LO 16.4 Prepare the Completed Statement of Cash Flows Using the Indirect Method

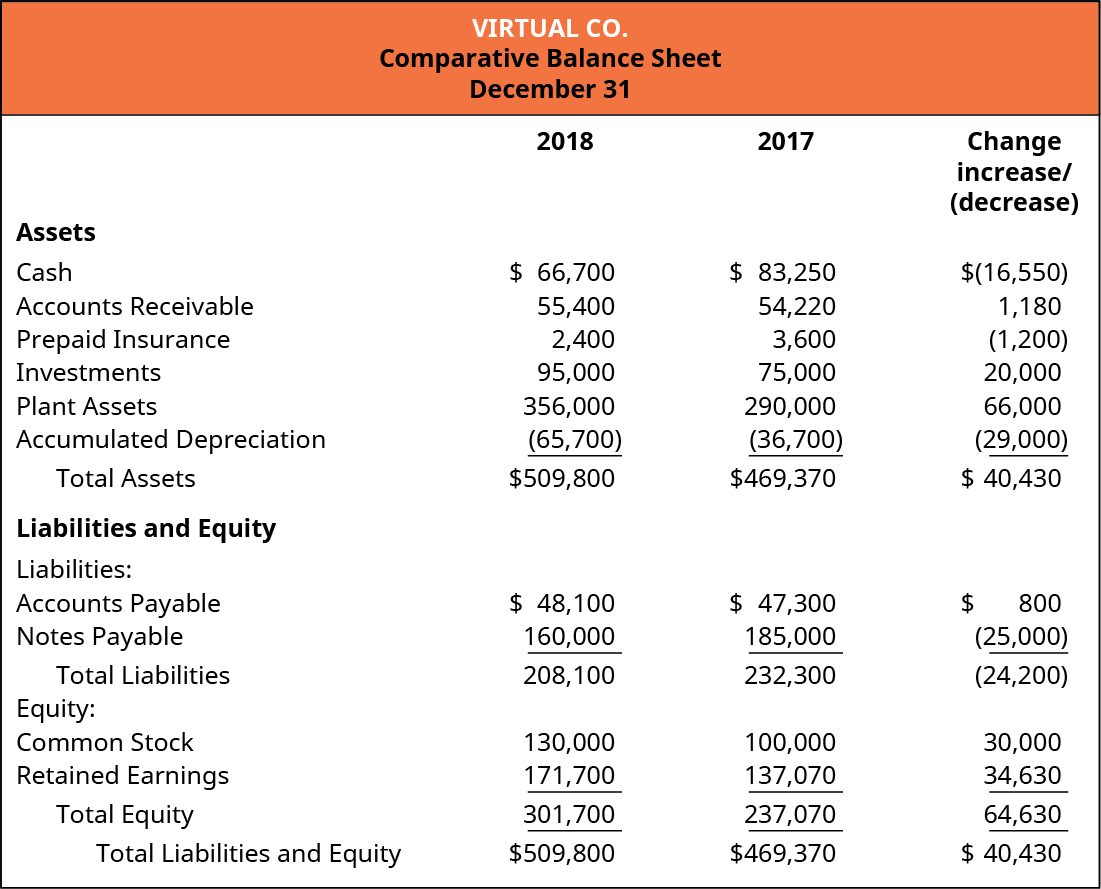

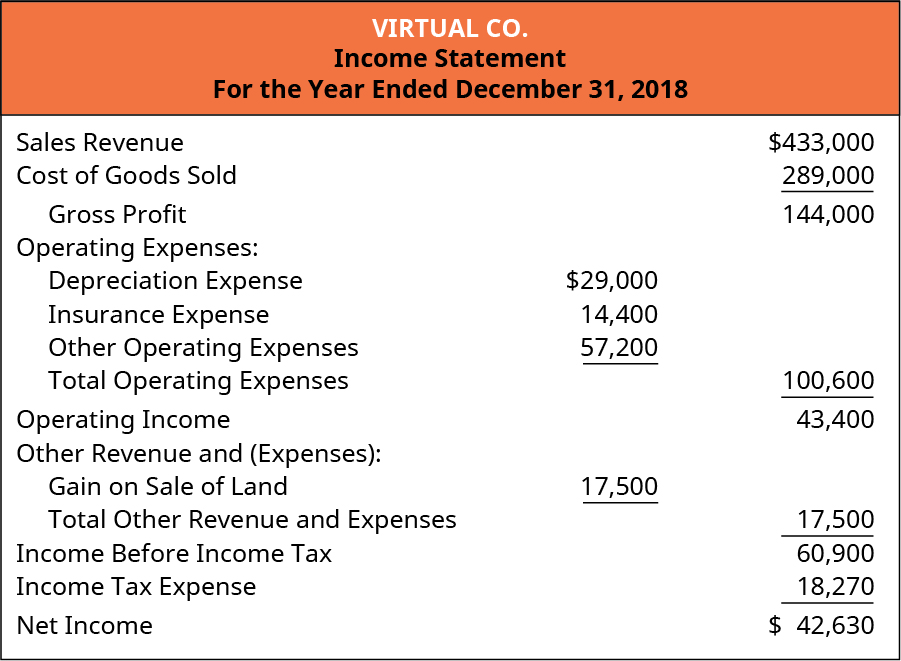

In this section, we use the example of Virtual Co. to work through the entire process of preparing the company’s statement of cash flows using the indirect method. Virtual’s comparative balance sheet and income statement are provided as a base for the preparation of the statement of cash flows.

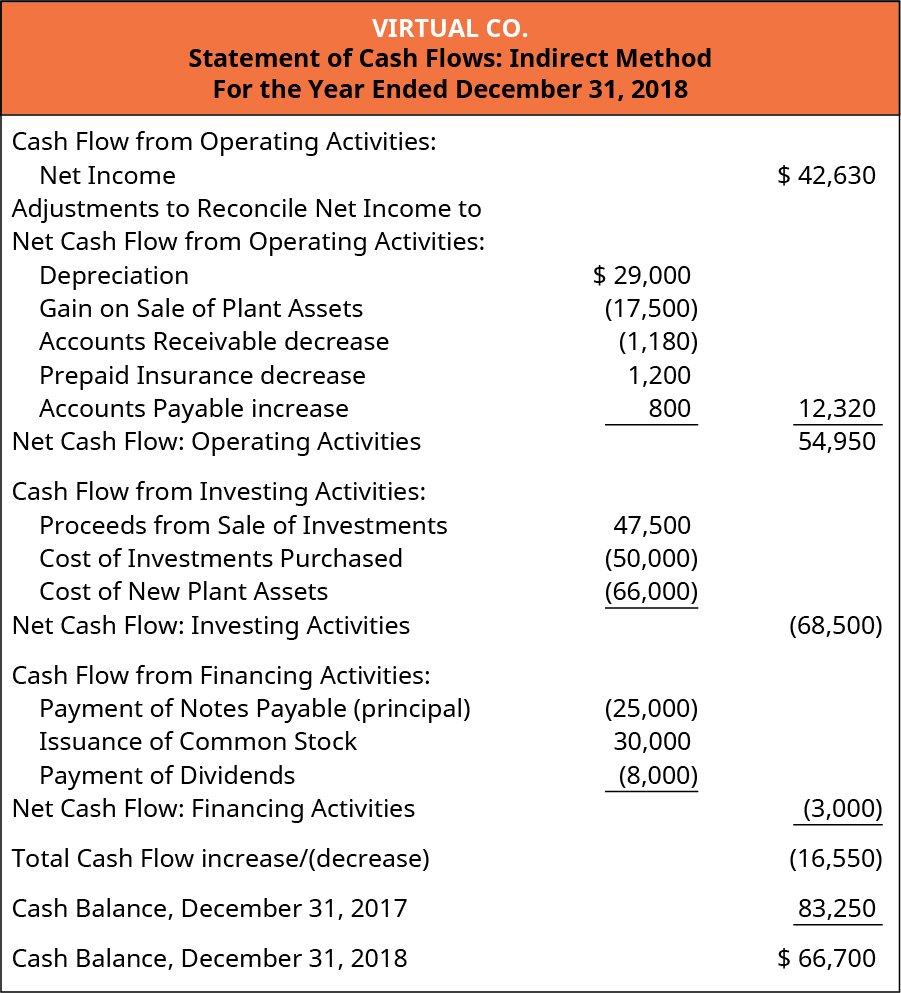

Review Problem: Preparing the Virtual Co. Statement of Cash Flows

Additional Information

The following additional information is provided:

- Investments that originally cost $30,000 were sold for $47,500 cash.

- Investments were purchased for $50,000 cash.

- Plant assets were purchased for $66,000 cash.

- Cash dividends were declared and paid to shareholders in the amount of $8,000.

Directions:

Prepare the statement of cash flows (indirect method), for the year ended December 31, 2018.

KEY TAKEAWAYS

Key Concepts and Summary

- Preparing the operating section of statement of cash flows by the indirect method starts with net income from the income statement and adjusts for items that affect cash flows differently than they affect net income.

- Multiple levels of adjustments are required to reconcile accrual-based net income to cash flows from operating activities.

- The investing section of the statement of cash flows relates to changes in long-term assets.

- The financing section of statement of cash flows relates to changes in long-term liabilities and changes in equity.

- Company activities that reflect changes in long-term assets, long-term liabilities, or equity, but have no cash impact, require special reporting treatment, as noncash investing and financing transactions.

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting