LO 12.2 Analyze, Journalize, and Report Current Liabilities

To illustrate current liability entries, we use transaction information from Sierra Sports (see (Figure)). Sierra Sports owns and operates a sporting goods store in the Southwest specializing in sports apparel and equipment. The company engages in regular business activities with suppliers, creditors, customers, and employees.

Accounts Payable

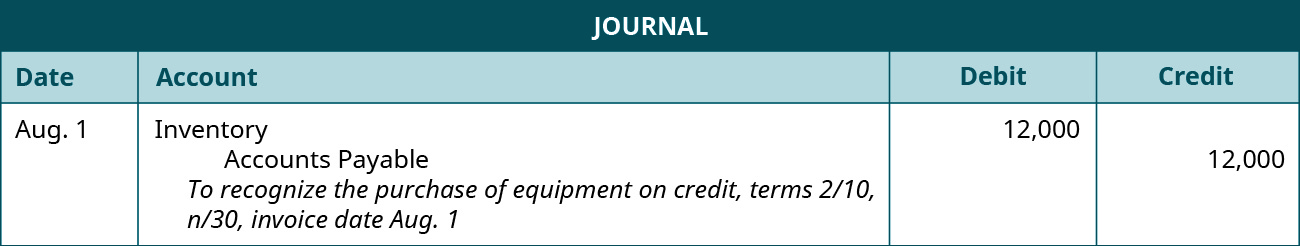

On August 1, Sierra Sports purchases $12,000 of soccer equipment from a manufacturer (supplier) on credit. Assume for the following examples that Sierra Sports uses the perpetual inventory method, which uses the Inventory account when the company buys, sells, or adjusts the inventory balance, such as in the following example where they qualified for a discount. In the current transaction, credit terms are 2/10, n/30, the invoice date is August 1, and shipping charges are FOB shipping point (which is included in the purchase cost).

Recall from Merchandising Transactions, that credit terms of 2/10, n/30 signal the payment terms and discount, and FOB shipping point establishes the point of merchandise ownership, the responsibility during transit, and which entity pays shipping charges. Therefore, 2/10, n/30 means Sierra Sports has ten days to pay its balance due to receive a 2% discount, otherwise Sierra Sports has net thirty days, in this case August 31, to pay in full but not receive a discount. FOB shipping point signals that since Sierra Sports takes ownership of the merchandise when it leaves the manufacturer, it takes responsibility for the merchandise in transit and will pay the shipping charges.

Sierra Sports would make the following journal entry on August 1.

The merchandise is purchased from the supplier on credit. In this case, Accounts Payable would increase (a credit) for the full amount due. Inventory, the asset account, would increase (a debit) for the purchase price of the merchandise.

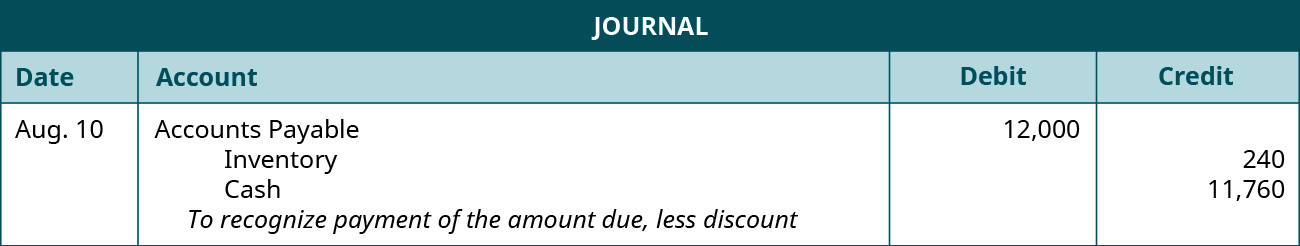

If Sierra Sports pays the full amount owed on August 10, it qualifies for the discount, and the following entry would occur.

Assume that the payment to the manufacturer occurs within the discount period of ten days (2/10, n/30) and is recognized in the entry. Accounts Payable decreases (debit) for the original amount due, Inventory decreases (credit) for the discount amount of $240 ($12,000 × 2%), and Cash decreases (credit) for the remaining balance due after discount.

Note that Inventory is decreased in this entry because the value of the merchandise (soccer equipment) is reduced. When applying the perpetual inventory method, this reduction is required by generally accepted accounting principles (GAAP) (under the cost principle) to reflect the actual cost of the merchandise.

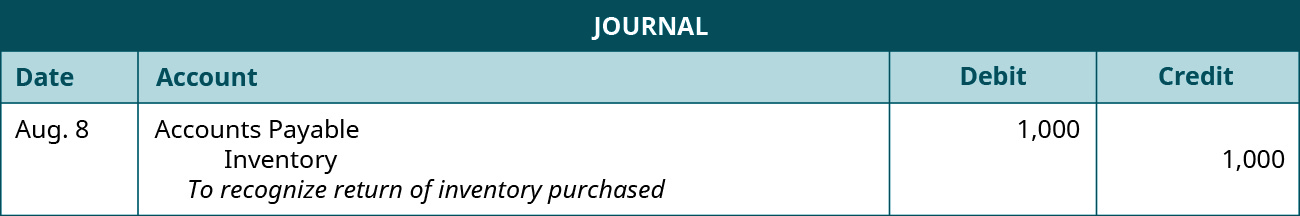

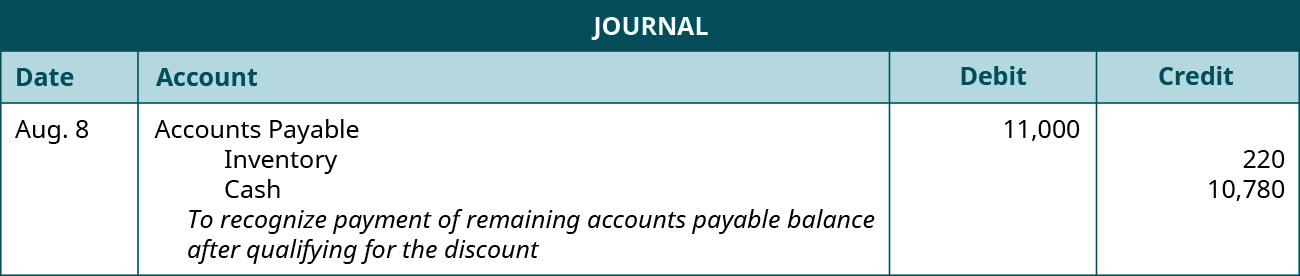

A second possibility is that Sierra will return part of the purchase before the ten-day discount window has expired. Assume in this example that $1,000 of the $12,000 purchase was returned to the seller on August 8 and the remaining account payable due was paid by Sierra to the seller on August 10, which means that Sierra qualified for the remaining eligible discount. The following two journal entries represent the return of inventory and the subsequent payment for the remaining account payable owed. The initial journal entry from August 1 will still apply, because we assume that Sierra intended to keep the full $12,000 of inventory when the purchase was made.

When the $1,000 in inventory was returned on August 8, the accounts payable account and the inventory accounts should be reduced by $1,000 as demonstrated in this journal entry.

After this transaction, Sierra still owed $11,000 and still had $11,000 in inventory from the purchase, assuming that Sierra had not sold any of it yet.

When Sierra paid the remaining balance on August 10, the company qualified for the discount. However, since Sierra only owed a remaining balance of $11,000 and not the original $12,000, the discount received was 2% of $11,000, or $220, as demonstrated in this journal entry. Since Sierra owed $11,000 and received a discount of $220, the supplier was paid $10,780. This second journal entry is the same as the one that would have recognized an original purchase of $11,000 that qualified for a discount.

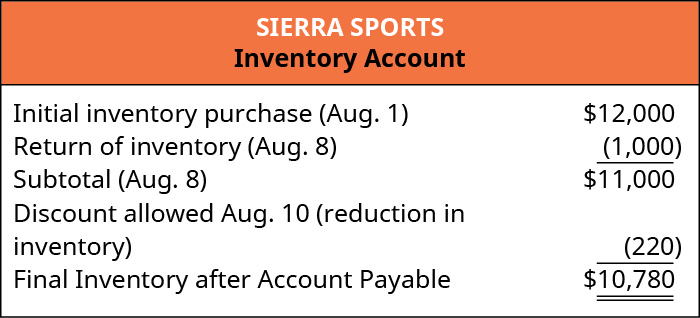

Remember that since we are assuming that Sierra was using the perpetual inventory method, purchases, payments, and adjustments in goods available for sale are reflected in the company’s Inventory account. In our example, one of the potential adjustments is that discounts received are recorded as reductions to the Inventory account.

To demonstrate this concept, after buying $12,000 in inventory, returning $1,000 in inventory, and then paying for the remaining balance and qualifying for the discount, Sierra’s Inventory balance increased by $10,780, as shown.

If Sierra had bought $11,000 of inventory on August 1 and paid cash and taken the discount, after taking the $220 discount, the increase of Inventory on their balance sheet would have been $10,780, as it finally ended up being in our more complicated set of transactions on three different days. The important factor is that the company qualified for a 2% discount on inventory that had a retail price before discounts of $11,000.

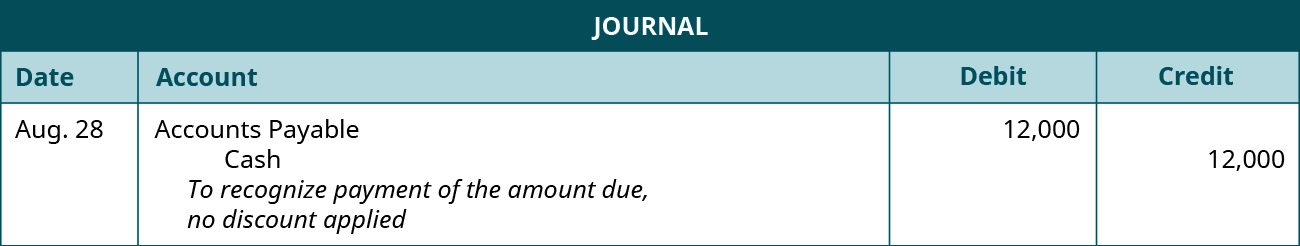

In a final possible scenario, assume that Sierra Sports remitted payment outside of the discount window on August 28, but inside of thirty days. In this case, they did not qualify for the discount, and assuming that they made no returns they paid the full, undiscounted balance of $12,000.

If this occurred, both Accounts Payable and Cash decreased by $12,000. Inventory is not affected in this instance because the full cost of the merchandise was paid; so, the increase in value for the inventory was $12,000, and not the $11,760 value determined in our beginning transactions where they qualified for the discount.

YOUR TURN

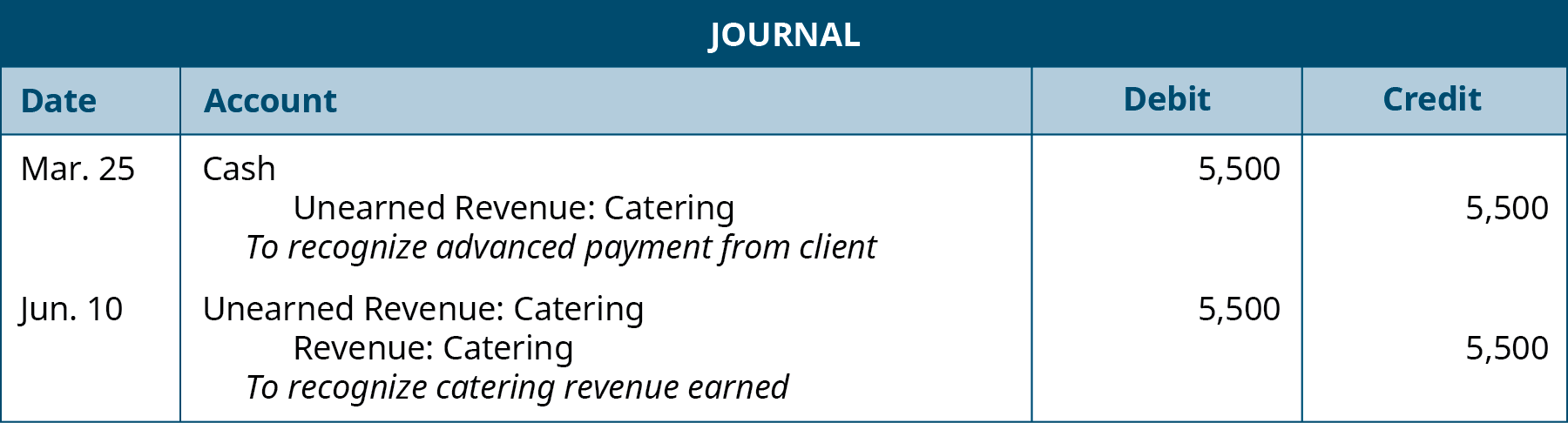

You are the owner of a catering company and require advance payments from clients before providing catering services. You receive an order from the Coopers, who would like you to cater their wedding on June 10. The Coopers pay you $5,500 cash on March 25. Record your journal entries for the initial payment from the Coopers, and when the catering service has been provided on June 10.

Solution

Unearned Revenue

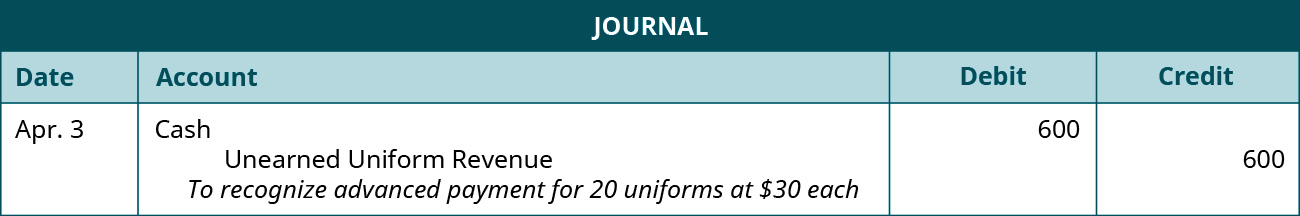

Sierra Sports has contracted with a local youth football league to provide all uniforms for participating teams. The league pays for the uniforms in advance, and Sierra Sports provides the customized uniforms shortly after purchase. The following situation shows the journal entry for the initial purchase with cash. Assume the league pays Sierra Sports for twenty uniforms (cost per uniform is $30, for a total of $600) on April 3.

Sierra Sports would see an increase to Cash (debit) for the payment made from the football league. The revenue from the sale of the uniforms is $600 (20 uniforms × $30 per uniform). Unearned Uniform Revenue accounts reflect the prepayment from the league, which cannot be recognized as earned revenue until the uniforms are provided. Unearned Uniform Revenue is a current liability account that increases (credit) with the increase in outstanding product debt.

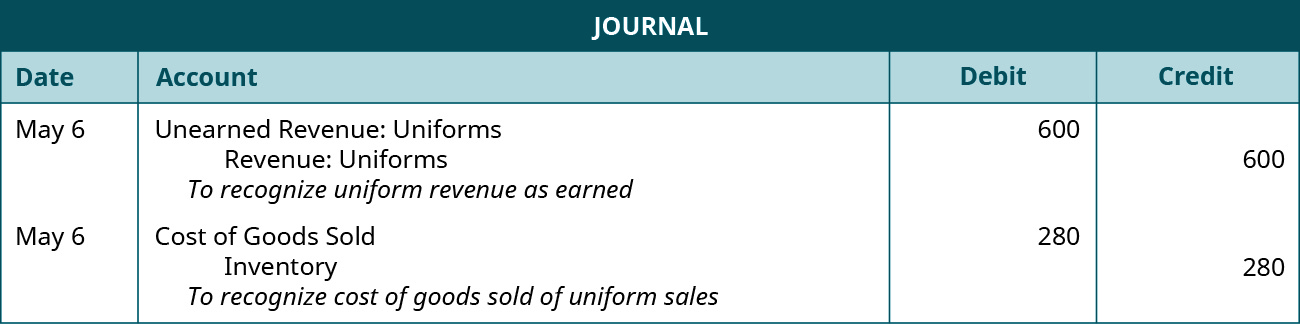

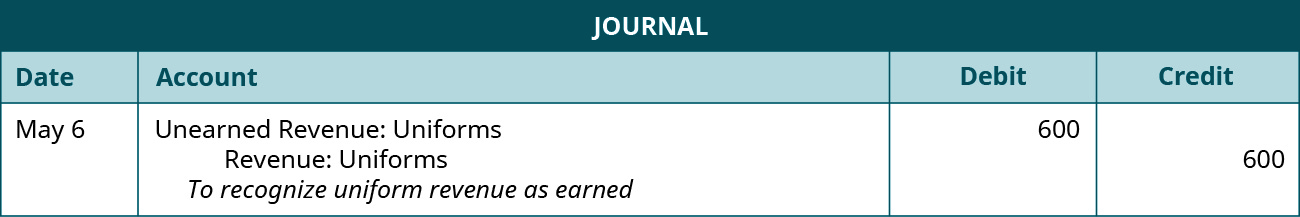

Sierra provides the uniforms on May 6 and records the following entry.

Now that Sierra has provided all of the uniforms, the unearned revenue can be recognized as earned. This satisfies the revenue recognition principle. Therefore, Unearned Uniform Revenue would decrease (debit), and Uniform Revenue would increase (credit) for the total amount.

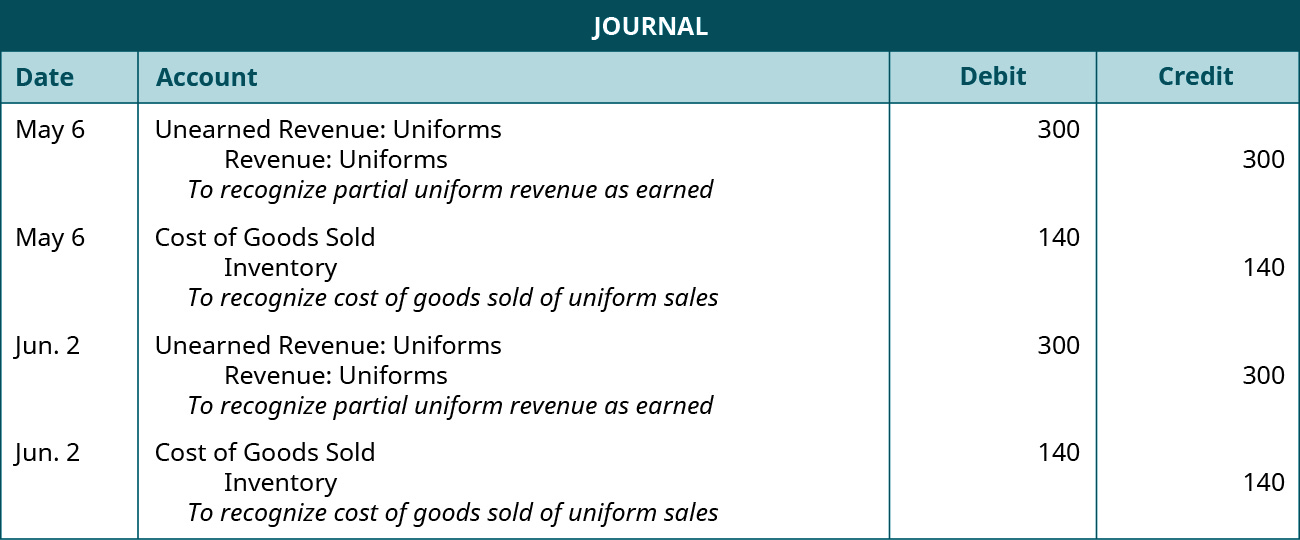

Let’s say that Sierra only provides half the uniforms on May 6 and supplies the rest of the order on June 2. The company may not recognize revenue until a product (or a portion of a product) has been provided. This means only half the revenue can be recognized on May 6 ($300) because only half of the uniforms were provided. The rest of the revenue recognition will have to wait until June 2. Since only half of the uniforms were delivered on May 6, only half of the costs of goods sold would be recognized on May 6. The other half of the costs of goods sold would be recognized on June 2 when the other half of the uniforms were delivered. The following entries show the separate entries for partial revenue recognition.

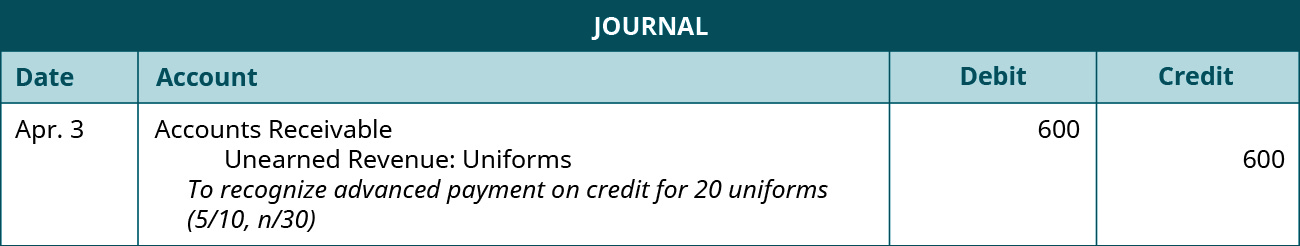

In another scenario using the same cost information, assume that on April 3, the league contracted for the production of the uniforms on credit with terms 5/10, n/30. They signed a contract for the production of the uniforms, so an account receivable was created for Sierra, as shown.

Sierra and the league have worked out credit terms and a discount agreement. As such, the league can delay cash payment for ten days and receive a discount, or for thirty days with no discount assessed. Instead of cash increasing for Sierra, Accounts Receivable increases (debit) for the amount the football league owes.

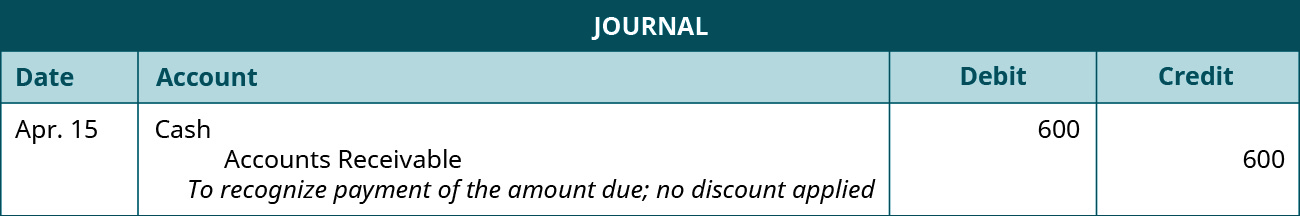

The league pays for the uniforms on April 15, and Sierra provides all uniforms on May 6. The following entry shows the payment on credit.

The football league made payment outside of the discount period, since April 15 is more than ten days from the invoice date. Thus, they do not receive the 5% discount. Cash increases (debit) for the $600 paid by the football league, and Accounts Receivable decreases (credit).

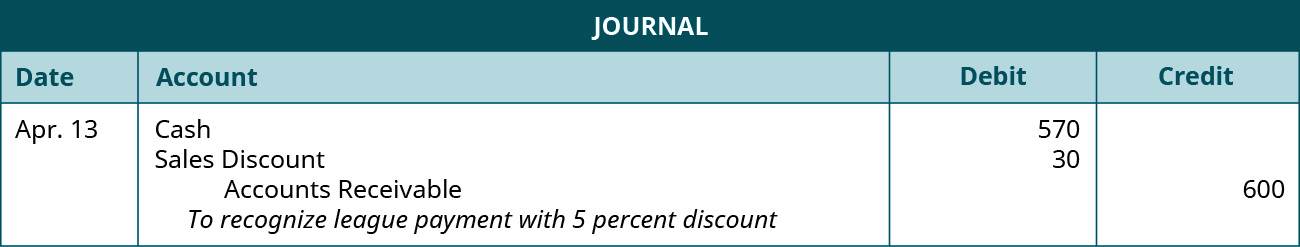

In the next example, let’s assume that the league made payment within the discount window, on April 13. The following entry occurs.

In this case, Accounts Receivable decreases (credit) for the original amount owed, Sales Discount increases (debit) for the discount amount of $30 ($600 × 5%), and Cash increases (debit) for the $570 paid by the football league less discount.

When the company provides the uniforms on May 6, Unearned Uniform Revenue decreases (debit) and Uniform Revenue increases (credit) for $600.

ETHICAL CONSIDERATIONS

The anticipated income of public companies is projected by stock market analysts through whisper-earnings, or forecasted earnings. It can be advantageous for a company to have its stock beat the stock market’s expectation of earnings. Likewise, falling below the market’s expectation can be a disadvantage. If a company’s whisper-earnings are not going to be met, there could be pressure on the chief financial officer to misrepresent earnings through manipulation of unearned revenue accounts to better match the stock market’s expectation.

Because many executives, other top management, and even employees have stock options, this can also provide incentive to manipulate earnings. A stock option sets a minimum price for the stock on a certain date. This is the date the option vests, at what is commonly called the strike price. Options are worthless if the stock price on the vesting date is lower than the price at which they were granted. This could result in a loss of income, potentially incentivizing earnings manipulation to meet the stock market’s expectations and exceed the vested stock price in the option.

Researchers have found that when executive options are about to vest, companies are more likely to present financial statements meeting or just slightly beating the earnings forecasts of analysts. The proximity of the actual earnings to earnings forecasts suggests they were manipulated because of the vesting.1 As Douglas R. Carmichael points out, “public companies that fail to report quarterly earnings which meet or exceed analysts’ expectations often experience a drop in their stock prices. This can lead to practices that sometimes include fraudulent overstatement of quarterly revenue.”2 If earnings meet or exceed expectations, a stock price can hit or surpass the vested stock price in the option. For company members with stock options, this could result in higher income. Thus, financial statements that align closely with analysts’ estimates, rather than showing large projections above or below whisper-earnings, could indicate that accounting information has possibly been adjusted to meet the expected numbers. Such manipulations can be made in unearned revenue accounts.

In November 1998, the Securities and Exchange Commission (SEC) issued Practice Alert 98-3, Revenue Recognition Issues, SEC Practice Section Professional Issues Task Force, recognizing and discussing the manipulation of earnings used to exceed stock market and analysts’ expectations. Accountants should watch for revenue recognition related issues in preparing the financial statements of their company or client, especially when employees’ or management’s stock options are about to vest.

Current Portion of a Noncurrent Note Payable

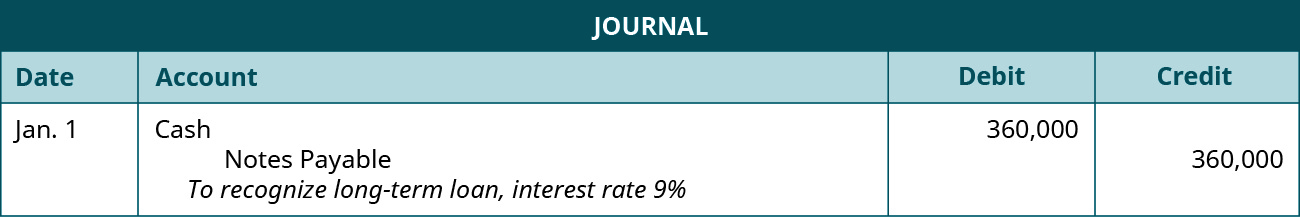

Sierra Sports takes out a bank loan on January 1, 2017 to cover expansion costs for a new store. The note amount is $360,000. The note has terms of repayment that include equal principal payments annually over the next twenty years. The annual interest rate on the loan is 9%. Interest accumulates each month based on the standard interest rate formula discussed previously, and on the current outstanding principal balance of the loan. Sierra records interest accumulation every three months, at the end of each third month. The initial loan (note) entry follows.

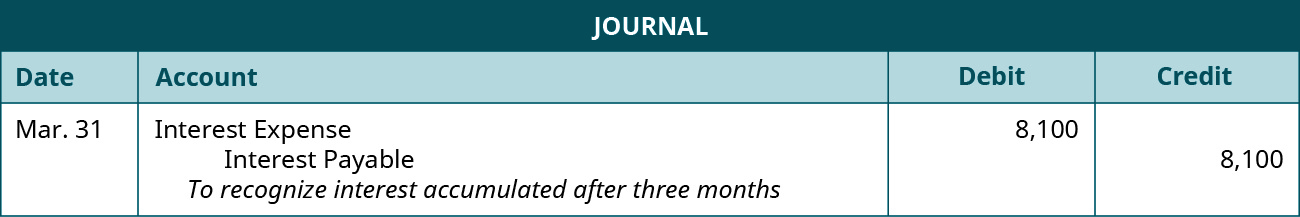

Notes Payable increases (credit) for the full loan principal amount. Cash increases (debit) as well. On March 31, the end of the first three months, Sierra records their first interest accumulation.

Interest Expense increases (debit) as does Interest Payable (credit) for the amount of interest accumulated but unpaid at the end of the three-month period. The amount $8,100 is found by using the interest formula, where the outstanding principal balance is $360,000, interest rate of 9%, and the part of the year being three out of twelve months: $360,000 × 9% × (3/12).

The same entry for interest will occur every three months until year-end. When accumulated interest is paid on January 1 of the following year, Sierra would record this entry.

Both Interest Payable and Cash decrease for the total interest amount accumulated during 2017. This is calculated by taking each three-month interest accumulation of $8,100 and multiplying by the four recorded interest entries for the periods. You could also compute this by taking the original principal balance and multiplying by 9%.

On December 31, 2017, the first principal payment is due. The following entry occurs to show payment of this principal amount due in the current period.

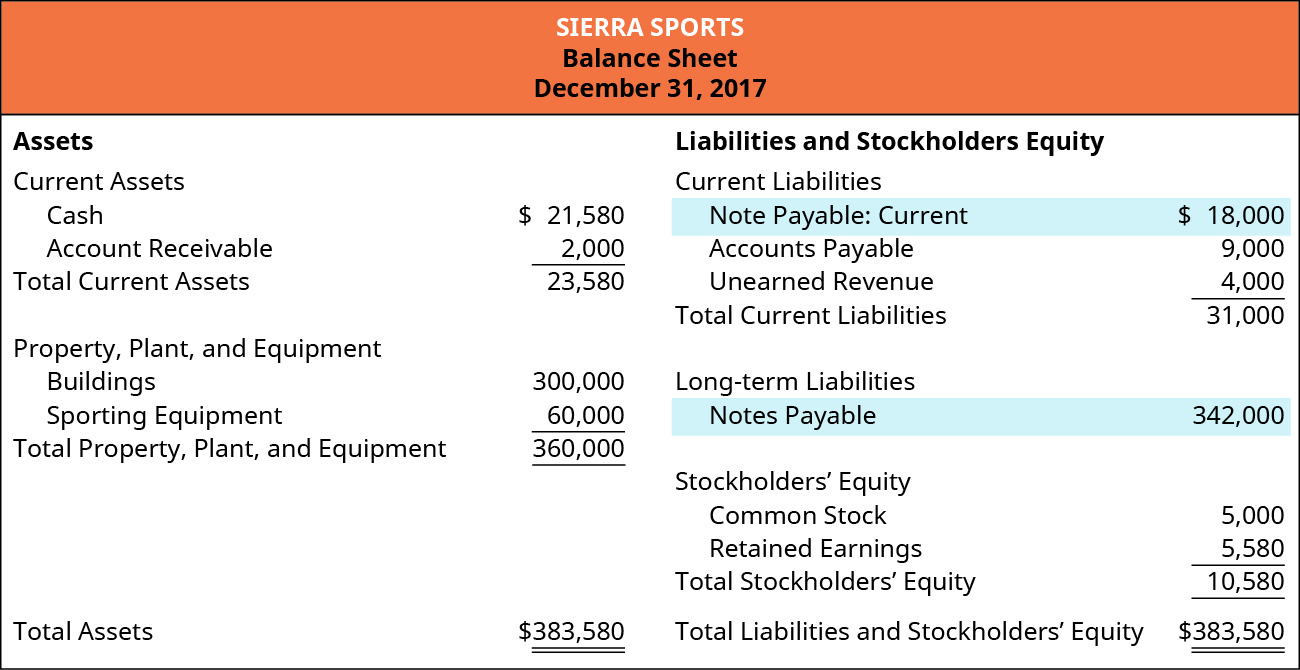

Notes Payable decreases (debit), as does Cash (credit), for the amount of the noncurrent note payable due in the current period. This amount is calculated by dividing the original principal amount ($360,000) by twenty years to get an annual current principal payment of $18,000 ($360,000/20).

While the accounts used to record a reduction in Notes Payable are the same as the accounts used for a noncurrent note, the reporting on the balance sheet is classified in a different area. The current portion of the noncurrent note payable ($18,000) is reported under Current Liabilities, and the remaining noncurrent balance of $342,000 ($360,000 – $18,000) is classified and displayed under noncurrent liabilities, as shown in (Figure).

Taxes Payable

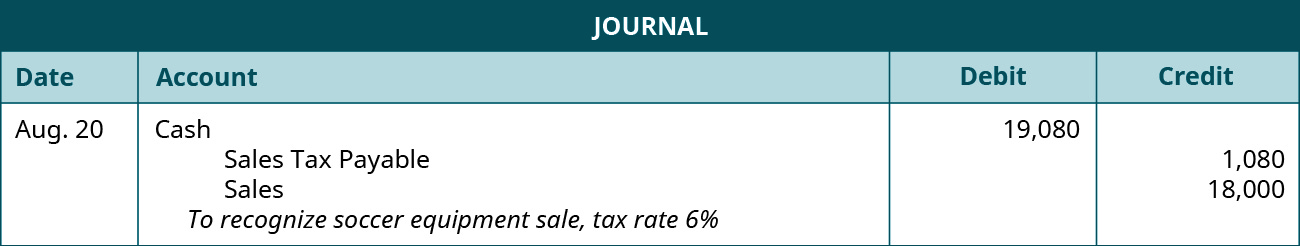

Let’s consider our previous example where Sierra Sports purchased $12,000 of soccer equipment in August. Sierra now sells the soccer equipment to a local soccer league for $18,000 cash on August 20. The sales tax rate is 6%. The following revenue entry would occur.

Cash increases (debit) for the sales amount plus sales tax. Sales Tax Payable increases (credit) for the 6% tax rate ($18,000 × 6%). Sierra’s tax liability is owed to the State Tax Board. Sales increases (credit) for the original amount of the sale, not including sales tax. If Sierra’s customer pays on credit, Accounts Receivable would increase (debit) for $19,080 rather than Cash.

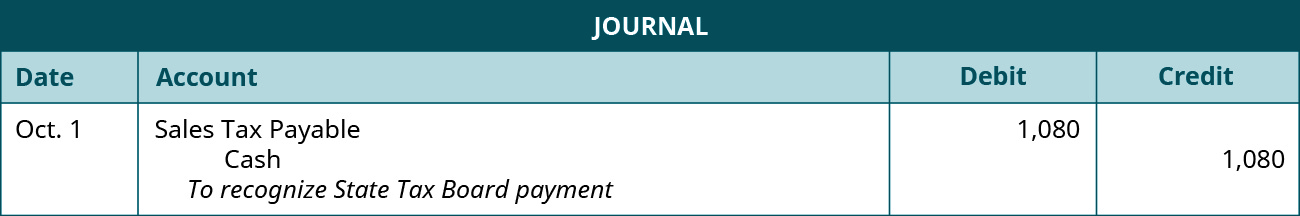

When Sierra remits payment to the State Tax Board on October 1, the following entry occurs.

Sales Tax Payable and Cash decrease for the payment amount of $1,080. Sales tax is not an expense to the business because the company is holding it on account for another entity.

Sierra Sports payroll tax journal entries will appear in Record Transactions Incurred in Preparing Payroll.

YOUR TURN

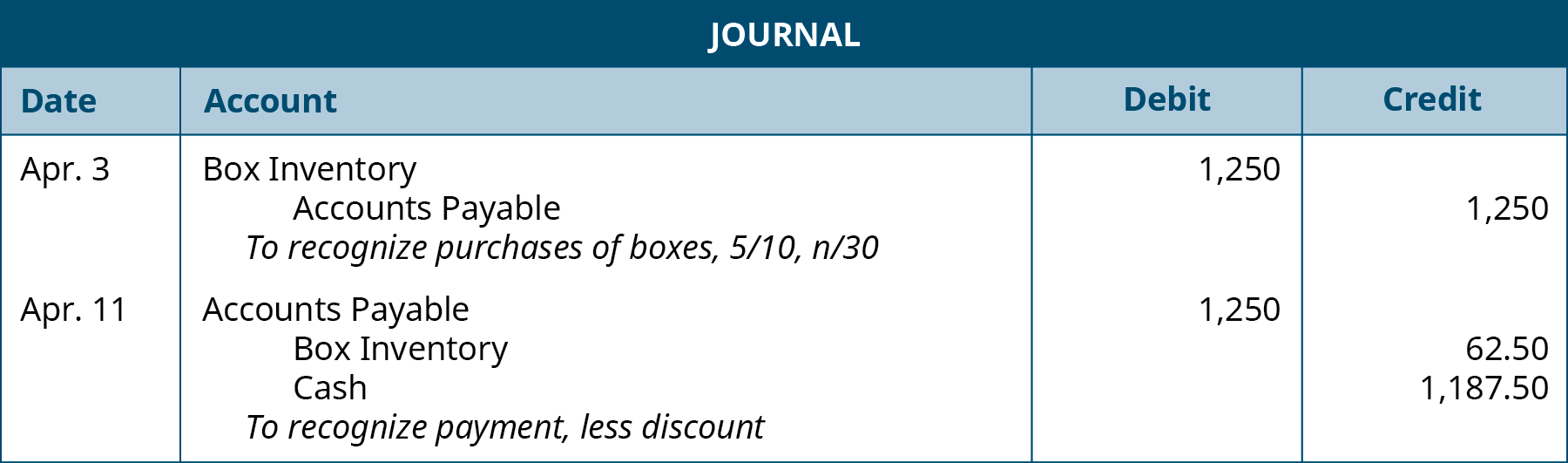

You own a shipping and packaging facility and provide shipping services to customers. You have worked out a contract with a local supplier to provide your business with packing materials on an ongoing basis. Terms of your agreement allow for delayed payment of up to thirty days from the invoice date, with an incentive to pay within ten days to receive a 5% discount on the packing materials. On April 3, you purchase 1,000 boxes (Box Inventory) from this supplier at a cost per box of $1.25. You pay the amount due to the supplier on April 11. Record the journal entries to recognize the initial purchase on April 3, and payment of the amount due on April 11.

Solution

KEY TAKEAWAYS

Key Concepts and Summary

- When the merchandiser initially pays the supplier on credit, it increases both Accounts Payable (a credit) and the appropriate merchandise Inventory account (a debit). When the amount due is later paid, it decreases both Accounts Payable (a debit) and Cash (a credit).

- When the company collects payment from a customer in advance of providing a product or service, it increases both Unearned Revenue (a credit) and Cash (a debit). When the company provides the product or service, Unearned Revenue decreases (a debit), and Revenue increases (a credit) to realize the amount earned.

- To recognize payment of the current portion of a noncurrent note payable, both Notes Payable and Cash would decrease, resulting in a debit and a credit, respectively. To recognize interest accumulation, both Interest Expense and Interest Payable would increase, resulting in a debit and a credit, respectively.

- To recognize sales tax in the initial sale to a customer, Cash or Accounts Receivable increases (a debit), and Sales Tax Payable increases (a credit), as does Sales (a credit). When the company remits the sales tax payment to the governing body, Sales Tax Payable decreases (a debit), as does Cash (a credit).

Footnotes

- 1 Jena McGregor. “How Stock Options Lead CEOs to Put Their Own Interests First.” Washington Post. February 11, 2014. https://www.washingtonpost.com/news/on-leadership/wp/2014/02/11/how-stock-options-lead-ceos-to-put-their-own-interests-first/?utm_term=.24d99a4fb1a5

- 2 Douglas R. Carmichael. “Hocus-Pocus Accounting.” Journal of Accountancy. October 1, 1999. https://www.journalofaccountancy.com/issues/1999/oct/carmichl.html

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting