Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System

Mitchell Franklin; Patty Graybeal; and Dixon Cooper

The following example transactions and subsequent journal entries for merchandise purchases are recognized using a perpetual inventory system. The periodic inventory system recognition of these example transactions and corresponding journal entries are shown in Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System.

Basic Analysis of Purchase Transaction Journal Entries

To better illustrate merchandising activities, let’s follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Each electronics hardware package (see (Figure)) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.

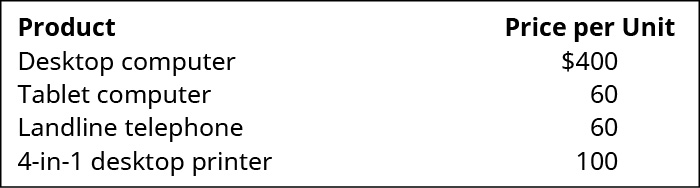

CBS purchases each electronic product from a manufacturer. The following are the per-item purchase prices from the manufacturer.

Cash and Credit Purchase Transaction Journal Entries

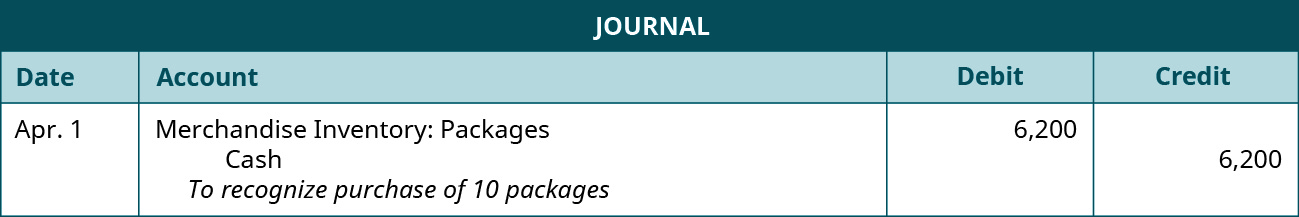

On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. CBS has enough cash-on-hand to pay immediately with cash. The following entry occurs.

Merchandise Inventory-Packages increases (debit) for 6,200 ($620 × 10), and Cash decreases (credit) because the company paid with cash. It is important to distinguish each inventory item type to better track inventory needs.

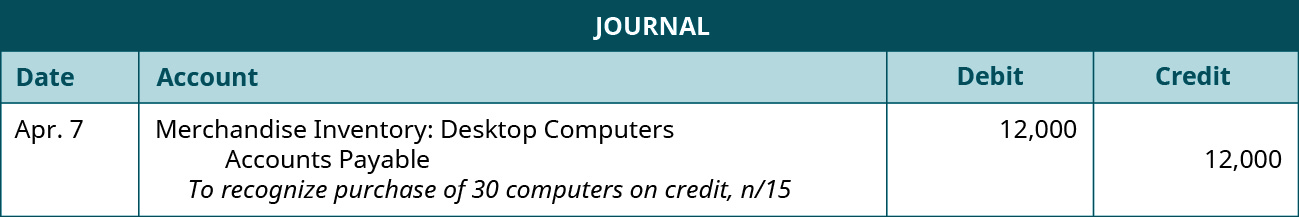

On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. The credit terms are n/15 with an invoice date of April 7. The following entry occurs.

Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). Since the computers were purchased on credit by CBS, Accounts Payable increases (credit).

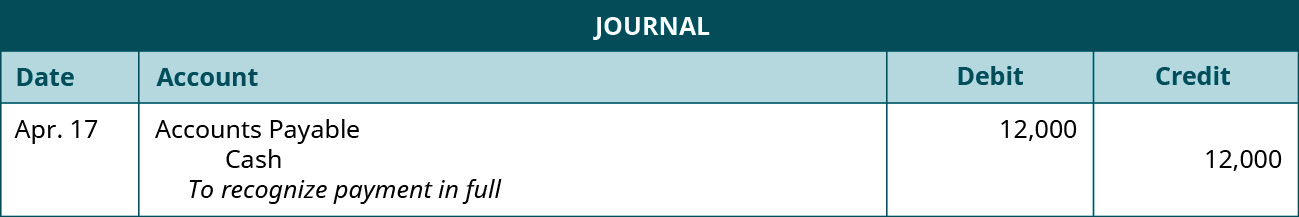

On April 17, CBS makes full payment on the amount due from the April 7 purchase. The following entry occurs.

Accounts Payable decreases (debit), and Cash decreases (credit) for the full amount owed. The credit terms were n/15, which is net due in 15 days. No discount was offered with this transaction. Thus the full payment of $12,000 occurs.

Purchase Discount Transaction Journal Entries

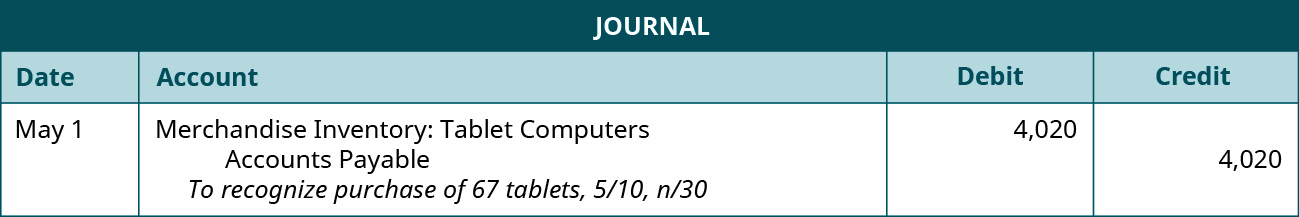

On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. The payment terms are 5/10, n/30, and the invoice is dated May 1. The following entry occurs.

Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 × $60). Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. These credit terms include a discount opportunity (5/10), meaning, CBS has 10 days from the invoice date to pay on their account to receive a 5% discount on their purchase.

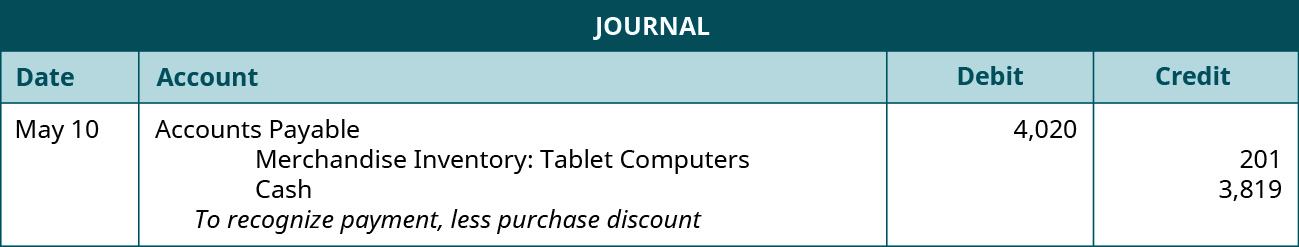

On May 10, CBS pays their account in full. The following entry occurs.

Accounts Payable decreases (debit) for the original amount owed of $4,020 before any discounts are taken. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Merchandise Inventory-Tablet Computers decreases (credit) for the amount of the discount ($4,020 × 5%). Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost.

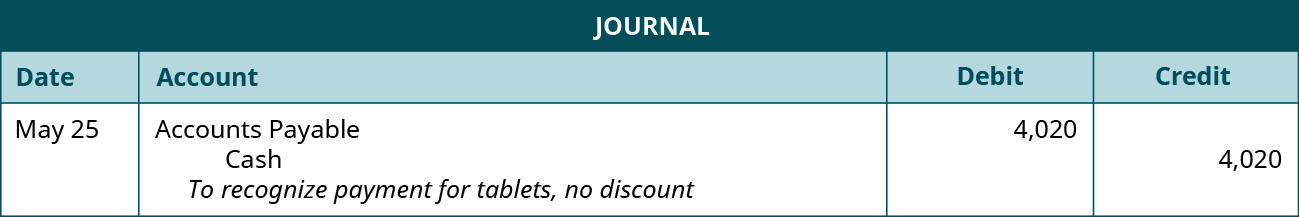

Let’s take the same example purchase with the same credit terms, but now CBS paid their account on May 25. The following entry would occur instead.

Accounts Payable decreases (debit) and Cash decreases (credit) for $4,020. The company paid on their account outside of the discount window but within the total allotted timeframe for payment. CBS does not receive a discount in this case but does pay in full and on time.

Purchase Returns and Allowances Transaction Journal Entries

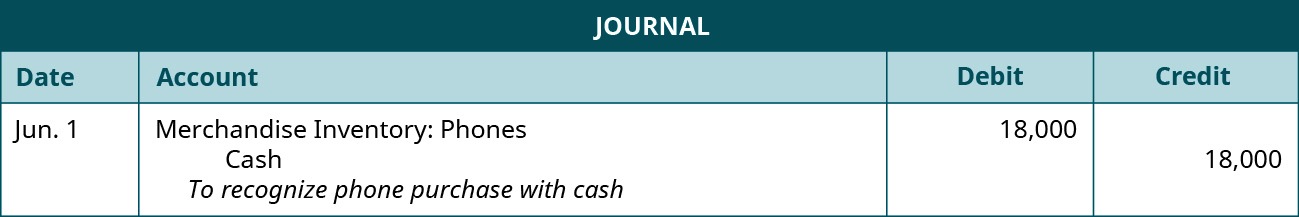

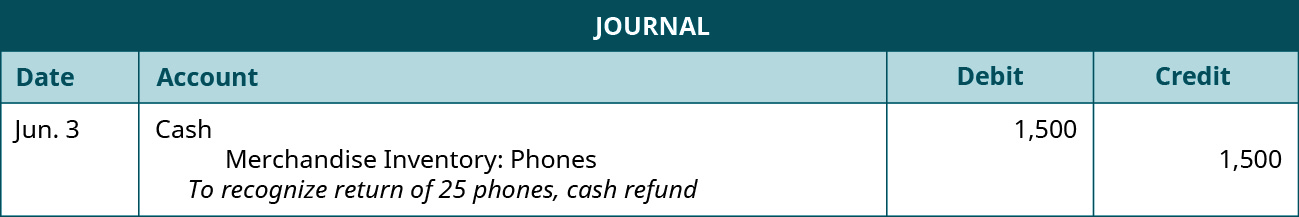

On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The following entries occur with the purchase and subsequent return.

Both Merchandise Inventory-Phones increases (debit) and Cash decreases (credit) by $18,000 ($60 × 300).

Since CBS already paid in full for their purchase, a full cash refund is issued. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier.

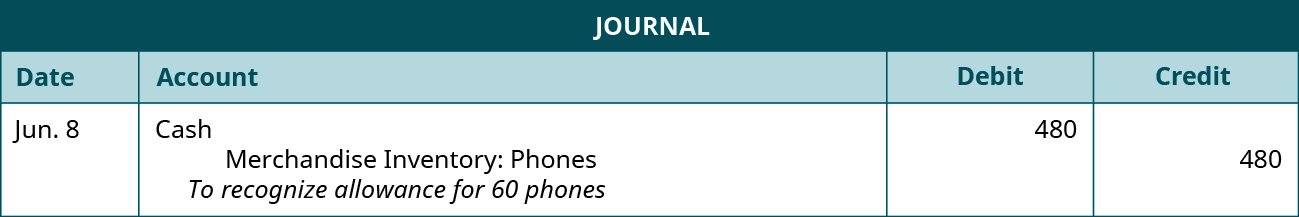

On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. CBS decides to keep the phones but receives a purchase allowance from the manufacturer of $8 per phone. The following entry occurs for the allowance.

Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 × $8). This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise is less valuable than before the damage discovery.

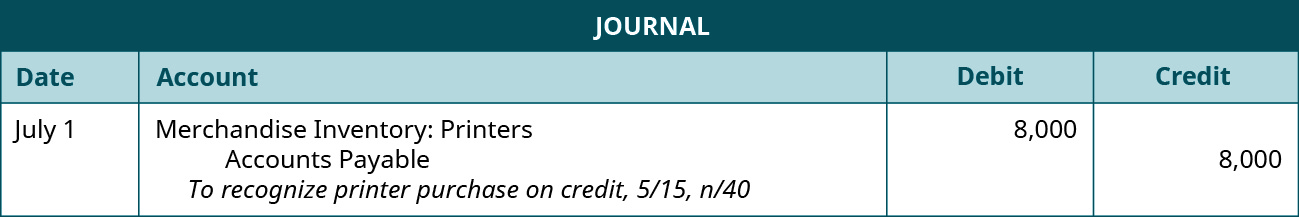

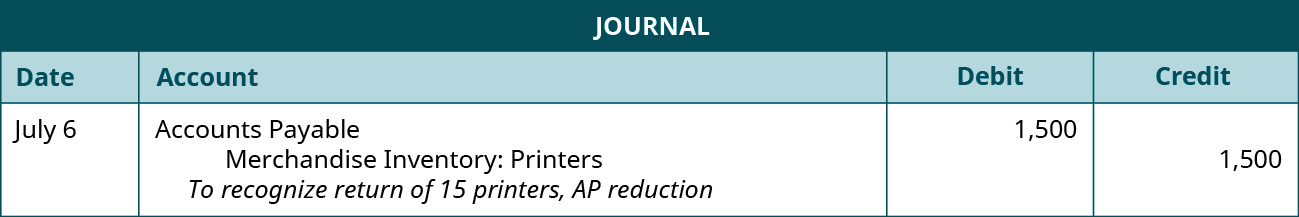

CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. The following entries show the purchase and subsequent return.

Both Merchandise Inventory-Printers increases (debit) and Accounts Payable increases (credit) by $8,000 ($100 × 80).

Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $1,500 (15 × $100). The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the return of the merchandise back to the manufacturer.

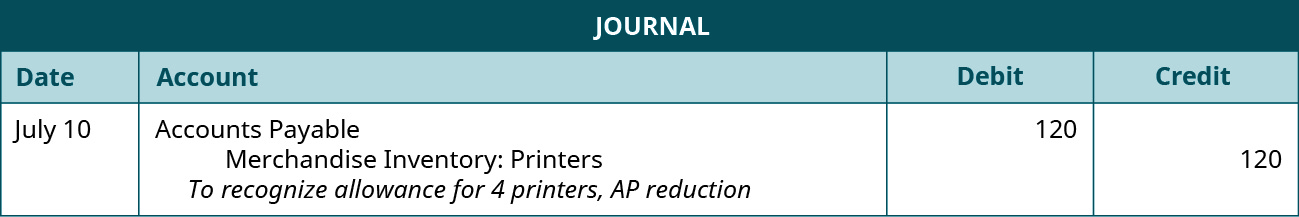

On July 10, CBS discovers that 4 more printers from the July 1 purchase are slightly damaged but decides to keep them, with the manufacturer issuing an allowance of $30 per printer. The following entry recognizes the allowance.

Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 × $30). The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the loss in value of the merchandise.

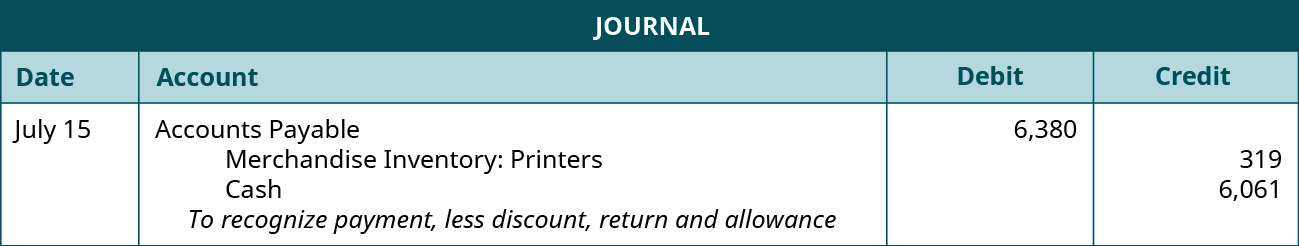

On July 15, CBS pays their account in full, less purchase returns and allowances. The following payment entry occurs.

Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 – $1,500 – $120). Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Merchandise Inventory-Printers decreases (credit) for the amount of the discount ($6,380 × 5%). Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost.

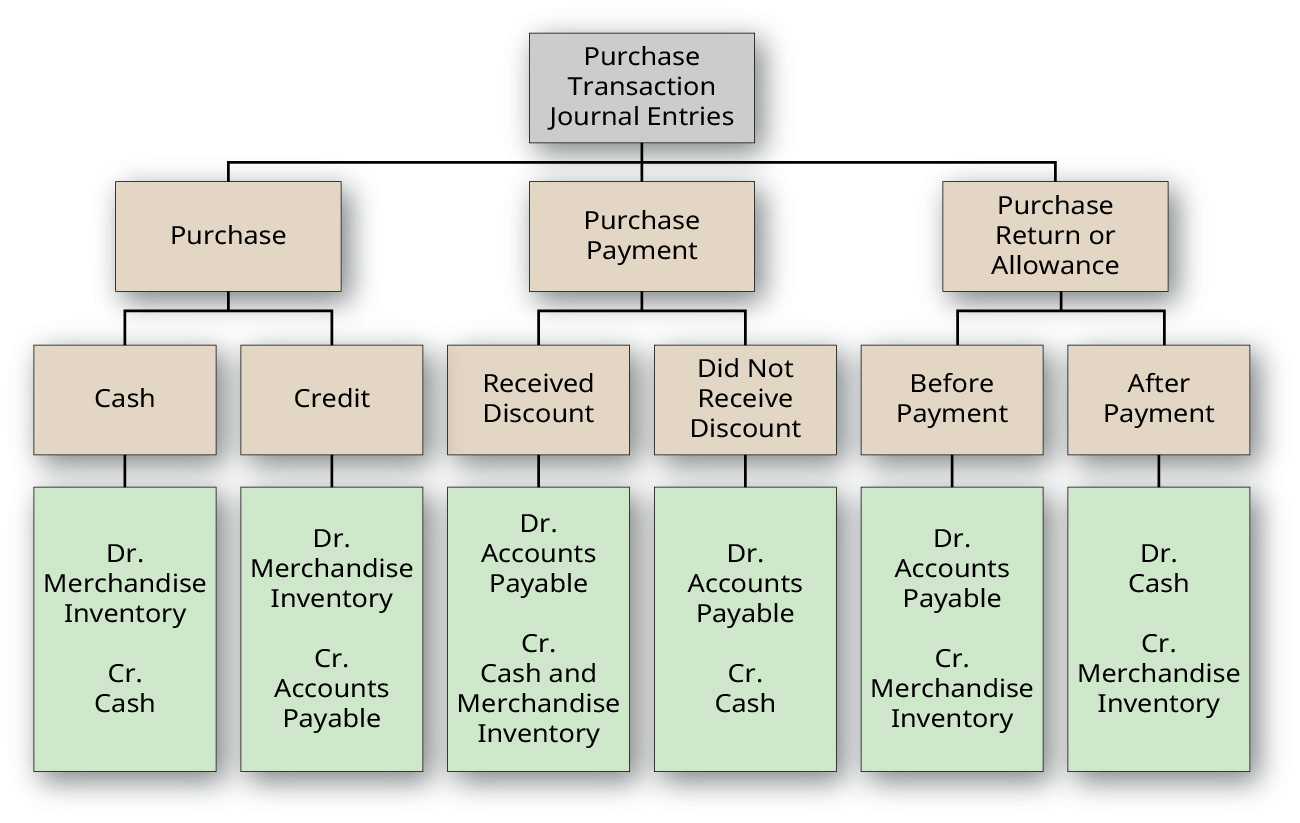

Summary of Purchase Transaction Journal Entries

The chart in (Figure) represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system.

Note that (Figure) considers an environment in which inventory physical counts and matching books records align. This is not always the case given concerns with shrinkage (theft), damages, or obsolete merchandise. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books.

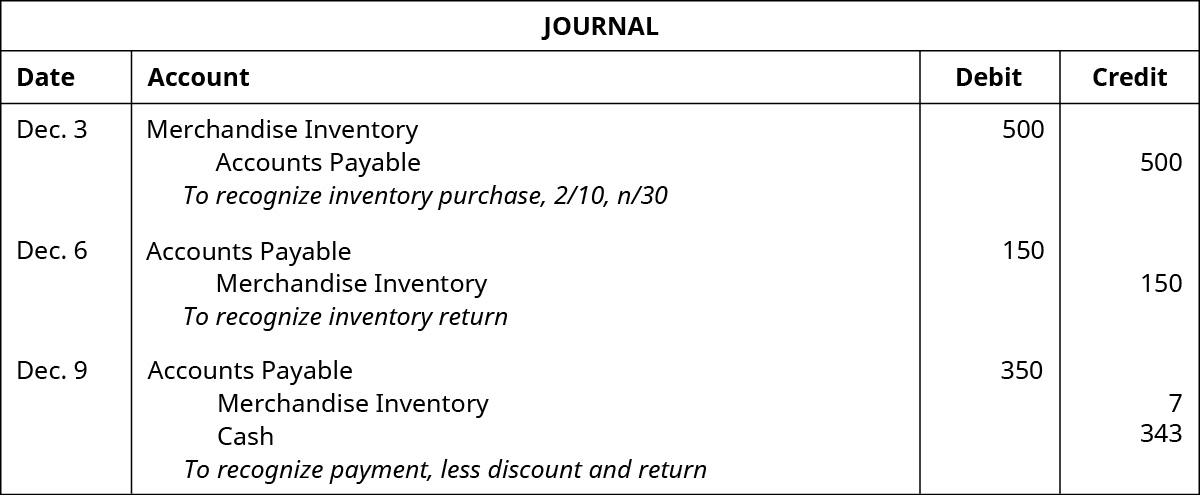

Record the journal entries for the following purchase transactions of a retailer.

| Dec. 3 | Purchased $500 worth of inventory on credit with terms 2/10, n/30, and invoice dated December 3. |

| Dec. 6 | Returned $150 worth of damaged inventory to the manufacturer and received a full refund. |

| Dec. 9 | Paid the account in full |

Solution

Bean Counter is a website that offers free, fun and interactive games, simulations, and quizzes about accounting. You can “Fling the Teacher,” “Walk the Plank,” and play “Basketball” while learning the fundamentals of accounting topics. Check out Bean Counter to see what you can learn.

Key Concepts and Summary

- A retailer can pay with cash or on credit. If paying with cash, Cash decreases. If paying on credit instead of cash, Accounts Payable increases.

- If a company pays for merchandise within the discount window, they debit Accounts Payable, credit Merchandise Inventory, and credit Cash. If they pay outside the discount window, the company debits Accounts Payable and credits Cash.

- If a company returns merchandise before remitting payment, they would debit Accounts Payable and credit Merchandise Inventory. If the company returns merchandise after remitting payment, they would debit Cash and credit Merchandise Inventory.

- If a company obtains an allowance for damaged merchandise before remitting payment, they would debit Accounts Payable and credit Merchandise Inventory. If the company obtains an allowance for damaged merchandise after remitting payment, they would debit Cash and credit Merchandise Inventory.

Multiple Choice

(Figure)Which of the following accounts are used when recording a purchase?

- cash, merchandise inventory

- accounts payable, merchandise inventory

- A or B

- cash, accounts payable

C

(Figure)A retailer pays on credit for $650 worth of inventory, terms 3/10, n/40. If the merchandiser pays within the discount window, how much will the retailer remit in cash to the manufacturer?

- $19.50

- $630.50

- $650

- $195

(Figure)A retailer returns $400 worth of inventory to a manufacturer and receives a full refund. What accounts recognize this return before the retailer remits payment to the manufacturer?

- accounts payable, merchandise inventory

- accounts payable, cash

- cash, merchandise inventory

- merchandise inventory, cost of goods sold

A

(Figure)A retailer obtains a purchase allowance from the manufacturer in the amount of $600 for faulty inventory parts. Which of the following represents the journal entry for this transaction if the retailer has already remitted payment?

Questions

(Figure)Name two situations where cash would be remitted to a retailer from a manufacturer after purchase.

Cash would be remitted to a retainer if the retailer returns merchandise to a manufacturer after payment, or if the retailer receives an allowance for damaged merchandise after payment.

(Figure)If a retailer purchased inventory in the amount of $750, terms 2/10, n/60, returned $30 of the inventory for a full refund, and received an allowance for $95, how much would the discount be if the retailer remitted payment within the discount window?

(Figure)A retailer discovers that 50% of the total inventory items delivered from the manufacturer are damaged. The original purchase for all inventory was $1,100. The retailer decides to return 20% of the damaged inventory for a full refund and keep the remaining 80% of damaged inventory. What is the value of the merchandise returned?

$110; $1,100 × 50% = $550, $550 × 20% = $110

Exercise Set A

(Figure)Record journal entries for the following purchase transactions of Flower Company.

| Oct. 13 | Purchased 85 bushels of flowers with cash for $1,300. |

| Oct. 20 | Purchased 240 bushels of flowers for $20 per bushel on credit. Terms of the purchase are 5/10, n/30, invoice dated October 20. |

| Oct. 30 | Paid account in full from the October 20 purchase. |

(Figure)Record journal entries for the following purchase transactions of Apex Industries.

| Nov. 6 | Purchased 24 computers on credit for $560 per computer. Terms of the purchase are 4/10, n/60, invoice dated November 6. |

| Nov. 10 | Returned 5 defective computers for a full refund from the manufacturer. |

| Nov. 22 | Paid account in full from the November 6 purchase. |

(Figure)Record the journal entry for each of the following transactions. Glow Industries purchases 750 strobe lights at $23 per light from a manufacturer on April 20. The terms of purchase are 10/15, n/40, invoice dated April 20. On April 22, Glow discovers 100 of the lights are the wrong model and is granted an allowance of $8 per light for the error. On April 30, Glow pays for the lights, less the allowance.

Exercise Set B

(Figure)Blue Barns purchased 888 gallons of paint at $19 per gallon from a supplier on June 3. Terms of the purchase are 2/15, n/45, invoice dated June 3. Blue Barns pays their account in full on June 20. On June 22, Blue Barns discovers 20 gallons are the wrong color and returns the gallons for a full cash refund. Record the journal entries to recognize these transactions for Blue Barns.

(Figure)Canary Lawnmowers purchased 300 lawnmower parts at $3.50 per part from a supplier on December 4. Terms of the purchase are 4/10, n/25, invoice dated December 4. Canary Lawnmowers pays their account in full on December 16. On December 21, Canary discovers 34 of the parts are the wrong size but decides to keep them after the supplier gives Canary an allowance of $1.00 per part. Record the journal entries to recognize these transactions for Canary Lawnmowers.

(Figure)Record journal entries for the following purchase transactions of Balloon Depot.

| Feb. 8 | Purchased 3,000 balloon bundles on credit for $25 per bundle. Terms of the purchase are 10/10, n/30, invoice dated February 8. |

| Feb. 11 | Returned 450 defective bundles for a full refund from the manufacturer. |

| Feb. 18 | Paid account in full from the February 8 purchase. |

Problem Set A

(Figure)Review the following transactions for Birdy Birdhouses and record any required journal entries.

| Sep. 6 | Birdy Birdhouses purchases 55 birdhouses at $40 each with cash. |

| Sep. 8 | Birdy Birdhouses purchases 80 birdhouses at $45 each on credit. Terms of the purchase are 2/10, n/30, invoice date September 8. |

| Sep. 10 | Birdy discovers 10 of the birdhouses are damaged from the Sept 6 purchase and returns them to the supplier for a full refund. Birdy also discovers that 10 of the birdhouses from the Sept 8 purchase are painted the wrong color but keeps them since the supplier granted an allowance of $20 per birdhouse. |

| Sep. 18 | Birdy pays their account in full from the September 8 purchase, less any returns, allowances, and/or discounts. |

(Figure)Review the following transactions for Dish Mart and record any required journal entries. Note that all purchase transactions are with the same supplier.

| Nov. 5 | Dish Mart purchases 26 sets of dishes for $460 per set with cash. |

| Nov. 9 | Dish Mart purchases 30 sets of dishes for $430 per set on credit. Terms of the purchase are 10/15, n/60, invoice date November 9. |

| Nov. 13 | Dish Mart discovers 5 of the dish sets are damaged from the November 9 purchase and returns them to the supplier for a full refund. |

| Nov. 14 | Dish Mart purchases 10 sets of dishes for $450 per set, on credit. Terms of the purchase are 10/10, n/60, invoice date November 14. |

| Nov. 15 | Dish Mart discovers that 2 of the dish sets from the November 14 purchase and 4 of the dish sets from the November 5 purchase are missing a few dishes but keeps them since the supplier granted an allowance of $50 per set for the November 14 dish sets and $75 per set for the November 5 dish sets. Dish Mart and the supplier have agreed to reduce the amount Dish Mart has outstanding debt, instead of sending a separate check for the November 5 allowance in cash. |

| Nov. 24 | Dish Mart pays their account in full for all outstanding purchases, less any returns, allowances, and/or discounts. |

Problem Set B

(Figure)Review the following transactions for April Anglers and record any required journal entries.

| Oct. 4 | April Anglers purchases 82 fishing poles at $33 each with cash. |

| Oct. 5 | April Anglers purchases 116 fishing poles at $30 each on credit. Terms of the purchase are 3/15, n/30, invoice date October 5. |

| Oct. 12 | April discovers 18 of the fishing poles are damaged from the October 4 purchase and returns them to the supplier for a full refund. April also discovers that 32 of the fishing poles from the October 5 purchase are the wrong length but keeps them since the supplier granted an allowance of $15 per fishing pole. |

| Oct. 24 | April pays their account in full from the October 5 purchase, less any returns, allowances, and/or discounts. |

(Figure)Review the following transactions for Dish Mart and record any required journal entries. Note that all purchase transactions are with the same supplier.

| Nov. 5 | Dish Mart purchases 45 sets of cutlery for $100 per set with cash. |

| Nov. 9 | Dish Mart purchases 50 sets of cutlery for $120 per set on credit. Terms of the purchase are 5/15, n/60, invoice date November 9. |

| Nov. 13 | Dish Mart discovers 15 of the cutlery sets are damaged from the November 9 purchase and returns them to the supplier for a full refund. |

| Nov. 14 | Dish Mart purchases 30 sets of cutlery for $130 per set on credit. Terms of the purchase are 5/10, n/60, invoice date November 14. |

| Nov. 15 | Dish Mart discovers that 10 of the cutlery sets from the November 14 purchase and 20 of the cutlery sets from the November 5 purchase are missing a few spoons but keeps them since the supplier granted an allowance of $30 per set for the November 14 cutlery sets and $35 per set for the November 5 cutlery sets. Dish Mart and the supplier have agreed to reduce the amount of debt Dish Mart has outstanding instead of sending a separate check for the November 5 allowance in cash. |

| Nov. 24 | Dish Mart pays their account in full for all outstanding purchases, less any returns, allowances, and/or discounts. |