LO 6.7 Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System

Some organizations choose to report merchandising transactions using a periodic inventory system rather than a perpetual inventory system. This requires different account usage, transaction recognition, adjustments, and closing procedures. We will not explore the entries for adjustment or closing procedures but will look at some of the common situations that occur with merchandising companies and how these transactions are reported using the periodic inventory system.

Merchandise Purchases

The following example transactions and subsequent journal entries for merchandise purchases are recognized using a periodic inventory system.

Basic Analysis of Purchase Transaction Journal Entries

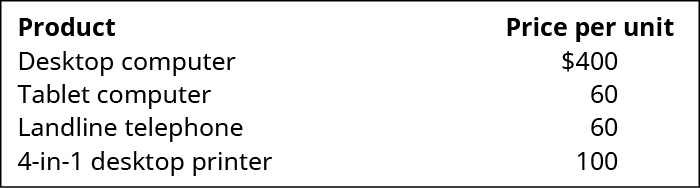

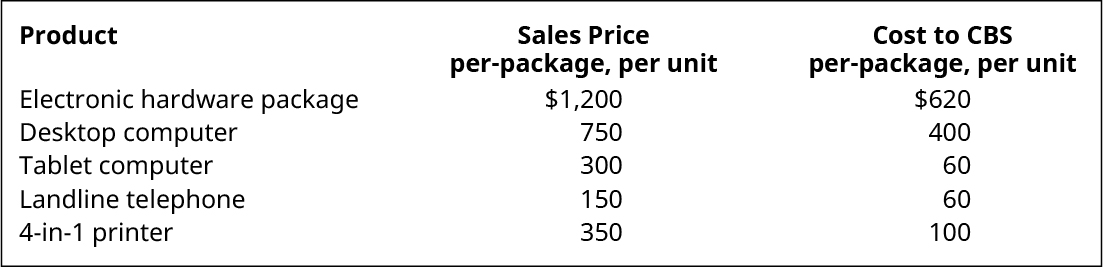

To better illustrate merchandising activities under the periodic system, let’s return to the example of California Business Solutions (CBS). CBS is a retailer providing electronic hardware packages to meet small business needs. Each electronics hardware package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.

CBS purchases each electronic product from a manufacturer. The per-item purchase prices from the manufacturer are shown.

Cash and Credit Purchase Transaction Journal Entries

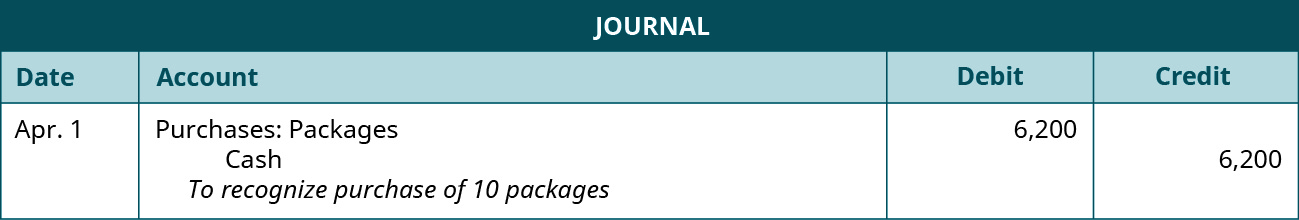

On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. CBS has enough cash-on-hand to pay immediately with cash. The following entry occurs.

Purchases-Packages increases (debit) by $6,200 ($620 × 10), and Cash decreases (credit) by the same amount because the company paid with cash. Under a periodic system, Purchases is used instead of Merchandise Inventory.

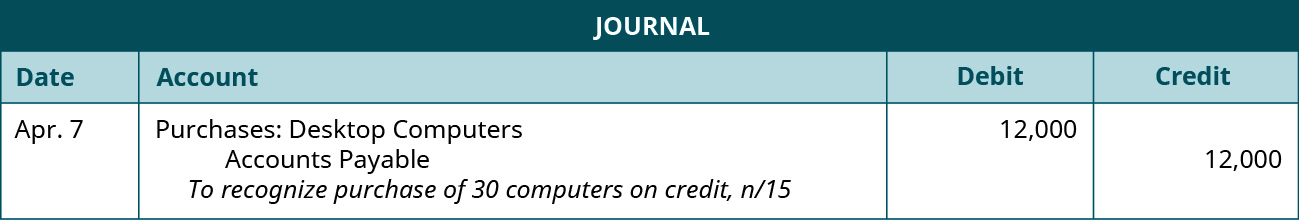

On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. The credit terms are n/15 with an invoice date of April 7. The following entry occurs.

Purchases-Desktop Computers increases (debit) for the value of the computers, $12,000 ($400 × 30). Since the computers were purchased on credit by CBS, Accounts Payable increases (credit) instead of cash.

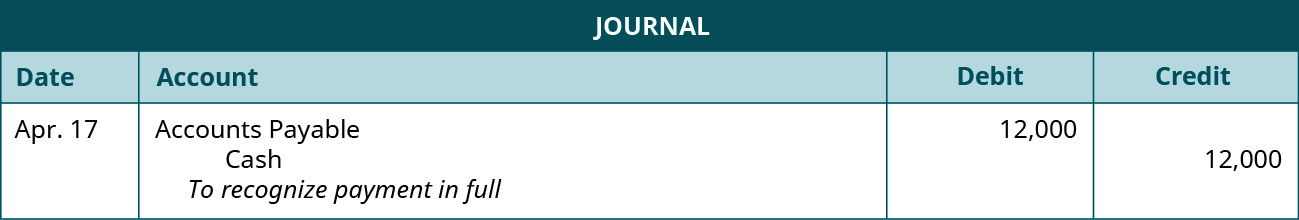

On April 17, CBS makes full payment on the amount due from the April 7 purchase. The following entry occurs.

Accounts Payable decreases (debit) and Cash decreases (credit) for the full amount owed. The credit terms were n/15, which is net due in 15 days. No discount was offered with this transaction. Thus the full payment of $12,000 occurs.

Purchase Discount Transaction Journal Entries

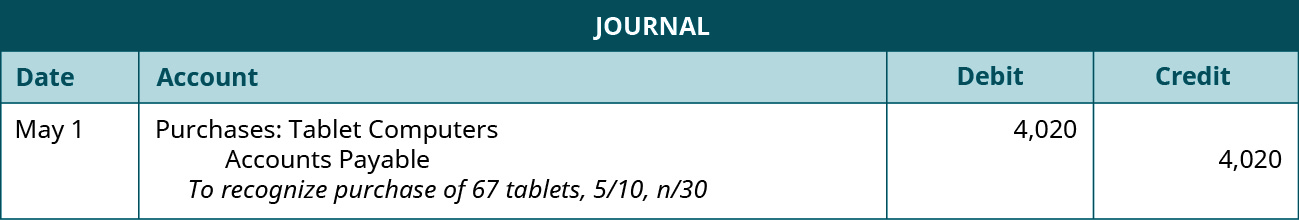

On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. Terms are 5/10, n/30, and invoice dated May 1. The following entry occurs.

Purchases–Tablet Computers increases (debit) in the amount of $4,020 (67 × $60). Accounts Payable also increases (credit), but the credit terms are a little different than the earlier example. These credit terms include a discount opportunity (5/10). This means that CBS has 10 days from the invoice date to pay on their account to receive a 5% discount on their purchase.

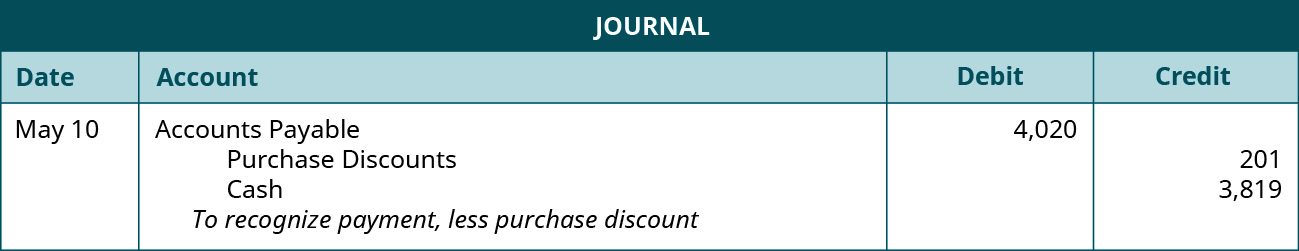

On May 10, CBS pays their account in full. The following entry occurs.

Accounts Payable decreases (debit) for the original amount owed of $4,020 before any discounts are taken. Since CBS paid on May 10, they made the 10-day window, thus receiving a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Purchase Discounts increases (credit) for the amount of the discount ($4,020 × 5%). Purchase Discounts is considered a contra account and will reduce Purchases at the end of the period.

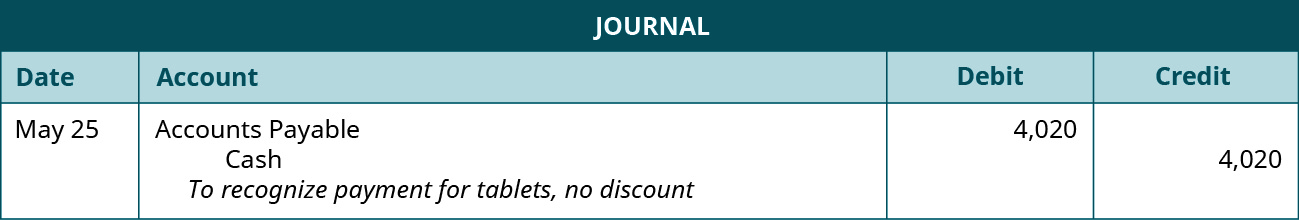

Let’s take the same example purchase with the same credit terms, but now assume that CBS paid their account on May 25. The following entry occurs.

Accounts Payable decreases (debit) and Cash decreases (credit) for $4,020. The company paid on their account outside of the discount window but within the total allotted timeframe for payment. CBS does not receive a discount in this case but does pay in full and on time.

Purchase Returns and Allowances Transaction Journal Entries

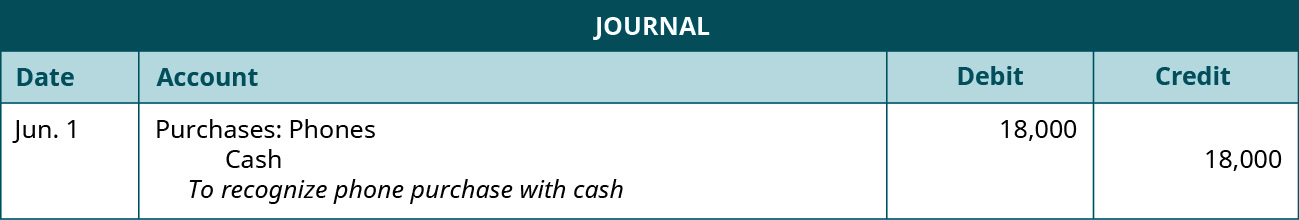

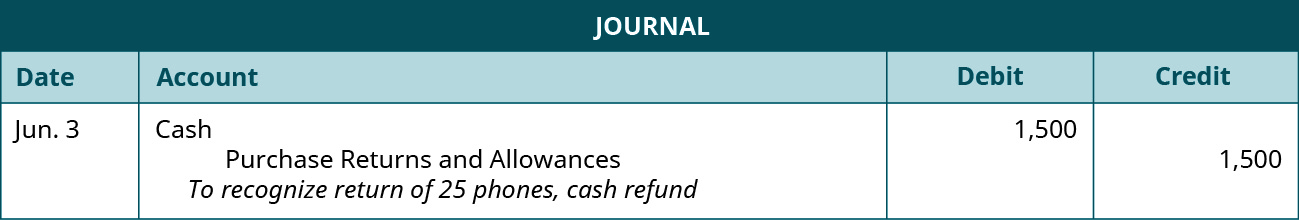

On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The following entries occur with the purchase and subsequent return.

Purchases-Phones increases (debit) and Cash decreases (credit) by $18,000 ($60 × 300).

Since CBS already paid in full for their purchase, a full cash refund is issued. This increases Cash (debit) and increases (credit) Purchase Returns and Allowances. Purchase Returns and Allowances is a contra account and decreases Purchases at the end of a period.

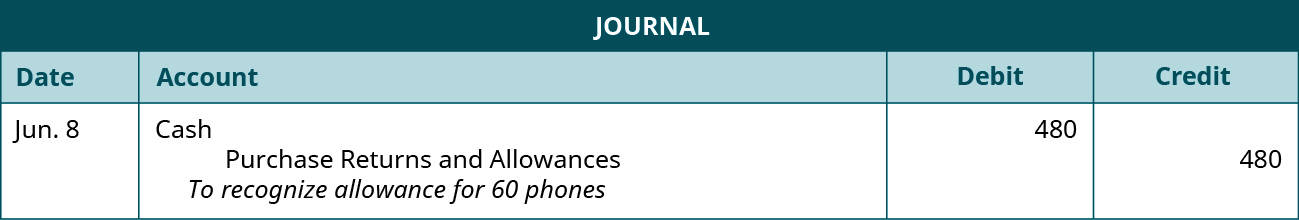

On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. CBS decides to keep the phones but receives a purchase allowance from the manufacturer of $8 per phone. The following entry occurs for the allowance.

Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 × $8). This increases Cash (debit) and increases Purchase Returns and Allowances.

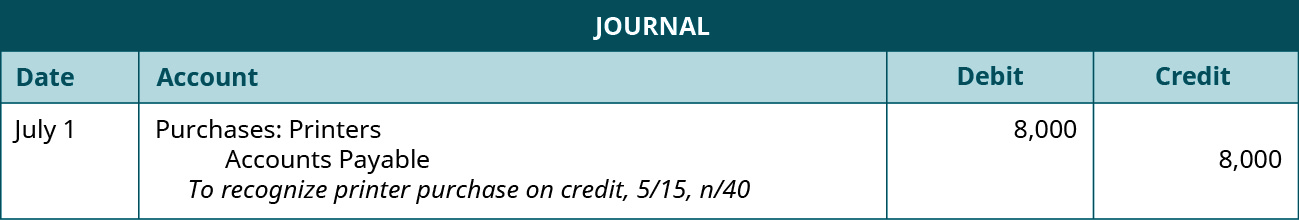

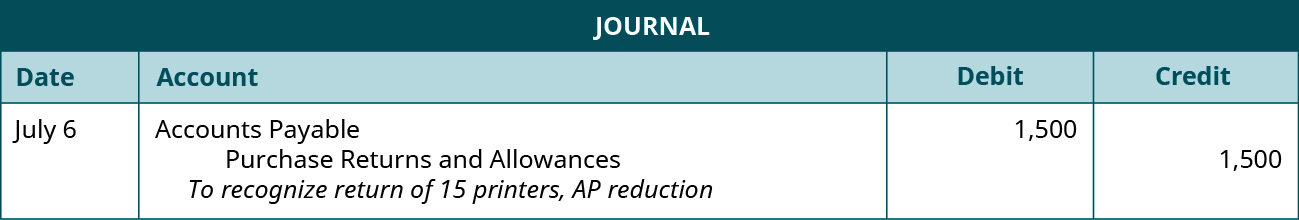

CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. The following entries show the purchase and subsequent return.

Purchases-Printers increases (debit) and Accounts Payable increases (credit) by $8,000 ($100 × 80).

Accounts Payable decreases (debit) and Purchase Returns and Allowances increases (credit) by $1,500 (15 × $100). The purchase was on credit and the return occurred before payment. Thus Accounts Payable is debited.

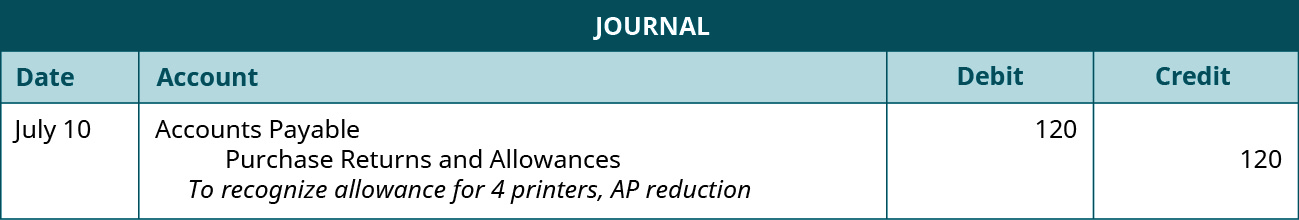

On July 10, CBS discovers that 4 more printers from the July 1 purchase are slightly damaged but decides to keep them because the manufacturer issues an allowance of $30 per printer. The following entry recognizes the allowance.

Accounts Payable decreases (debit) and Purchase Returns and Allowances increases (credit) by $120 (4 × $30). The purchase was on credit and the allowance occurred before payment. Thus, Accounts Payable is debited.

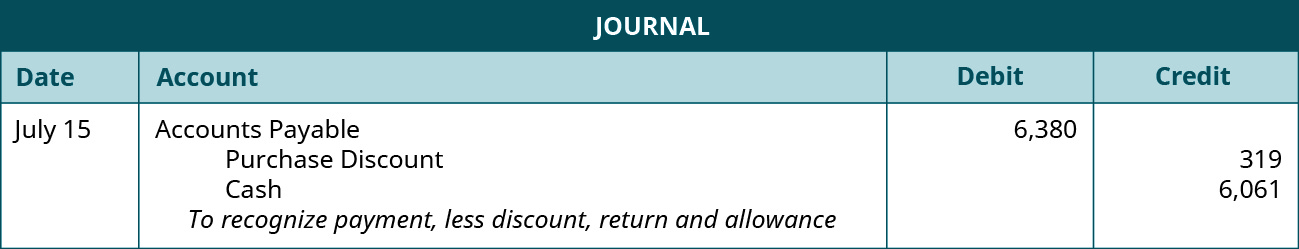

On July 15, CBS pays their account in full, less purchase returns and allowances. The following payment entry occurs.

Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 – $1,500 – $120). Since CBS paid on July 15, they made the 15-day window and received a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Purchase Discounts increases (credit) for the amount of the discount ($6,380 × 5%).

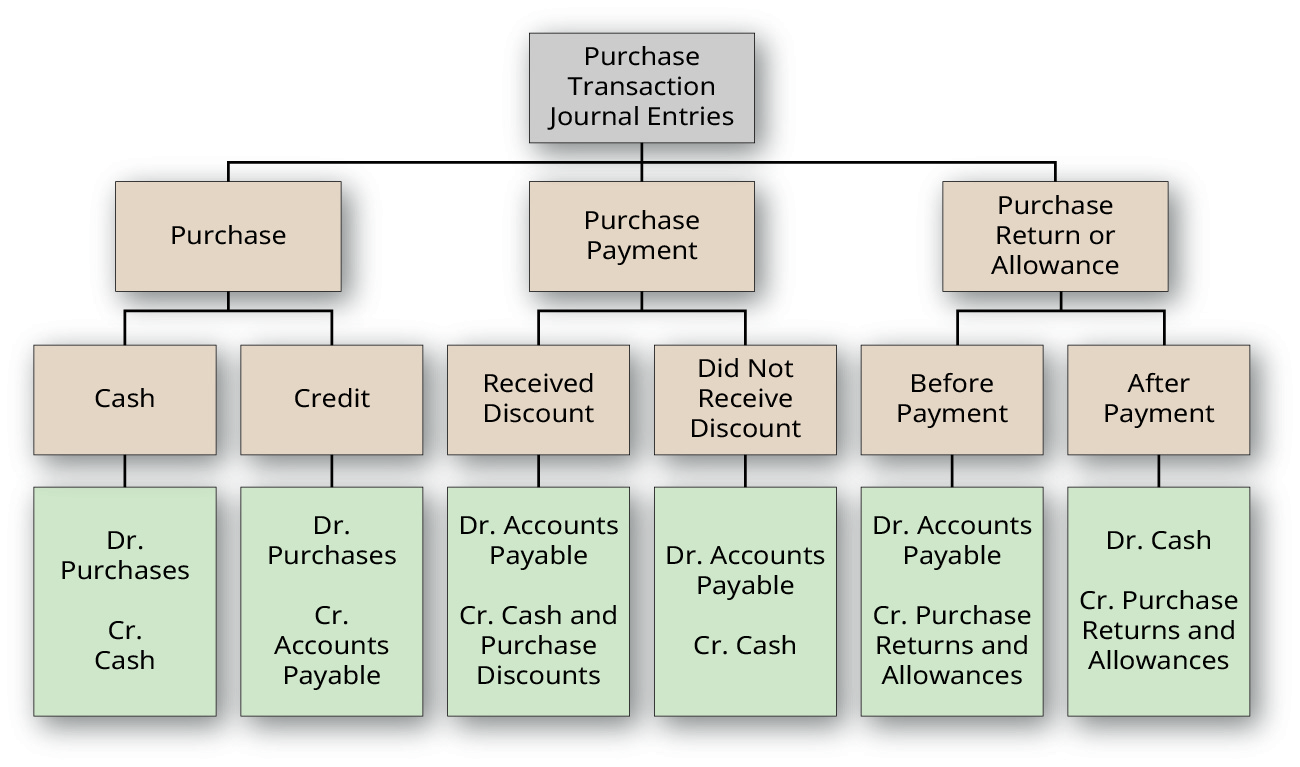

Summary of Purchase Transaction Journal Entries

The chart in the Figure below represents the journal entry requirements based on various merchandising purchase transactions using the periodic inventory system.

YOUR TURN

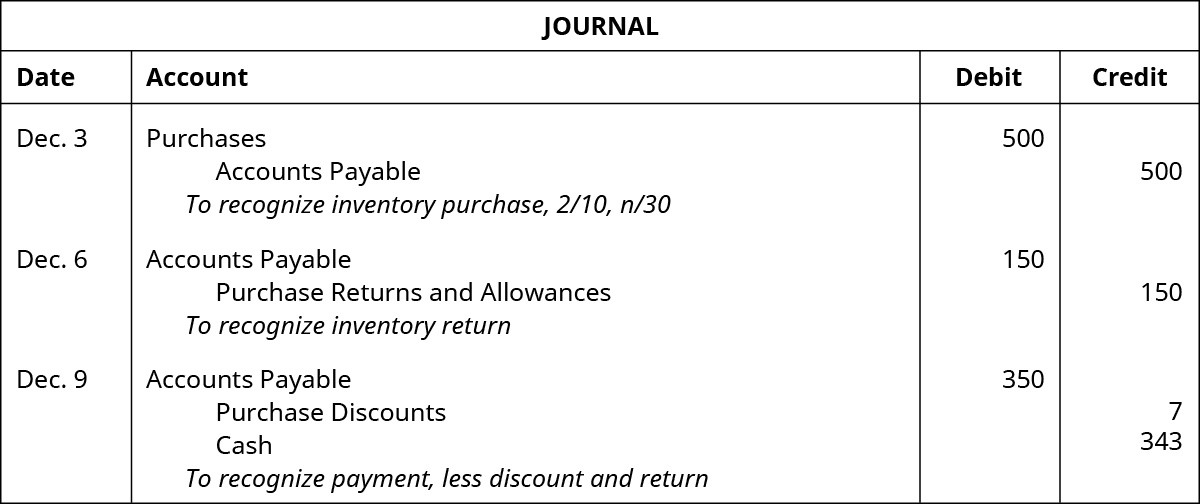

Record the journal entries for the following purchase transactions of a retailer, using the periodic inventory system.

| Dec. 3 | Purchased $500 worth of inventory on credit with terms 2/10, n/30, and invoice dated December 3. |

| Dec. 6 | Returned $150 worth of damaged inventory to the manufacturer and received a full refund. |

| Dec. 9 | Customer paid the account in full, less the return. |

Solution

Merchandise Sales

The following example transactions and subsequent journal entries for merchandise sales are recognized using a periodic inventory system.

Basic Analysis of Sales Transaction Journal Entries

Let’s continue to follow California Business Solutions (CBS) and the sale of electronic hardware packages to business customers. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and 4-in-1 printer. CBS sells each hardware package for $1,200. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. The following is the list of products CBS sells to customers; the prices are per-package, and per unit.

Cash and Credit Sales Transaction Journal Entries

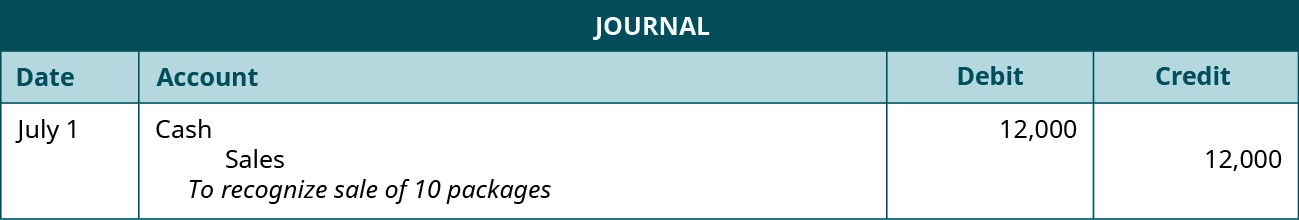

On July 1, CBS sells 10 electronic packages to a customer at a sales price of $1,200 each. The customer pays immediately with cash. The following entries occur.

Cash increases (debit) and Sales increases (credit) by the selling price of the packages, $12,000 ($1,200 × 10). Unlike the perpetual inventory system, there is no entry for the cost of the sale. This recognition occurs at the end of the period with an adjustment to Cost of Goods Sold.

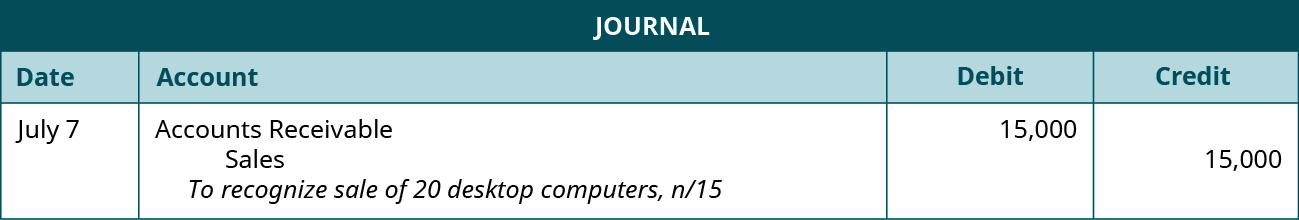

On July 7, CBS sells 20 desktop computers to a customer on credit. The credit terms are n/15 with an invoice date of July 7. The following entries occur.

Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) by the selling price of the computers, $15,000 ($750 × 20).

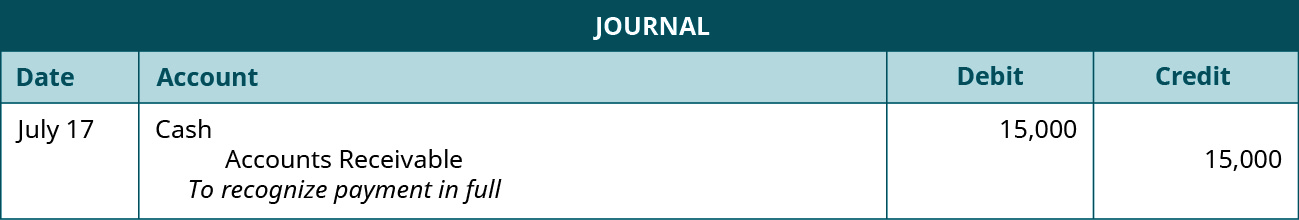

On July 17, the customer makes full payment on the amount due from the July 7 sale. The following entry occurs.

Accounts Receivable decreases (credit) and Cash increases (debit) by the full amount owed. The credit terms were n/15, which is net due in 15 days. No discount was offered with this transaction, thus the full payment of $15,000 occurs.

Sales Discount Transaction Journal Entries

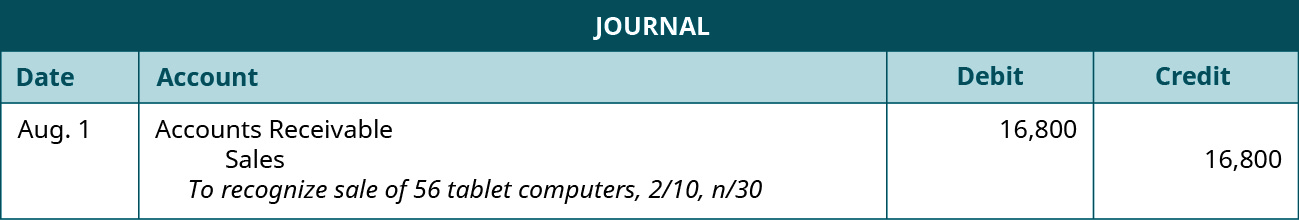

On August 1, a customer purchases 56 tablet computers on credit. Terms are 2/10, n/30, and invoice dated August 1. The following entries occur.

Accounts Receivable increases (debit) and Sales increases (credit) by $16,800 ($300 × 56). These credit terms are a little different than the earlier example. These credit terms include a discount opportunity (2/10). This means that the customer has 10 days from the invoice date to pay on their account to receive a 2% discount on their purchase.

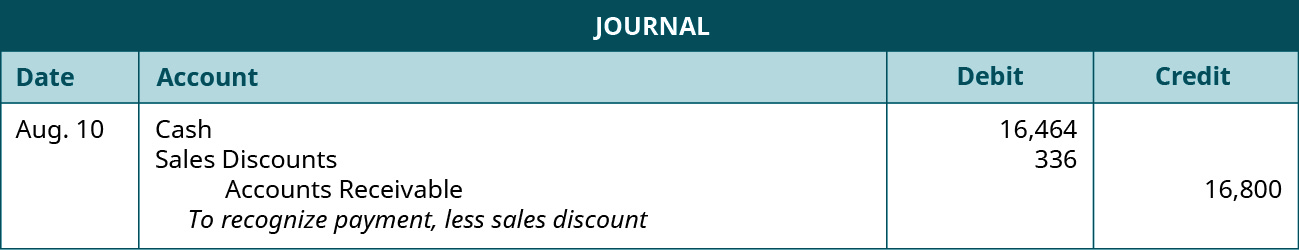

On August 10, the customer pays their account in full. The following entry occurs.

Since the customer paid on August 10, they made the 10-day window, thus receiving a discount of 2%. Cash increases (debit) for the amount paid to CBS, less the discount. Sales Discounts increases (debit) by the amount of the discount ($16,800 × 2%), and Accounts Receivable decreases (credit) by the original amount owed, before discount. Sales Discounts will reduce Sales at the end of the period to produce net sales.

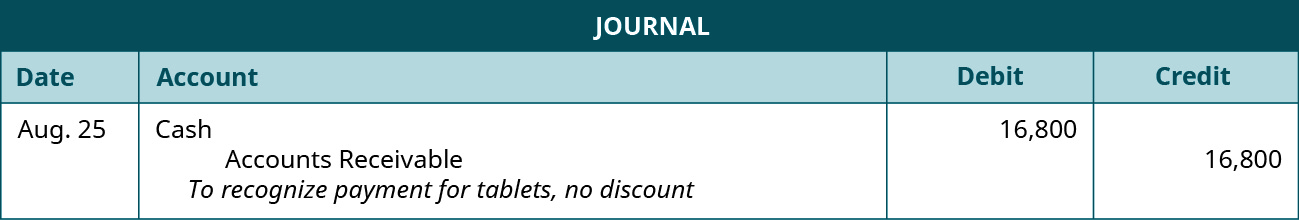

Let’s take the same example sale with the same credit terms, but now assume that the customer paid their account on August 25. The following entry occurs.

Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. The customer paid on their account outside of the discount window but within the total allotted timeframe for payment. The customer does not receive a discount in this case but does pay in full and on time.

Sales Returns and Allowances Transaction Journal Entries

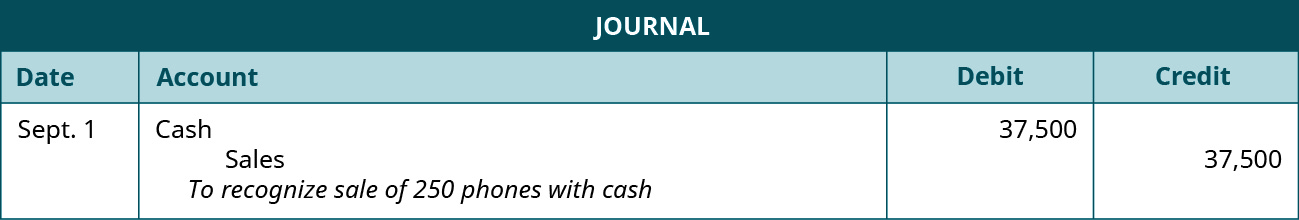

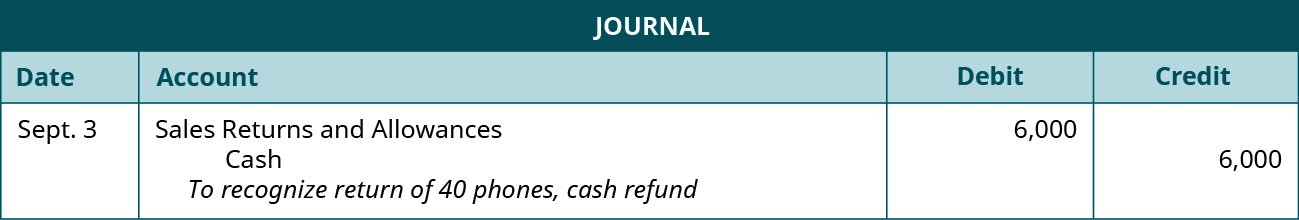

On September 1, CBS sold 250 landline telephones to a customer who paid with cash. On September 3, the customer discovers that 40 of the phones are the wrong color and returns the phones to CBS in exchange for a full refund. The following entries occur for the sale and subsequent return.

Cash increases (debit) and Sales increases (credit) by $37,500 (250 × $150), the sales price of the phones.

Since the customer already paid in full for their purchase, a full cash refund is issued on September 3. This increases Sales Returns and Allowances (debit) and decreases Cash (credit) by $6,000 (40 × $150). Unlike in the perpetual inventory system, CBS does not recognize the return of merchandise to inventory. Instead, CBS will make an adjustment to Merchandise Inventory at the end of the period.

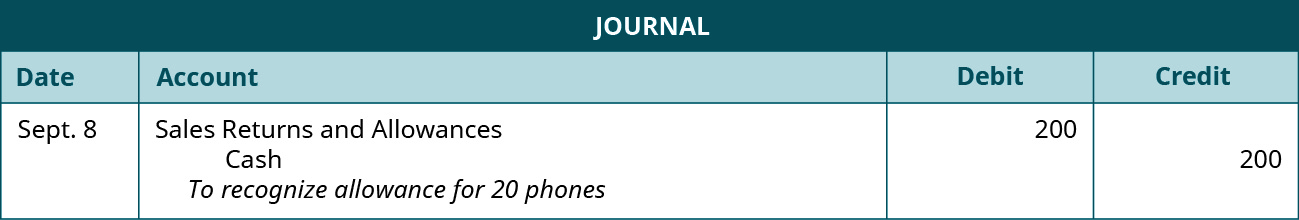

On September 8, the customer discovers that 20 more phones from the September 1 purchase are slightly damaged. The customer decides to keep the phones but receives a sales allowance from CBS of $10 per phone. The following entry occurs for the allowance.

Since the customer already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $200 (20 × $10). This increases (debit) Sales Returns and Allowances and decreases (credit) Cash.

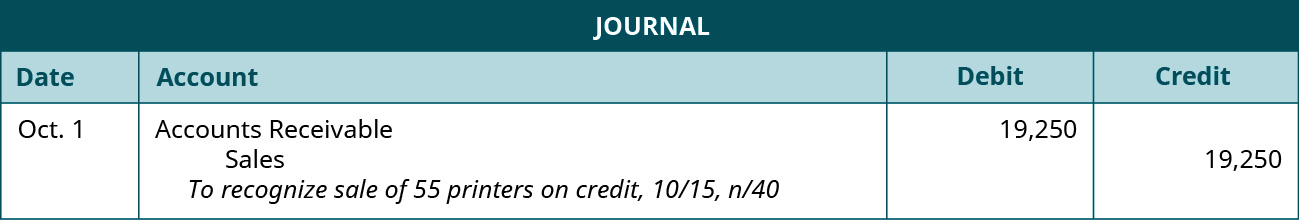

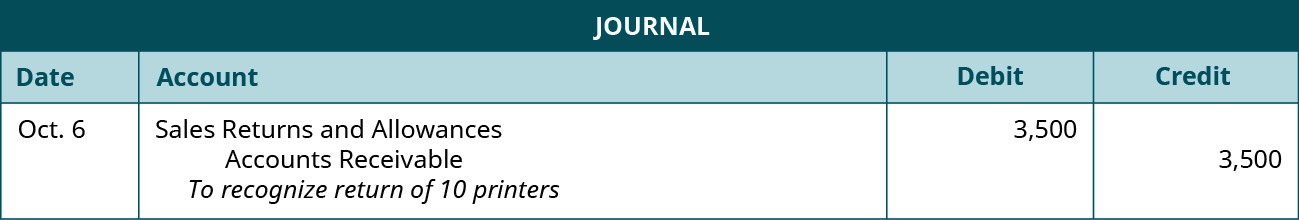

A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. Terms of the sale are 10/15, n/40, with an invoice date of October 1. On October 6, the customer discovers 10 of the printers are damaged and returns them to CBS for a full refund. The following entries show the sale and subsequent return.

Accounts Receivable increases (debit) and Sales increases (credit) by $19,250 (55 × $350), the sales price of the printers. Accounts Receivable is used instead of Cash because the customer purchased on credit.

The customer has not yet paid for their purchase as of October 6. This increases Sales Returns and Allowances (debit) and decreases Accounts Receivable (credit) by $3,500 (10 × $350).

On October 10, the customer discovers that 5 more printers from the October 1 purchase are slightly damaged, but decides to keep them because CBS issues an allowance of $60 per printer. The following entry recognizes the allowance.

Sales Returns and Allowances increases (debit) and Accounts Receivable decreases (credit) by $300 (5 × $60). A reduction to Accounts Receivable occurs because the customer has yet to pay their account on October 10.

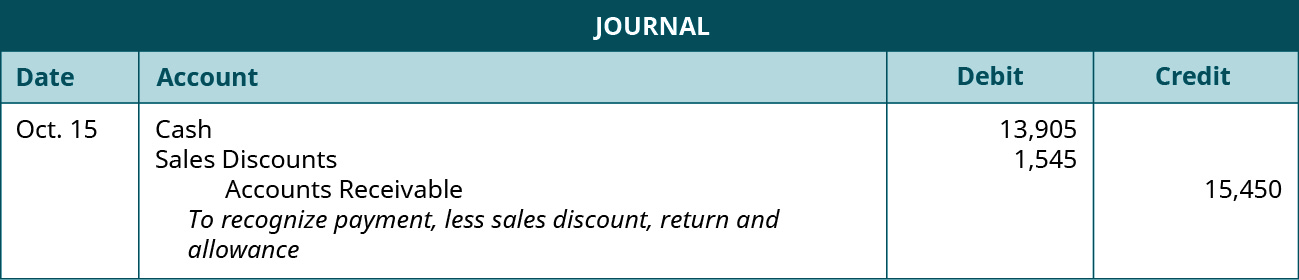

On October 15, the customer pays their account in full, less sales returns and allowances. The following payment entry occurs.

Accounts Receivable decreases (credit) for the original amount owed, less the return of $3,500 and the allowance of $300 ($19,250 – $3,500 – $300). Since the customer paid on October 15, they made the 15-day window and receiving a discount of 10%. Sales Discounts increases (debit) for the discount amount ($15,450 × 10%). Cash increases (debit) for the amount owed to CBS, less the discount.

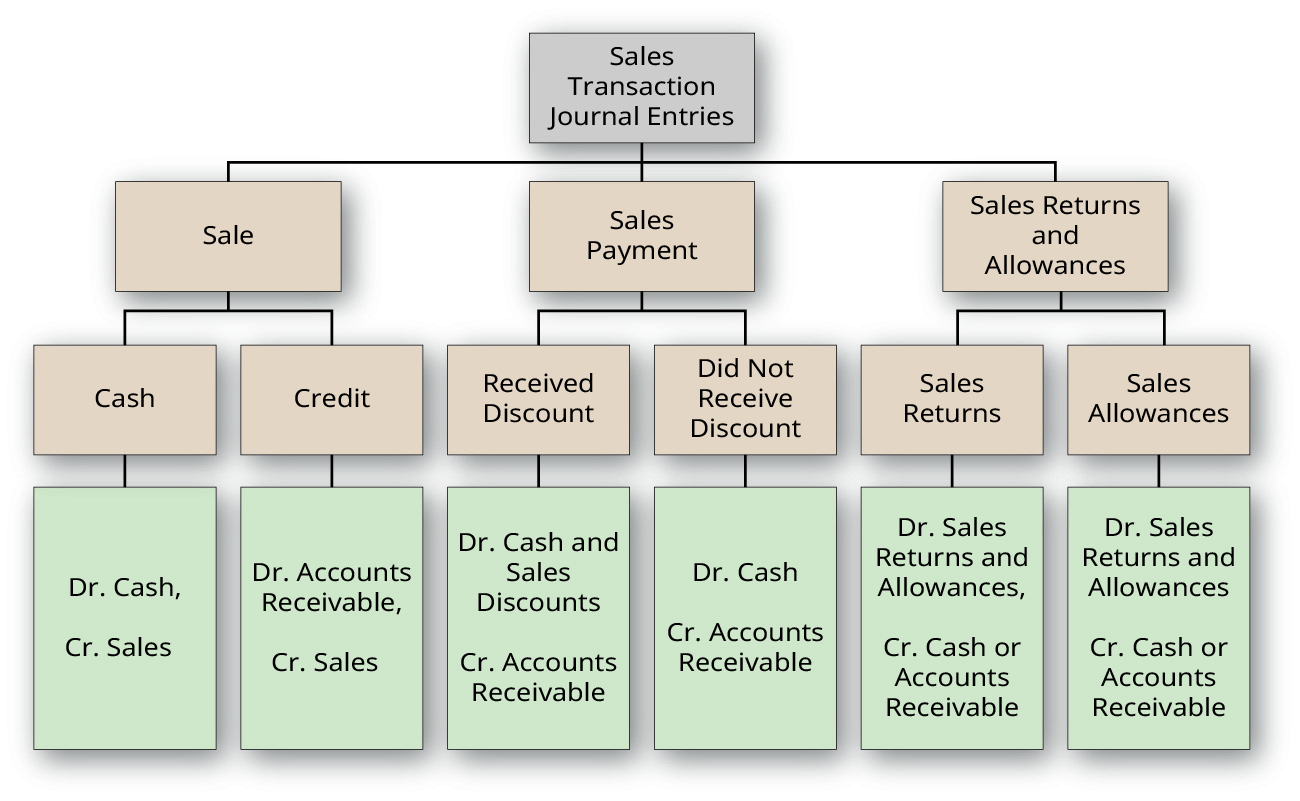

Summary of Sales Transaction Journal Entries

The chart in the Figure below represents the journal entry requirements based on various merchandising sales transactions using a periodic inventory system.

YOUR TURN

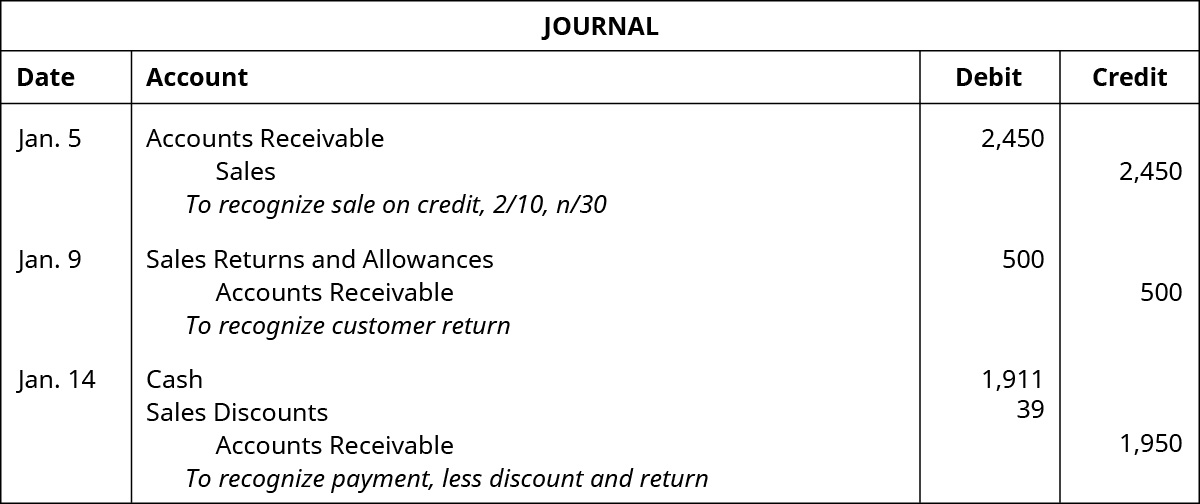

Record the journal entries for the following sales transactions of a retailer using the periodic inventory system.

| Jan. 5 | Sold $2,450 of merchandise on credit (cost of $1,000), with terms 2/10, n/30, and invoice dated January 5. |

| Jan. 9 | The customer returned $500 worth of slightly damaged merchandise to the retailer and received a full refund. |

| Jan. 14 | Customer paid the account in full, less the return. |

Solution

KEY TAKEAWAYS

Key Concepts and Summary

- A retailer can pay with cash or credit. Unlike in the perpetual inventory system, purchases of inventory in the periodic inventory system will debit Purchases rather than Merchandise Inventory.

- If a company pays for merchandise within the discount window, it debits Accounts Payable, credits Purchase Discounts, and credits Cash. If they pay outside the discount window, the company debits Accounts Payable and credits Cash.

- If a company returns merchandise before remitting payment, they would debit Accounts Payable and credit Purchase Returns and Allowances. If the company returns merchandise after remitting payment, they would debit Cash and credit Purchase Returns and Allowances.

- If a company obtains an allowance for damaged merchandise before remitting payment, they would debit Accounts Payable and credit Purchase Returns and Allowances. If the company obtains an allowance for damaged merchandise after remitting payment, they would debit Cash and credit Purchase Returns and Allowances.

- A customer can pay with cash or on credit. Unlike a perpetual inventory system, when recording a sale under a periodic system, there is no cost entry.

- If a customer pays for merchandise within the discount window, the company would debit Cash and Sales Discounts and credit Accounts Receivable. If the customer pays outside the discount window, the company debits Cash and credits Accounts Receivable only.

- If a customer returns merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash.

- If a customer obtains an allowance for damaged merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash.

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting