Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries

Mitchell Franklin; Patty Graybeal; and Dixon Cooper

The bank is a very important partner to all businesses. Not only does the bank provide basic checking services, but they process credit card transactions, keep cash safe, and may finance loans when needed.

Bank accounts for businesses can involve thousands of transactions per month. Due to the number of ongoing transactions, an organization’s book balance for its checking account rarely is the same as the balance that the bank records reflect for the entity at any given point. These timing differences are typically caused by the fact that there will be some transactions that the organization is aware of before the bank, or transactions the bank is aware of before the company.

For example, if a company writes a check that has not cleared yet, the company would be aware of the transaction before the bank is. Similarly, the bank might have received funds on the company’s behalf and recorded them in the bank’s records for the company before the organization is aware of the deposit.

With the large volume of transactions that impact a bank account, it becomes necessary to have an internal control system in place to assure that all cash transactions are properly recorded within the bank account, as well as on the ledger of the business. The bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account as reflected by the bank’s records (bank balance) for a company and the company’s accounting records (company balance).

The bank reconciliation is an internal document prepared by the company that owns the checking account. The transactions with timing differences are used to adjust and reconcile both the bank and company balances; after the bank reconciliation is prepared accurately, both the bank balance and the company balance will be the same amount.

Note that the transactions the company is aware of have already been recorded (journalized) in its records. However, the transactions that the bank is aware of but the company is not must be journalized in the entity’s records.

Fundamentals of the Bank Reconciliation Procedure

The balance on a bank statement can differ from company’s financial records due to one or more of the following circumstances:

- An outstanding check: a check that was written and deducted from the financial records of the company but has not been cashed by the recipient, so the amount has not been removed from the bank account.

- A deposit in transit: a deposit that was made by the business and recorded on its books but has not yet been recorded by the bank.

- Deductions for a bank service fee: fees often charged by banks each month for management of the bank account. These may be fixed maintenance fees, per-check fees, or a fee for a check that was written for an amount greater than the balance in the checking account, called an nonsufficient funds (NSF) check. These fees are deducted by the bank from the account but would not appear on the financial records.

- Errors initiated by either the client or the bank: for example, the client might record a check incorrectly in its records, for either a greater or lesser amount than was written. Also, the bank might report a check either with an incorrect balance or in the wrong client’s checking account.

- Additions such as interest or funds collected by the bank for the client: interest is added to the bank account as earned but is not reported on the financial records. These additions might also include funds collected by the bank for the client.

Demonstration of a Bank Reconciliation

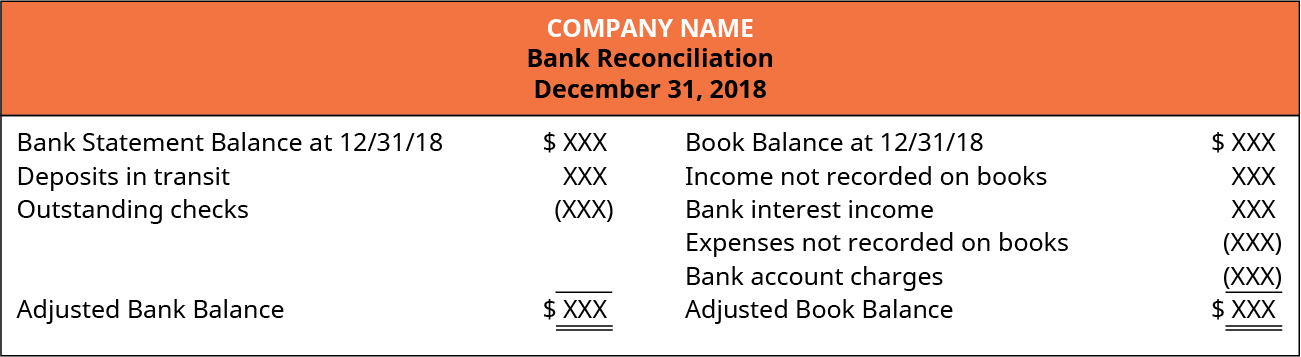

A bank reconciliation is structured to include the information shown in (Figure).

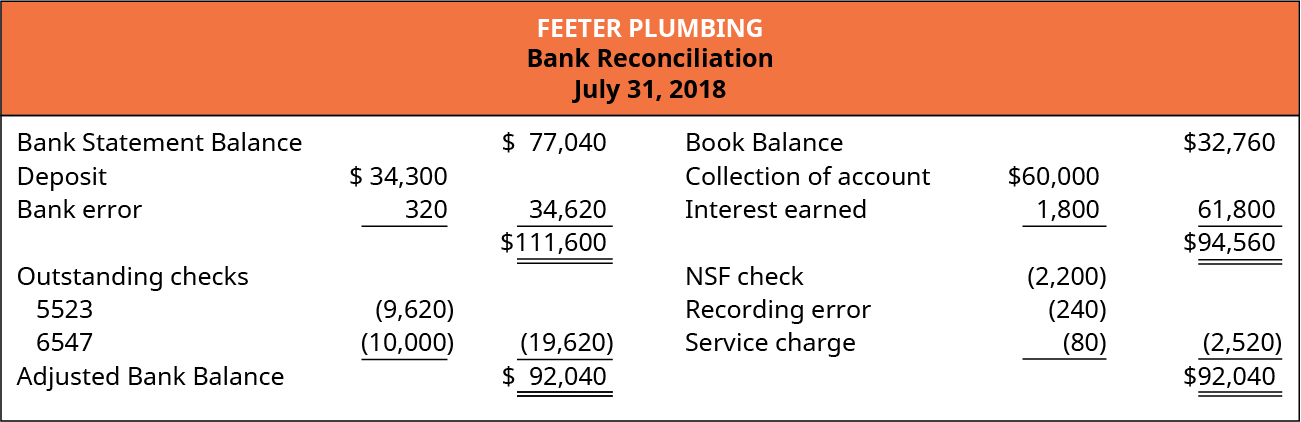

Assume the following circumstances for Feeter Plumbing Company, a small business located in Northern Ohio.

- After all posting is up to date, at the end of July 31, the book balance shows $32,760, and the bank statement balance shows $77,040.

- Check 5523 for $9,620 and 6547 for $10,000 are outstanding.

- Check 5386 for $2,000 is removed from the bank account correctly but is recorded on the accounting records for $1,760. This was in payment of dues. The effects of this transaction resulted in an error of $320 that must be deducted from the company’s book balance.

- The July 31 night deposit of $34,300 was delivered to the bank after hours. As a result, the deposit is not on the bank statement, but it is on the financial records.

- Upon review of the bank statement, an error is uncovered. A check is removed from the account from Feeter for $240 that should have been removed from the account of another customer of the bank.

- In the bank statement is a note stating that the bank collected $60,000 in charges (payments) from the credit card company as well as $1,800 in interest. This transaction is on the bank statement but not in the company’s financial records.

- The bank notified Feeter that a $2,200 check was returned unpaid from customer Berson due to insufficient funds in Berson’s account. This check return is reflected on the bank statement but not in the records of Feeter.

- Bank service charges for the month are $80. They have not been recorded on Feeter’s records.

Each item would be recorded on the bank reconciliation as follows:

One important trait of the bank reconciliation is that it identifies transactions that have not been recorded by the company that are supposed to be recorded. Journal entries are required to adjust the book balance to the correct balance.

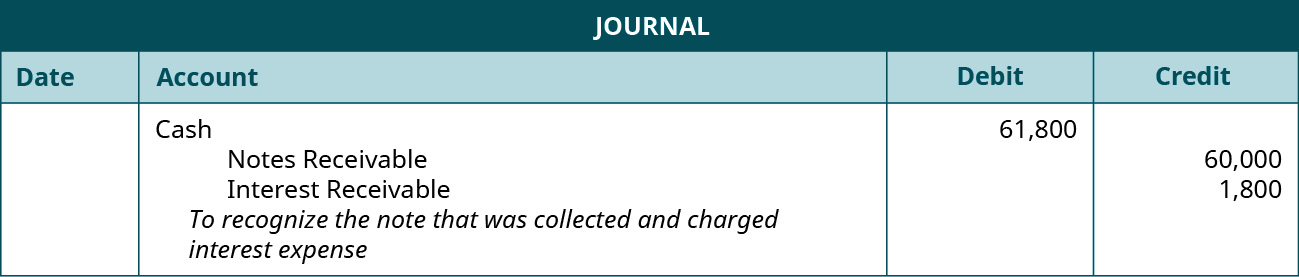

In the case of Feeter, the first entry will record the collection of the note, as well as the interest collected.

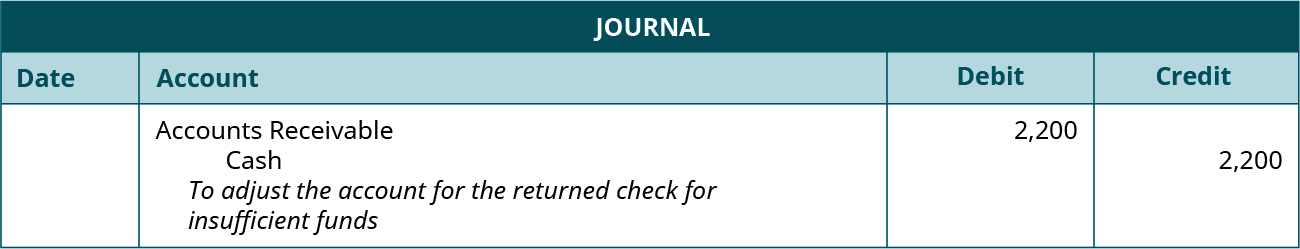

The second entry required is to adjust the books for the check that was returned from Berson.

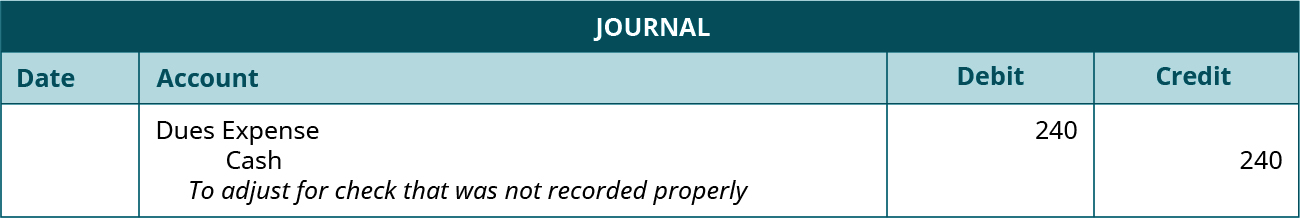

The third entry is to adjust the recording error for check 5386.

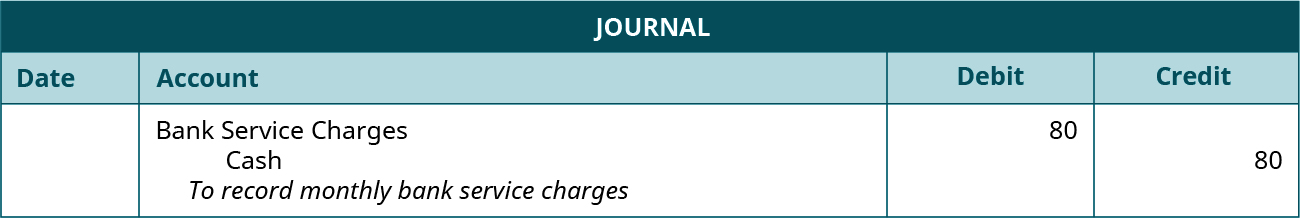

The final entry is to record the bank service charges that are deducted by the bank but have not been recorded on the records.

The previous entries are standard to ensure that the bank records are matching to the financial records. These entries are necessary to update Feeter‛s general ledger cash account to reflect the adjustments made by the bank.

This practical article illustrates the key points of why a bank reconciliation is important for both business and personal reasons.

Key Concepts and Summary

- The bank reconciliation is an internal document that verifies the accuracy of records maintained by the depositor and the financial institution. The balance on the bank statement is adjusted for outstanding checks and uncleared deposits. The record balance is adjusted for service charges and interest earned.

- The bank reconciliation is an internal control document that ensures transactions to the bank account are properly recorded, and allows for verification of transactions.

(Figure)Which of the following items are found on a book side of the bank reconciliation?

- beginning bank balance

- outstanding checks

- interest income

- error made by bank

C

(Figure)Which of the following are found on the bank side of the bank reconciliation?

- NSF check

- interest income

- wire transfer into client’s account

- deposit in transit

(Figure)What is the purpose of the bank reconciliation?

(Figure)What should be done if differences are found between the bank statement and the book account?

All differences must be researched, explained, and corrected. Differences pertaining to the bank must be reported. If fraud is suspected, a complete investigation must be performed.

(Figure)The bank reconciliation shows the following adjustments:

- Deposits in transit: $1,234

- Outstanding checks: $558

- Bank service charges: $50

- NSF checks: $250

Prepare the correcting journal entry.

(Figure)The bank reconciliation shows the following adjustments:

- Deposits in transit: $852

- Notes receivable collected by bank: $1,000; interest: $20

- Outstanding checks: $569

- Error by bank: $300

- Bank charges: $30

Prepare the correcting journal entry.

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $3,678

- Book balance: $2,547

- Deposits in transit: $321

- Outstanding checks: $108 and $334

- Bank charges: $25

- Notes receivable: $1,000; interest: $35

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $4,587

- Book balance: $5,577

- Deposits in transit: $1,546

- Outstanding checks: $956

- Interest income: $56

- NSF check: $456

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $6,988

- Book balance: $6,626

- Deposits in transit: $1,600

- Outstanding checks: $599 and $1,423

- Bank charges: $75

- Bank incorrectly charged the account $75. The bank will correct the error next month.

- Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense.

(Figure)The bank reconciliation shows the following adjustments.

- Deposits in transit: $526

- Outstanding checks: $328

- Bank charges: $55

- NSF checks: $69

Prepare the correcting journal entry.

(Figure)The bank reconciliation shows the following adjustments.

- Deposits in transit: $1,698

- Notes receivable collected by bank: $2,500; interest: $145

- Outstanding checks: $987

- Error by bank: $436

- Bank charges: $70

Prepare the correcting journal entry.

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $4,021

- Book balance: $2,928

- Deposits in transit: $1,111

- Outstanding checks: $679

- Bank charges: $35

- Notes receivable: $1,325; interest: $235

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $7,651

- Book balance: $10,595

- Deposits in transit: $2,588

- Outstanding checks: $489

- Interest income: $121

- NSF check: $966

(Figure)Using the following information, prepare a bank reconciliation.

- Bank balance: $12,565.

- Book balance: $13,744.

- Deposits in transit: $2,509.

- Outstanding checks: $1,777.

- Bank charges: $125.

- Bank incorrectly charged the account for $412. The bank will correct the error next month.

- Check number 1879 correctly cleared the bank in the amount of $562 but posted in the accounting records as $652. This check was expensed to Utilities Expense.

(Figure)Identify where each of the following transactions would be found on the bank reconciliation.

| Transaction | Increase to Bank Side | Decrease to Bank Side | Increase to Book Side | Decrease to Book Side |

|---|---|---|---|---|

| Outstanding check | ||||

| Interest income | ||||

| NFS check | ||||

| Wire transfer by customer | ||||

| Deposit in transit | ||||

| Bank charges | ||||

(Figure)Which of the following transactions will require a journal entry? Indicate if it will be a debit or a credit and to what account the entry will be recorded.

| Transaction | No Journal Entry Needed | Journal Entry Needed | Debit | Credit |

|---|---|---|---|---|

| Outstanding check | ||||

| Interest income | ||||

| NFS check | ||||

| Wire transfer by customer | ||||

| Deposit in transit | ||||

| Bank charges | ||||

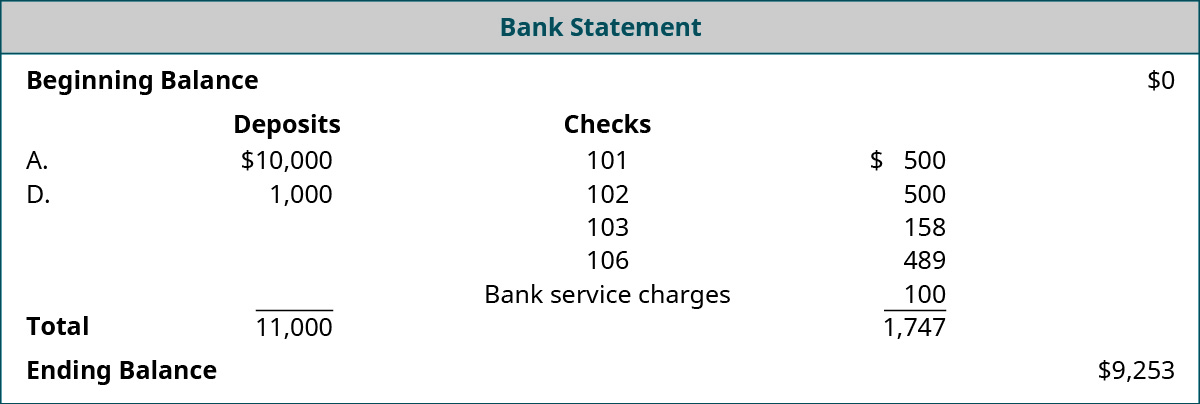

(Figure)Prepare the journal entry required to reconcile the book balance to the bank balance.

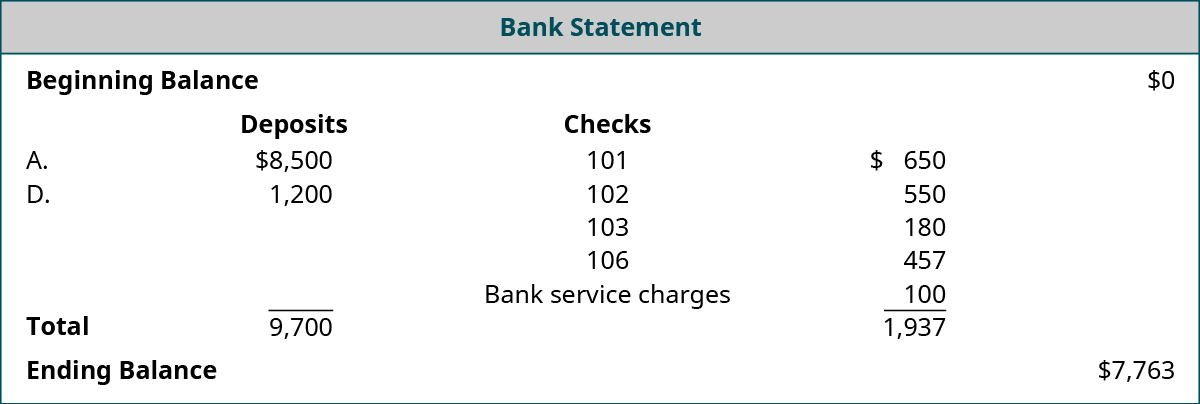

(Figure)Prepare the journal entry required to reconcile the book balance to the bank balance.

(Figure)Identify where each of the following transactions would be found on the bank reconciliation.

| Transaction | Increase to Bank Side | Decrease to Bank Side | Increase to Book Side | Decrease to Book Side |

|---|---|---|---|---|

| Overcharge by Bank (Error) | ||||

| Interest Income | ||||

| Automatic Loan Payment | ||||

| Wire Transfer by Customer | ||||

| Deposit in Transit | ||||

| Outstanding Check | ||||

(Figure)Which of the following transactions will require a journal entry? Indicate if it will be a debit or a credit, and to which account the entry will be recorded.

| Transaction | No Journal Entry | Journal Entry Needed | Debit | Credit |

|---|---|---|---|---|

| Overcharge by Bank (Error) | ||||

| Interest Income | ||||

| Automatic Loan Payment | ||||

| Wire Transfer by Customer | ||||

| Deposit in Transit | ||||

| Outstanding Check | ||||

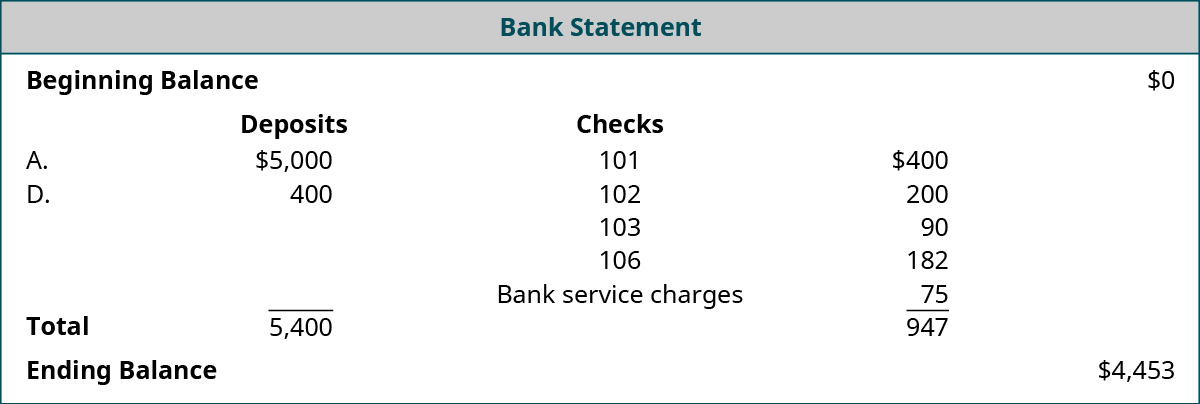

(Figure)Prepare the journal entry required to reconcile the book balance to the bank balance.

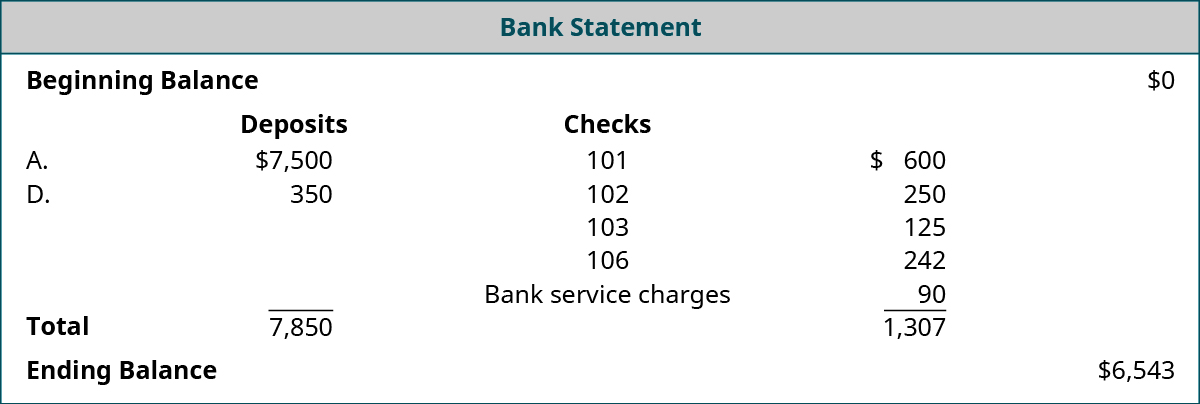

(Figure)Prepare the journal entry required to reconcile the book balance to the bank balance.

(Figure)A bank reconciliation takes time and must balance. An employee was struggling in balancing the bank reconciliation. Her supervisor told her to “plug” (make an unsupported entry for) the difference, record to Miscellaneous Expense, and simply move on. Discuss the internal controls problem with this directive.

(Figure)The bank reconciliation revealed that one deposit had cleared the bank two weeks after the date of the deposit. Should this be of concern? Why, or why not?

Glossary

- bank reconciliation

- internal financial report that explains and documents any differences that may exist between a balance within a checking account and the company’s records

- bank service fee

- fee often charged by a bank each month for management of the bank account

- deposit in transit

- deposit that was made by the business and recorded on its books but has not yet been recorded by the bank

- nonsufficient funds (NSF) check

- check written for an amount that is greater than the balance in the checking account

- outstanding check

- check that was written and deducted from the financial records of the company but has not been cashed by the recipient, so the amount has not been removed from the bank account