LO 7.4 Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet

Because of the dynamic relationship between cost of goods sold and merchandise inventory, errors in inventory counts have a direct and significant impact on the financial statements of the company. Errors in inventory valuation cause mistaken values to be reported for merchandise inventory and cost of goods sold due to the toggle effect that changes in either one of the two accounts have on the other. As explained, the company has a finite amount of inventory that they can work with during a given period of business operations, such as a year. This limited quantity of goods is known as goods available for sale and is sourced from

- beginning inventory (unsold goods left over from the previous period’s operations); and

- purchases of additional inventory during the current period.

These available inventory items (goods available for sale) will be handled in one of two ways:

- be sold to customers (normally) or be lost due to shrinkage, spoilage, or theft (occasionally), and reported as cost of goods sold on the income statement; OR

- be unsold and held in ending inventory, to be passed into the next period, and reported as merchandise inventory on the balance sheet.

Fundamentals of the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet

Understanding this interaction between inventory assets (merchandise inventory balances) and inventory expense (cost of goods sold) highlights the impact of errors. Errors in the valuation of ending merchandise inventory, which is on the balance sheet, produce an equivalent corresponding error in the company’s cost of goods sold for the period, which is on the income statement. When cost of goods sold is overstated, inventory and net income are understated. When cost of goods sold is understated, inventory and net income are overstated. Further, an error in ending inventory carries into the next period, since ending inventory of one period becomes the beginning inventory of the next period, causing both the balance sheet and the income statement values to be wrong in year two as well as in the year of the error. Over a two-year period, misstatements of ending inventory will balance themselves out. For example, an overstatement to ending inventory overstates net income, but next year, since ending inventory becomes beginning inventory, it understates net income. So over a two-year period, this corrects itself. However, financial statements are prepared for one period, so all this means is that two years of cost of goods sold are misstated (the first year is overstated/understated, and the second year is understated/overstated.)

In periodic inventory systems, inventory errors commonly arise from careless oversight of physical counts. Another common cause of periodic inventory errors results from management neglecting to take the physical count. Both perpetual and periodic updating inventory systems also face potential errors relating to ownership transfers during transportation (relating to FOB shipping point and FOB destination terms); losses in value due to shrinkage, theft, or obsolescence; and consignment inventory, the goods for which should never be included in the retailer’s inventory but should be recorded as an asset of the consignor, who remains the legal owner of the goods until they are sold.

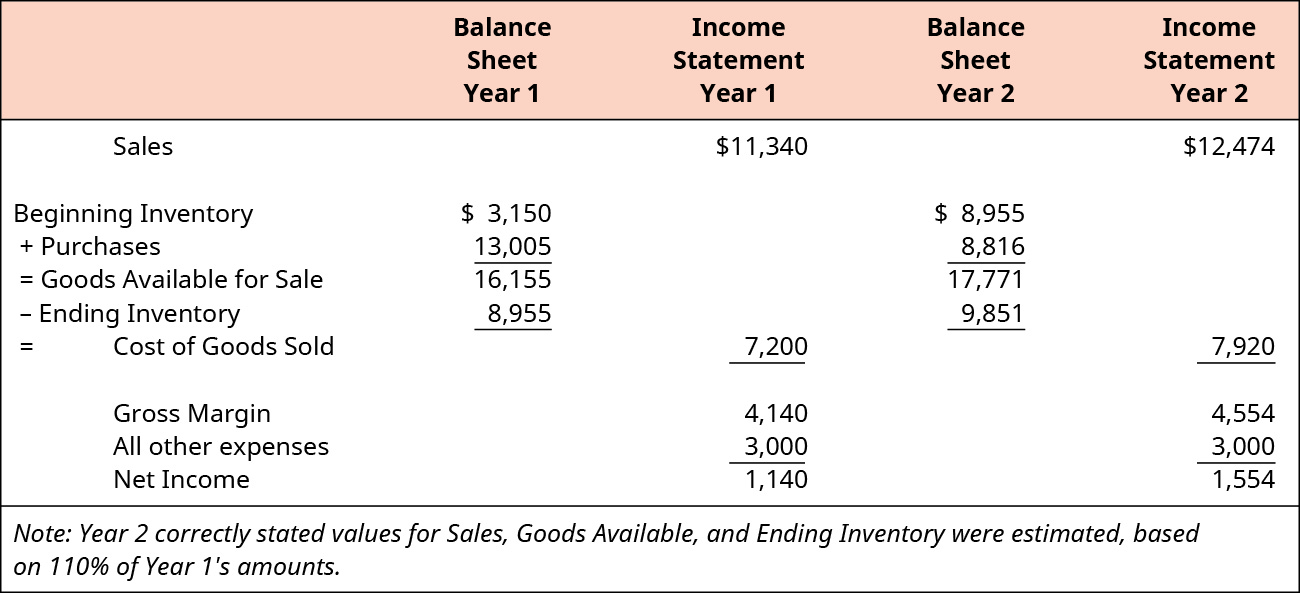

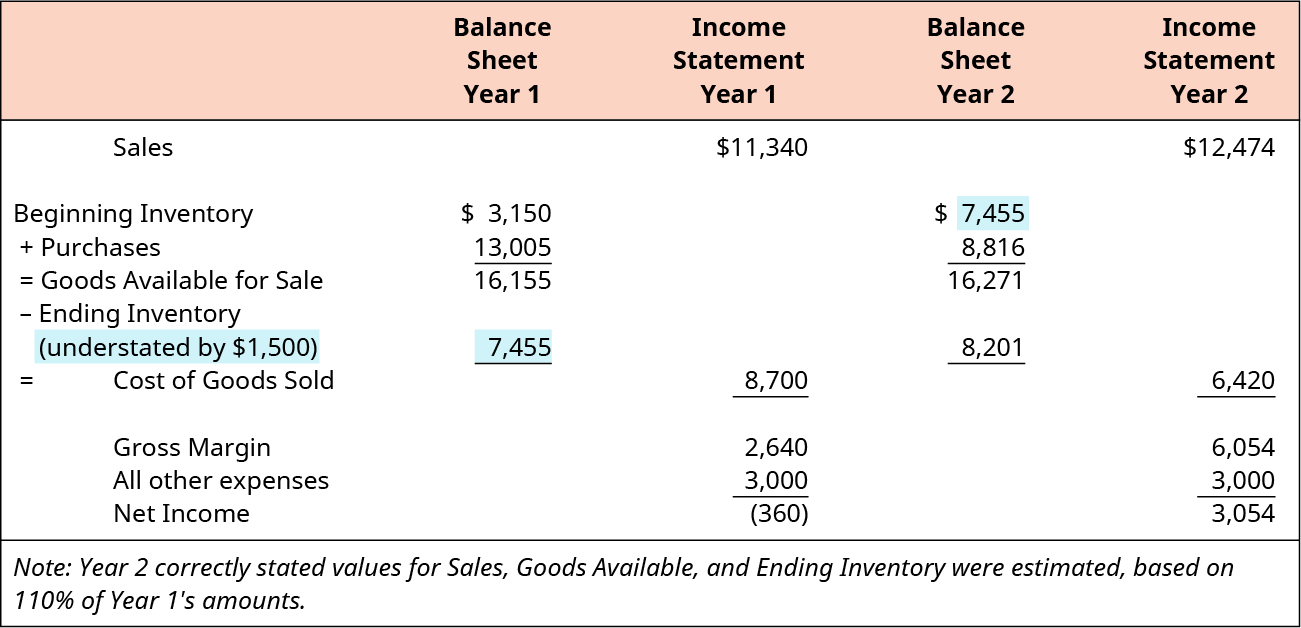

Calculated Income Statement and Balance Sheet Effects for Two Years

Let’s return to The Spy Who Loves You Company dataset to demonstrate the effects of an inventory error on the company’s balance sheet and income statement. Example 1 (see below) depicts the balance sheet and income statement toggle when no inventory error is present. Example 2 (see below) shows the balance sheet and income statement inventory toggle, in a case when a $1,500 understatement error occurred at the end of year 1.

Comparing the two examples with and without the inventory error highlights the significant effect the error had on the net results reported on the balance sheet and income statements for the two years. Users of financial statements make important business and personal decisions based on the data they receive from the statements and errors of this sort provide those users with faulty information that could negatively affect the quality of their decisions. In these examples, the combined net income was identical for the two years and the error worked itself out at the end of the second year, yet year 1 and year 2 were incorrect and not representative of the true activity of the business for those periods of time. Extreme care should be taken to value inventories accurately.

KEY TAKEAWAYS

Key Concepts and Summary

- The value for cost of the goods available for sale is dependent on accurate beginning and ending inventory numbers. Because of the interrelationship between inventory values and cost of goods sold, when the inventory values are incorrect, the associated income statement and balance sheet accounts are also incorrect.

- Inventory errors at the beginning of a reporting period affect only the income statement. Overstatements of beginning inventory result in overstated cost of goods sold and understated net income. Conversely, understatements of beginning inventory result in understated cost of goods sold and overstated net income.

- Inventory errors at the end of a reporting period affect both the income statement and the balance sheet. Overstatements of ending inventory result in understated cost of goods sold, overstated net income, overstated assets, and overstated equity. Conversely, understatements of ending inventory result in overstated cost of goods sold, understated net income, understated assets, and understated equity.

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting