) and locate the latest Form 10-K for a company you would like to analyze. Submit a short memo:

- State the name and ticker symbol of the company you have chosen.

- Review the company’s end-of-period Balance Sheet, Income Statement, and Statement of Retained Earnings.

- Use the information in these financial statements to answer these questions:

- If the company had used the income summary account for its closing entries, how much would the company have credited the Income Summary account in the first closing entry?

- How much would the company have debited the Income Summary account in the second closing entry?

Provide the web link to the company’s Form 10-K, to allow accurate verification of your answers.

(Figure)Assume you are a senior accountant and have been assigned the responsibility for making the entries to close the books for the year. You have prepared the following four entries and presented them to your boss, the chief financial officer of the company, along with the company CEO, in the weekly staff meeting:

As the CEO was reviewing your work, he asked the question, “What do these entries mean? Can we learn anything about the company from reviewing them?”

Provide an explanation to give to the CEO about what the entries reveal about the company’s operations this year.

Glossary

- closing

- returning the account to a zero balance

- closing entry

- prepares a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period

- income summary

- intermediary between revenues and expenses, and the Retained Earnings account, storing all the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period

- permanent (real) account

- account that transfers balances to the next period, and includes balance sheet accounts, such as assets, liabilities, and stockholder’s equity

- post-closing trial balance

- trial balance that is prepared after all the closing entries have been recorded

- temporary (nominal) account

- account that is closed at the end of each accounting period, and includes income statement, dividends, and income summary accounts