LO 6.4a Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System

The following example transactions and subsequent journal entries for merchandise sales are recognized using a perpetual inventory system. The periodic inventory system recognition of these example transactions and corresponding journal entries are shown in Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System.

Basic Analysis of Sales Transaction Journal Entries

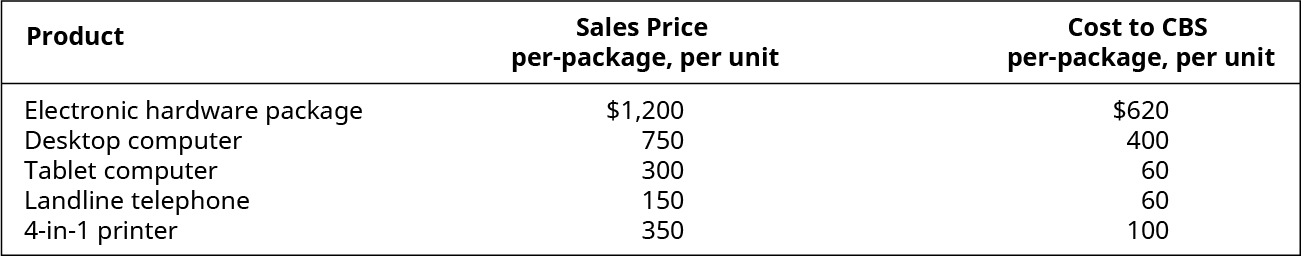

Let’s continue to follow California Business Solutions (CBS) and their sales of electronic hardware packages to business customers. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 printer. CBS sells each hardware package for $1,200. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. The Figure below lists the products CBS sells to customers; the prices are per-package, and per unit.

Cash and Credit Sales Transaction Journal Entries

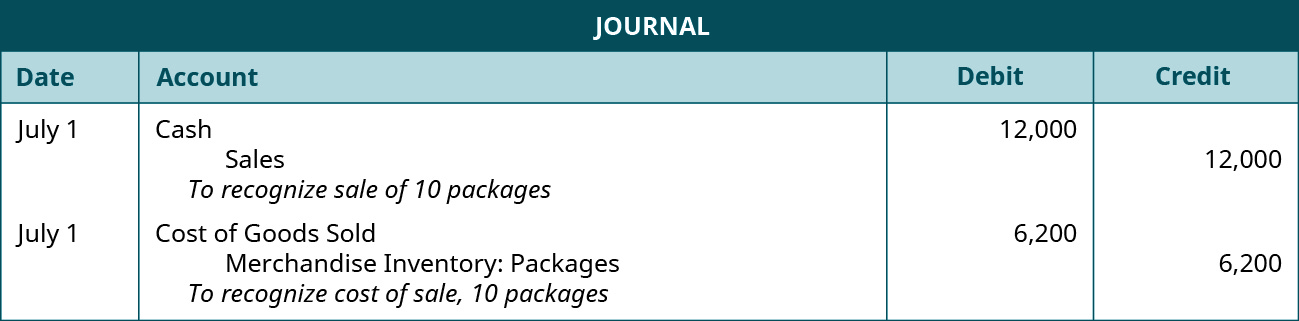

On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The customer pays immediately with cash. The following entries occur.

In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 × 10). In the second entry, the cost of the sale is recognized. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 × 10).

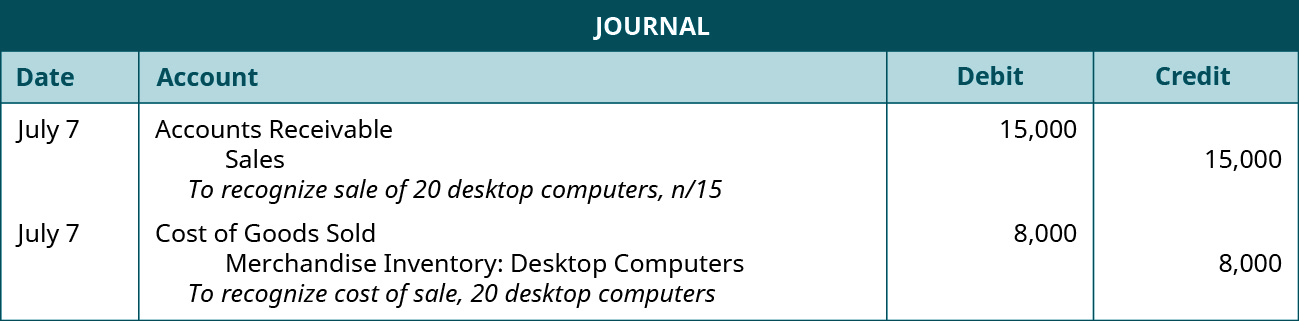

On July 7, CBS sells 20 desktop computers to a customer on credit. The credit terms are n/15 with an invoice date of July 7. The following entries occur.

Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 × 20). In the second entry, Merchandise Inventory-Desktop Computers decreases (credit), and COGS increases (debit) for the cost of the computers, $8,000 ($400 × 20).

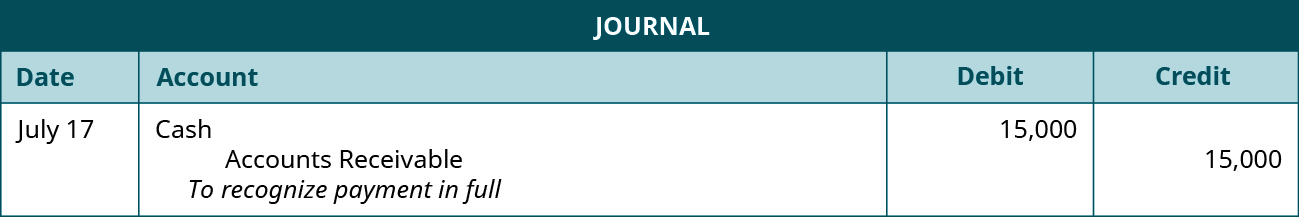

On July 17, the customer makes full payment on the amount due from the July 7 sale. The following entry occurs.

Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. The credit terms were n/15, which is net due in 15 days. No discount was offered with this transaction; thus the full payment of $15,000 occurs.

Sales Discount Transaction Journal Entries

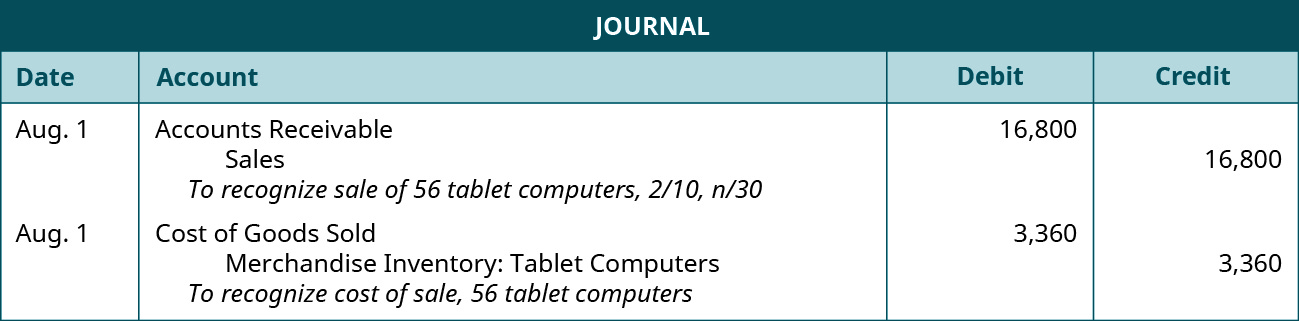

On August 1, a customer purchases 56 tablet computers on credit. The payment terms are 2/10, n/30, and the invoice is dated August 1. The following entries occur.

In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 × 56). These credit terms are a little different than the earlier example. These credit terms include a discount opportunity (2/10), meaning the customer has 10 days from the invoice date to pay on their account to receive a 2% discount on their purchase. In the second entry, COGS increases (debit) and Merchandise Inventory–Tablet Computers decreases (credit) in the amount of $3,360 (56 × $60).

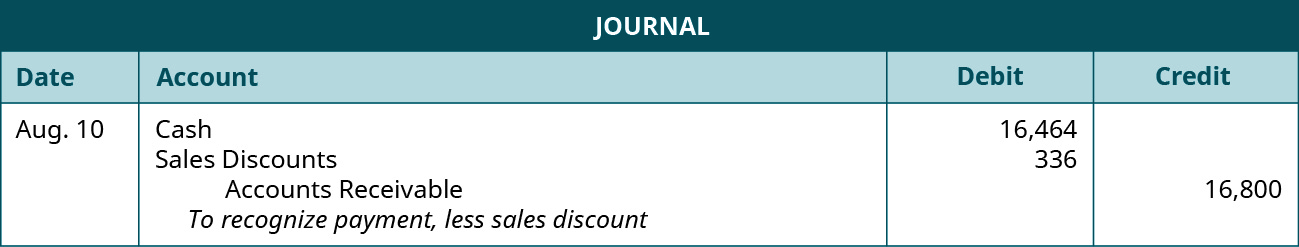

On August 10, the customer pays their account in full. The following entry occurs.

Since the customer paid on August 10, they made the 10-day window and received a discount of 2%. Cash increases (debit) for the amount paid to CBS, less the discount. Sales Discounts increases (debit) for the amount of the discount ($16,800 × 2%), and Accounts Receivable decreases (credit) for the original amount owed, before discount. Sales Discounts will reduce Sales at the end of the period to produce net sales.

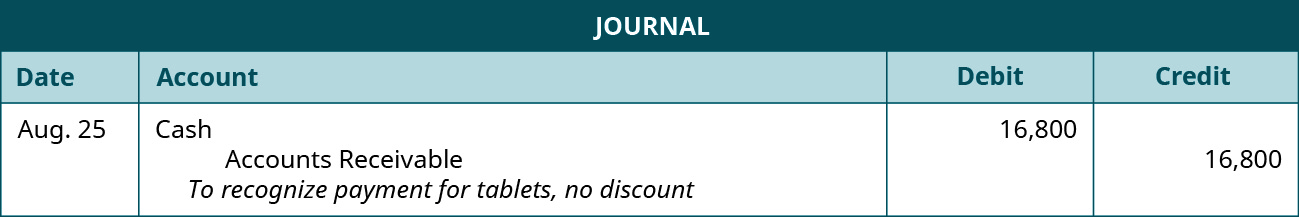

Let’s take the same example sale with the same credit terms, but now assume the customer paid their account on August 25. The following entry occurs.

Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. The customer paid on their account outside of the discount window but within the total allotted timeframe for payment. The customer does not receive a discount in this case but does pay in full and on time.

YOUR TURN

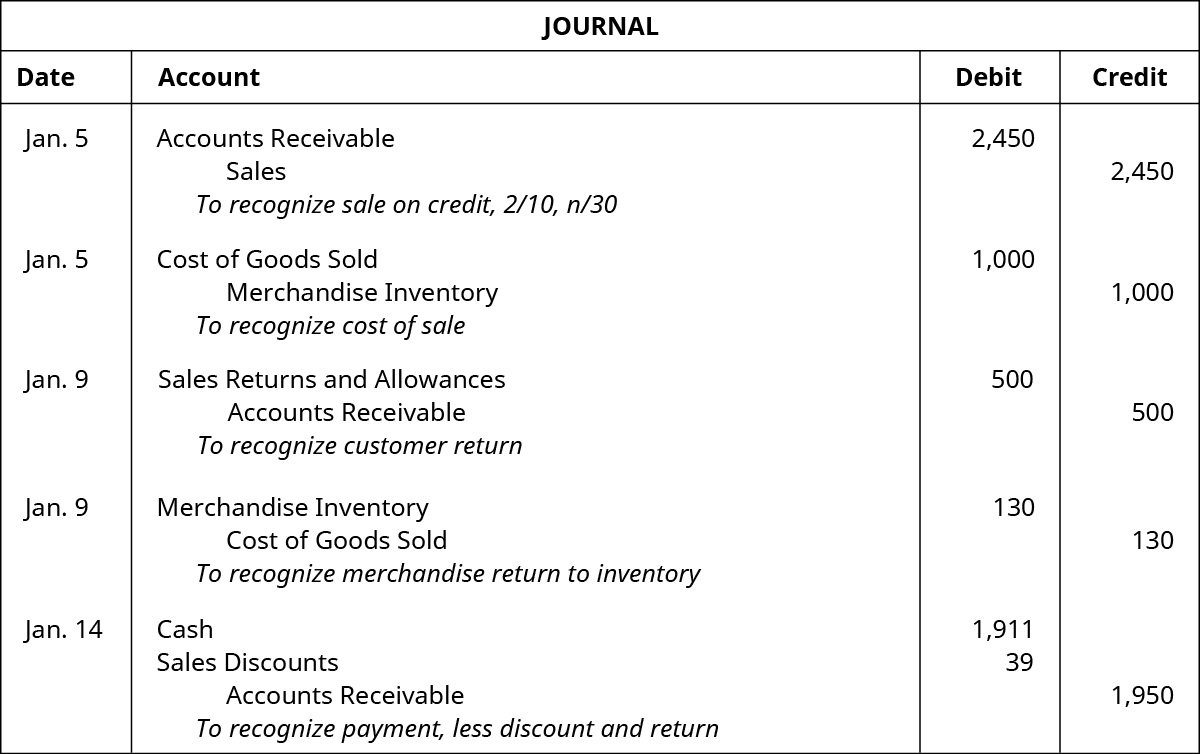

Record the journal entries for the following sales transactions by a retailer.

| Jan. 5 | Sold $2,450 of merchandise on credit (cost of $1,000), with terms 2/10, n/30, and invoice dated January 5. |

| Jan. 9 | The customer returned $500 worth of slightly damaged merchandise to the retailer and received a full refund. The retailer returned the merchandise to its inventory at a cost of $130. |

| Jan. 14 | Account paid in full. |

Solution

Sales Returns and Allowances Transaction Journal Entries

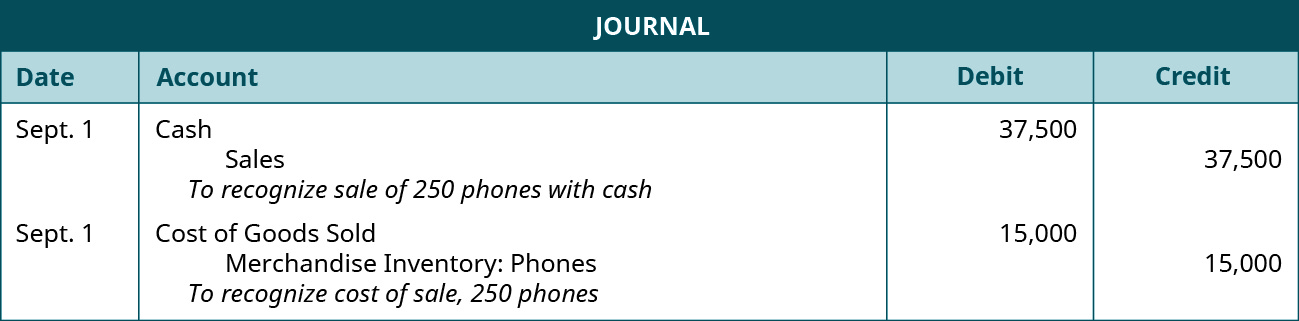

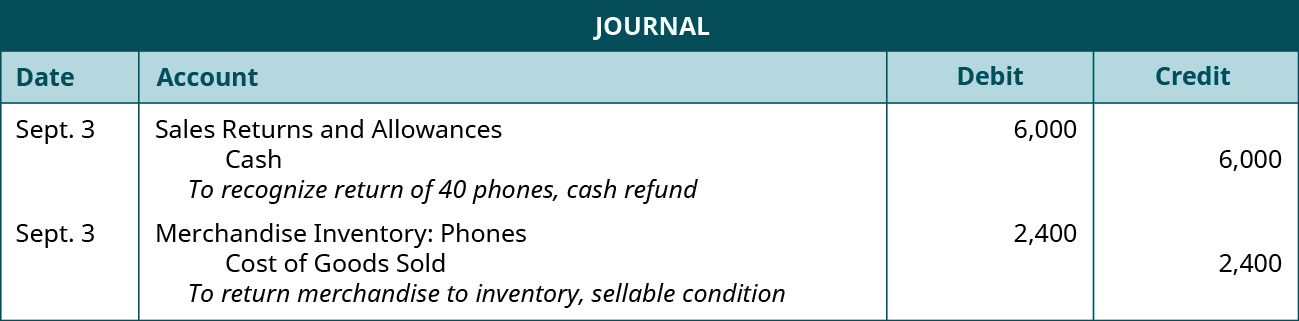

On September 1, CBS sold 250 landline telephones to a customer who paid with cash. On September 3, the customer discovers that 40 of the phones are the wrong color and returns the phones to CBS in exchange for a full refund. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The following entries occur for the sale and subsequent return.

In the first entry on September 1, Cash increases (debit) and Sales increases (credit) by $37,500 (250 × $150), the sales price of the phones. In the second entry, COGS increases (debit), and Merchandise Inventory-Phones decreases (credit) by $15,000 (250 × $60), the cost of the sale.

Since the customer already paid in full for their purchase, a full cash refund is issued on September 3. This increases Sales Returns and Allowances (debit) and decreases Cash (credit) by $6,000 (40 × $150). The second entry on September 3 returns the phones back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Merchandise Inventory–Phones increases (debit) and COGS decreases (credit) by $2,400 (40 × $60).

On September 8, the customer discovers that 20 more phones from the September 1 purchase are slightly damaged. The customer decides to keep the phones but receives a sales allowance from CBS of $10 per phone. The following entry occurs for the allowance.

Since the customer already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $200 (20 × $10). This increases (debit) Sales Returns and Allowances and decreases (credit) Cash. CBS does not have to consider the condition of the merchandise or return it to their inventory because the customer keeps the merchandise.

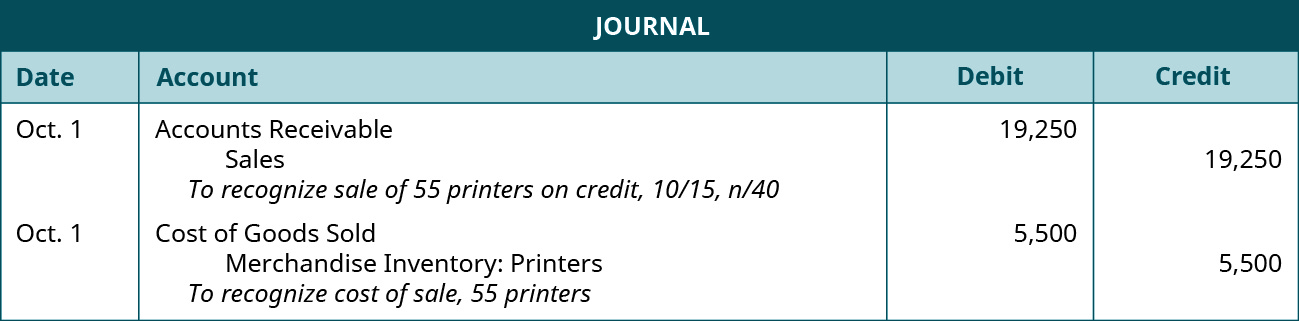

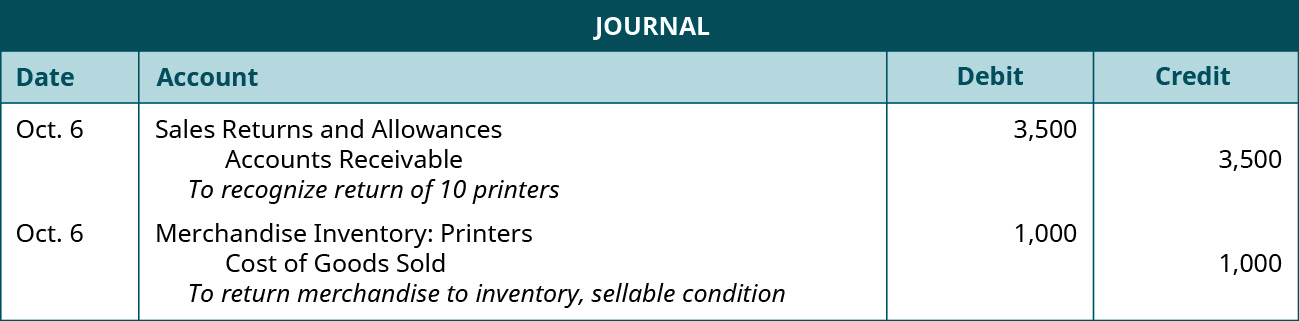

A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. Terms of the sale are 10/15, n/40, with an invoice date of October 1. On October 6, the customer returned 10 of the printers to CBS for a full refund. CBS returns the printers to their inventory at the original cost. The following entries show the sale and subsequent return.

In the first entry on October 1, Accounts Receivable increases (debit) and Sales increases (credit) by $19,250 (55 × $350), the sales price of the printers. Accounts Receivable is used instead of Cash because the customer purchased on credit. In the second entry, COGS increases (debit) and Merchandise Inventory–Printers decreases (credit) by $5,500 (55 × $100), the cost of the sale.

The customer has not yet paid for their purchase as of October 6. Therefore, the return increases Sales Returns and Allowances (debit) and decreases Accounts Receivable (credit) by $3,500 (10 × $350). The second entry on October 6 returns the printers back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Merchandise Inventory–Printers increases (debit) and COGS decreases (credit) by $1,000 (10 × $100).

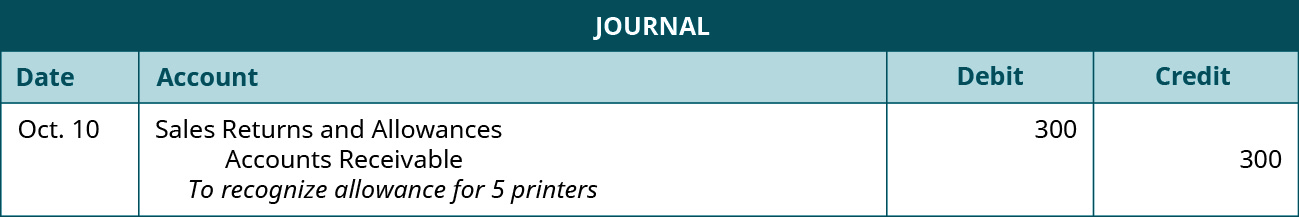

On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer. The following entry recognizes the allowance.

Sales Returns and Allowances increases (debit) and Accounts Receivable decreases (credit) by $300 (5 × $60). A reduction to Accounts Receivable occurs because the customer has yet to pay their account on October 10. CBS does not have to consider the condition of the merchandise or return it to their inventory because the customer keeps the merchandise.

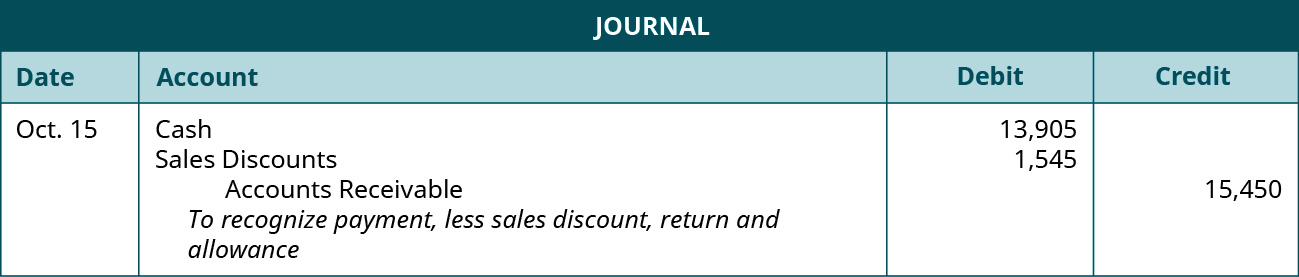

On October 15, the customer pays their account in full, less sales returns and allowances. The following payment entry occurs.

Accounts Receivable decreases (credit) for the original amount owed, less the return of $3,500 and the allowance of $300 ($19,250 – $3,500 – $300). Since the customer paid on October 15, they made the 15-day window, thus receiving a discount of 10%. Sales Discounts increases (debit) for the discount amount ($15,450 × 10%). Cash increases (debit) for the amount owed to CBS, less the discount.

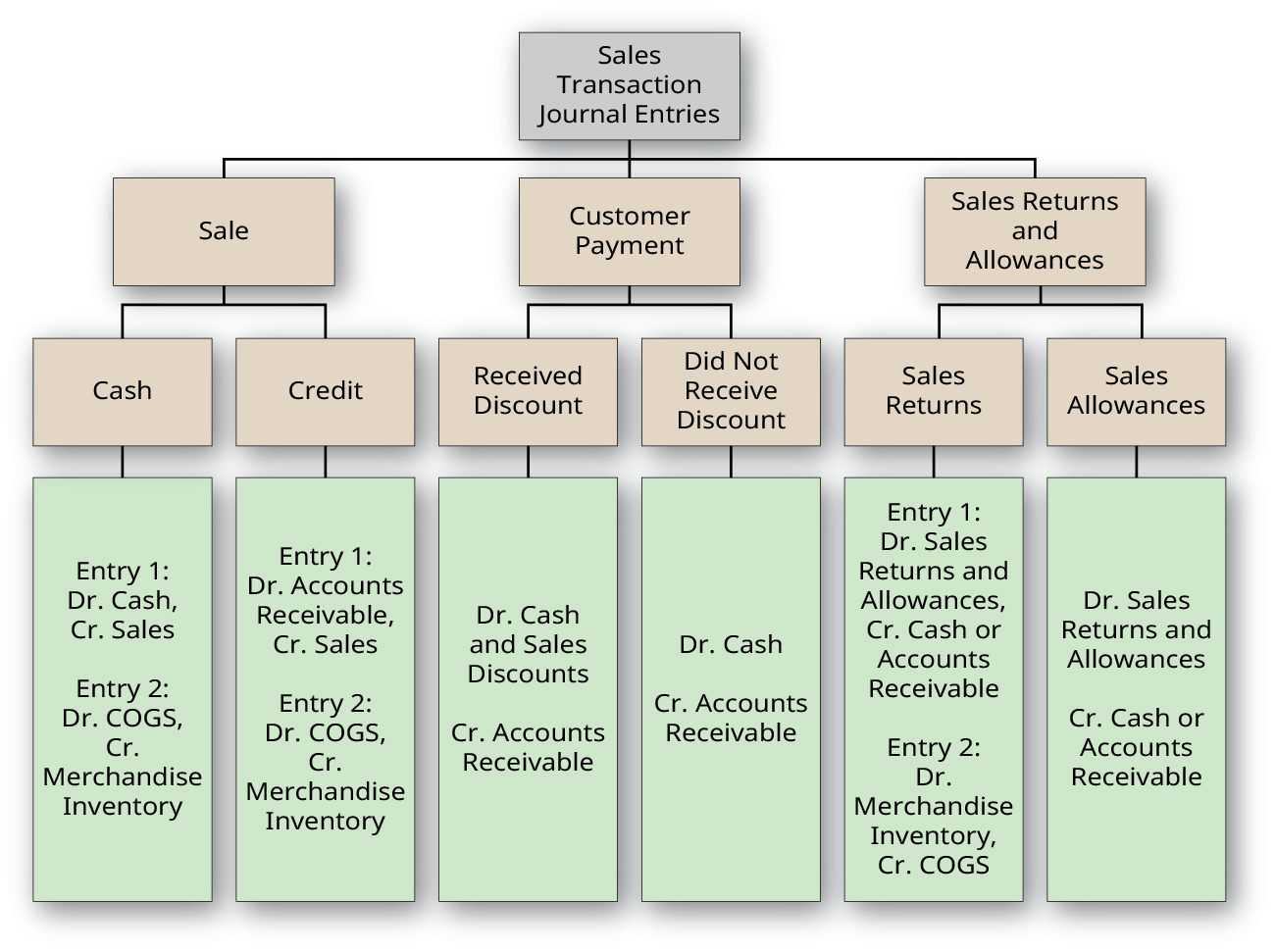

Summary of Sales Transaction Journal Entries

The chart in the Figure below represents the journal entry requirements based on various merchandising sales transactions.

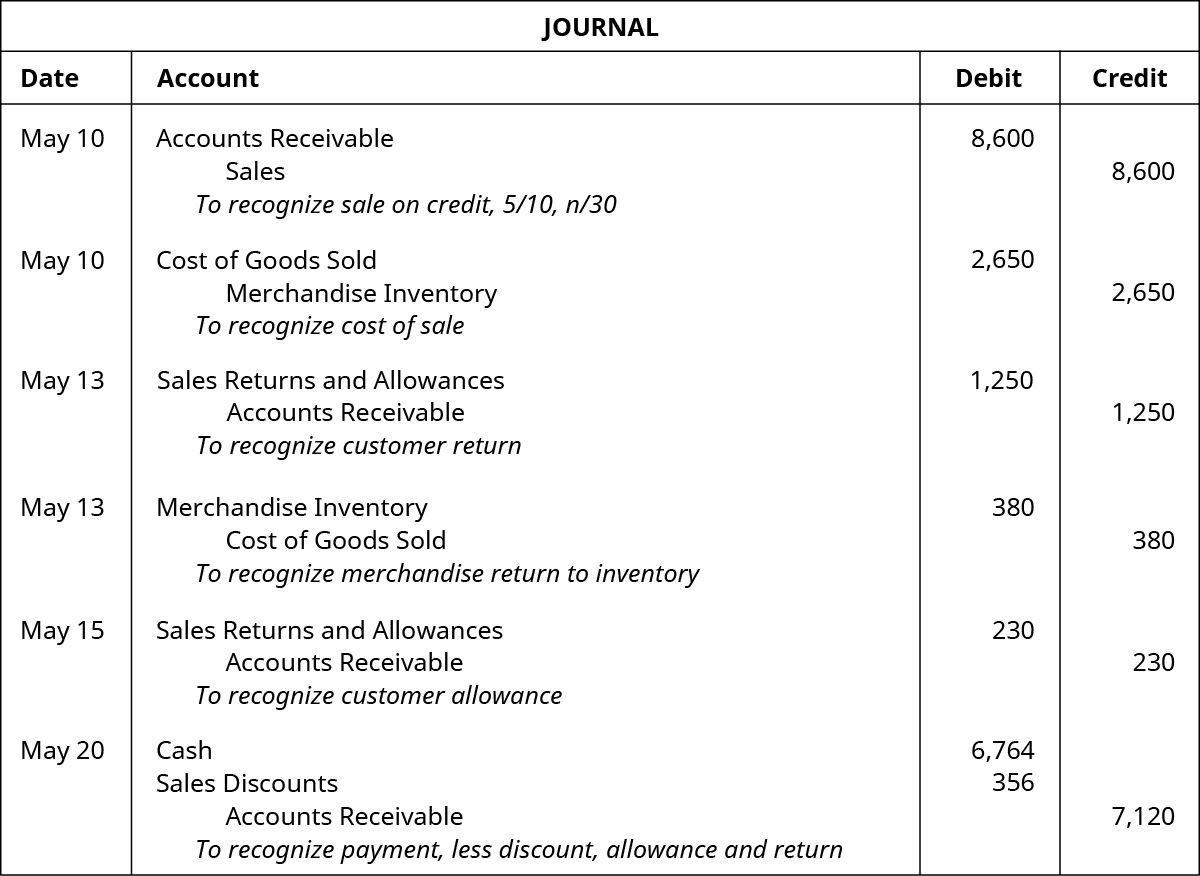

YOUR TURN

Record the journal entries for the following sales transactions of a retailer.

| May 10 | Sold $8,600 of merchandise on credit (cost of $2,650), with terms 5/10, n/30, and invoice dated May 10. |

| May 13 | The customer returned $1,250 worth of slightly damaged merchandise to the retailer and received a full refund. The retailer returned the merchandise to its inventory at a cost of $380. |

| May 15 | The customer discovered some merchandise were the wrong color and received an allowance from the retailer of $230. |

| May 20 | The customer paid the account in full, less the return and allowance. |

Solution

KEY TAKEAWAYS

Key Concepts and Summary

- A customer can pay with cash or on credit. If paying on credit instead of cash, Accounts Receivable increases rather than Cash; Sales increases in both instances. A company must also record the cost of sale entry, where Merchandise Inventory decreases and COGS increases.

- If a customer pays for merchandise within the discount window, the company would debit Cash and Sales Discounts while crediting Accounts Receivable. If the customer pays outside the discount window, the company debits Cash and credits Accounts Receivable only.

- If a customer returns merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash. The company may return the merchandise to their inventory by debiting Merchandise Inventory and crediting COGS.

- If a customer obtains an allowance for damaged merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash. The company does not have to consider the merchandise condition because the customer keeps the merchandise in this instance.

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting