LO 6.6 Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies

Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of retained earnings. The presentation format for many of these statements is left up to the business. For the income statement, this means a company could prepare the statement using a multi-step format or a simple format (also known as a single-step format). Companies must decide the format that best fits their needs.

Similarities and Differences between the Multi-Step and Simple Income Statement Format

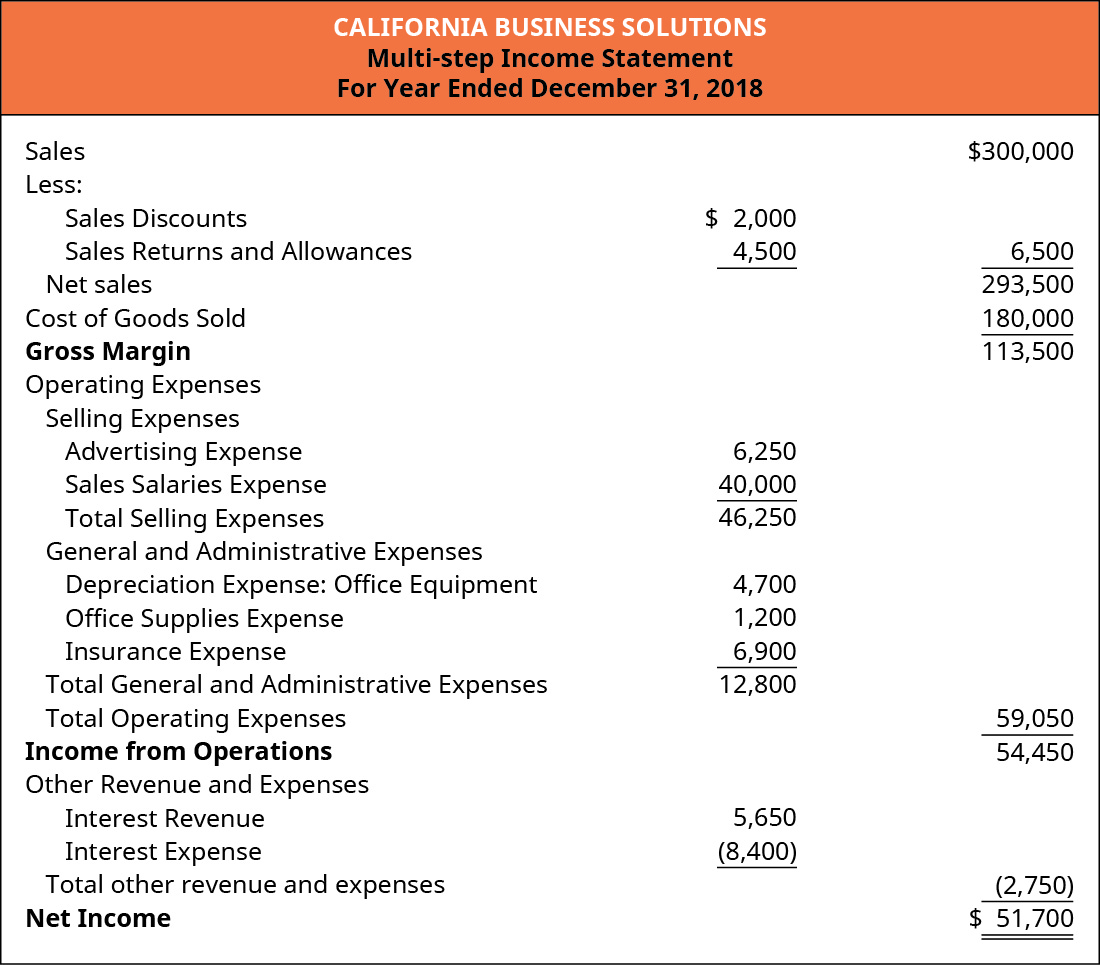

A multi-step income statement is more detailed than a simple income statement. Because of the additional detail, it is the option selected by many companies whose operations are more complex. Each revenue and expense account is listed individually under the appropriate category on the statement. The multi-step statement separates cost of goods sold from operating expenses and deducts cost of goods sold from net sales to obtain a gross margin.

Operating expenses are daily operational costs not associated with the direct selling of products or services. Operating expenses are broken down into selling expenses (such as advertising and marketing expenses) and general and administrative expenses (such as office supplies expense, and depreciation of office equipment). Deducting the operating expenses from gross margin produces income from operations.

Following income from operations are other revenue and expenses not obtained from selling goods or services or other daily operations. Other revenue and expenses examples include interest revenue, gains or losses on sales of assets (buildings, equipment, and machinery), and interest expense. Other revenue and expenses added to (or deducted from) income from operations produces net income (loss).

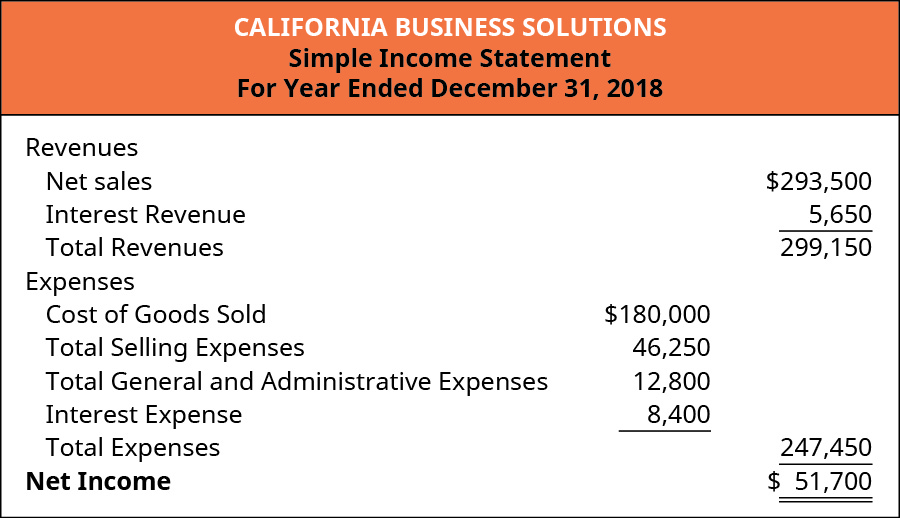

A simple income statement is less detailed than the multi-step format. A simple income statement combines all revenues into one category, followed by all expenses, to produce net income. There are very few individual accounts and the statement does not consider cost of sales separate from operating expenses.

Demonstration of the Multi-Step Income Statement Format

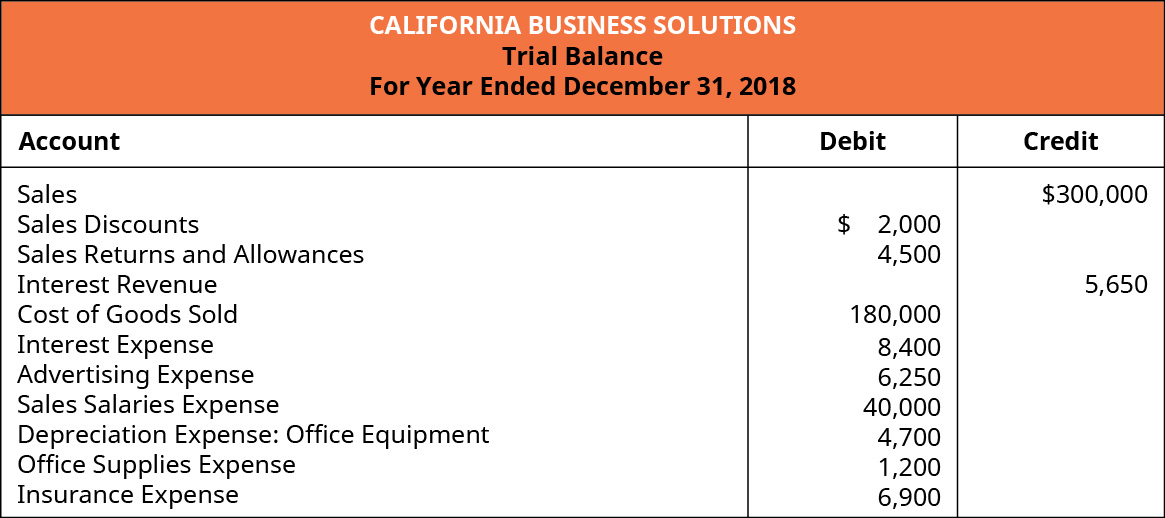

To demonstrate the use of the multi-step income statement format, let’s continue to discuss California Business Solutions (CBS). The following is select account data from the adjusted trial balance for the year ended, December 31, 2018. We will use this information to create a multi-step income statement. Note that the statements prepared are using a perpetual inventory system.

The following is the multi-step income statement for CBS.

Demonstration of the Simple Income Statement Format

We will use the same adjusted trial balance information for CBS but will now create a simple income statement.

The following is the simple income statement for CBS.

Final Analysis of the Two Income Statement Options

While companies may choose the format that best suits their needs, some might choose a combination of both the multi-step and simple income statement formats. The multi-step income statement may be more beneficial for internal use and management decision-making because of the detail in account information. The simple income statement might be more appropriate for external use, as a summary for investors and lenders.

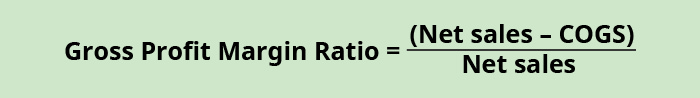

From the information obtained on the income statement, a company can make decisions related to growth strategies. One ratio that can help them in this process is the Gross Profit Margin Ratio. The gross profit margin ratio shows the margin of revenue above the cost of goods sold that can be used to cover operating expenses and profit. The larger the margin, the more availability the company has to reinvest in their business, pay down debt, and return dividends to shareholders.

Taking our example from CBS, net sales equaled $293,500 and cost of goods sold equaled $180,000. Therefore, the Gross Profit Margin Ratio is computed as 0.39 (rounded to the nearest hundredth). This means that CBS has a margin of 39% to cover operating expenses and profit.

Gross profit margin ratio = ($293,500 — $180,000) / $293,500 = 0.39 or 39%

THINK IT THROUGH

You are an accountant for a small retail store and are tasked with determining the best presentation for your income statement. You may choose to present it in a multi-step format or a simple income statement format. The information on the statement will be used by investors, lenders, and management to make financial decisions related to your company. It is important to the store owners that you give enough information to assist management with decision-making, but not too much information to possibly deter investors or lenders. Which statement format do you choose? Why did you choose this format? What are the benefits and challenges of your statement choice for each stakeholder group?

LINK TO LEARNING

KEY TAKEAWAYS

Key Concepts and Summary

- Multi-step income statements provide greater detail than simple income statements. The format differentiates sales costs from operating expenses and separates other revenue and expenses from operational activities. This statement is best used internally by managers to make pricing and cost reduction decisions.

- Simple income statements are not as detailed as multi-step income statements and combine all revenues and all expenses into general categories. There is no differentiation between operational and non-operational activities. Therefore, this statement is sometimes used as a summary for external users to view general company information.

- The gross profit margin ratio can show a company if they have a significant enough margin after sales revenue and cost data are computed to cover operational costs and profit goals. If a company is not meeting their target for this ratio, they may consider increasing prices or decreasing costs.

Glossary

- gross margin

- amount available after deducting cost of goods sold from net sales, to cover operating expenses and profit

- gross profit margin ratio

- proportion of margin a company attains, above their cost of goods sold to cover operating expenses and profit, calculated by subtracting cost of goods sold from total net revenue to arrive at gross profit and then taking gross profit divided by total net revenues

- income from operations

- gross margin less deductions for operating expenses

- net income

- when revenues and gains are greater than expenses and losses

- operating expenses

- daily operational costs not associated with the direct selling of products or services

- other revenue and expenses

- revenues and expenses not associated with daily operations, or the sale of goods and services

Adapted from Principles of Accounting, Volume 1: Financial Accounting (c) 2010 by Open Stax. The textbook content was produced by Open Stax and is licensed under a Creative Commons BY-NC-SA 4.0 license. Download for free at https://openstax.org/details/books/principles-financial-accounting

daily operational costs not associated with the direct selling of products or services

gross margin less deductions for operating expenses

revenues and expenses not associated with daily operations, or the sale of goods and services

when revenues and gains are greater than expenses and losses

proportion of margin a company attains, above their cost of goods sold to cover operating expenses and profit, calculated by subtracting cost of goods sold from total net revenue to arrive at gross profit and then taking gross profit divided by total net revenues