Preface

Welcome to Principles of Accounting, an OpenStax resource. This textbook was written to increase student access to high-quality learning materials, maintaining highest standards of academic rigor at little to no cost.

About OpenStax

OpenStax is a nonprofit based at Rice University, and it’s our mission to improve student access to education. Our first openly licensed college textbook was published in 2012, and our library has since scaled to over 30 books for college and AP® courses used by hundreds of thousands of students. OpenStax Tutor, our low-cost personalized learning tool, is being used in college courses throughout the country. Through our partnerships with philanthropic foundations and our alliance with other educational resource organizations, OpenStax is breaking down the most common barriers to learning and empowering students and instructors to succeed.

About OpenStax resources

Customization

Principles of Accounting is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA) license, which means that you can distribute, remix, and build upon the content, as long as you provide attribution to OpenStax and its content contributors, do not use the content for commercial purposes, and distribute the content under the same CC BY-NC-SA license.

Because our books are openly licensed, you are free to use the entire book or pick and choose the sections that are most relevant to the needs of your course. Feel free to remix the content by assigning your students certain chapters and sections in your syllabus, in the order that you prefer. You can even provide a direct link in your syllabus to the sections in the web view of your book.

Instructors also have the option of creating a customized version of their OpenStax book. The custom version can be made available to students in low-cost print or digital form through their campus bookstore. Visit the Instructor Resources section of your book page on openstax.org for more information.

Art attribution in Principles of Accounting

In Principles of Accounting, most art contains attribution to its title, creator or rights holder, host platform, and license within the caption. Because the art is openly licensed, anyone may reuse the art as long as they provide the same attribution to its original source.

To maximize readability and content flow, some art does not include attribution in the text. If you reuse art from this text that does not have attribution provided, use the following attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license.

Errata

All OpenStax textbooks undergo a rigorous review process. However, like any professional-grade textbook, errors sometimes occur. Since our books are web based, we can make updates periodically when deemed pedagogically necessary. If you have a correction to suggest, submit it through the link on your book page on openstax.org. Subject matter experts review all errata suggestions. OpenStax is committed to remaining transparent about all updates, so you will also find a list of past errata changes on your book page on openstax.org.

Format

You can access this textbook for free in web view or PDF through openstax.org, and for a low cost in print.

About Principles of Accounting

Principles of Accounting is designed to meet the scope and sequence requirements of a two-semester accounting course that covers the fundamentals of financial and managerial accounting. This book is specifically designed to appeal to both accounting and non-accounting majors, exposing students to the core concepts of accounting in familiar ways to build a strong foundation that can be applied across business fields. Each chapter opens with a relatable real-life scenario for today’s college student. Thoughtfully designed examples are presented throughout each chapter, allowing students to build on emerging accounting knowledge. Concepts are further reinforced through applicable connections to more detailed business processes. Students are immersed in the “why” as well as the “how” aspects of accounting in order to reinforce concepts and promote comprehension over rote memorization.

Coverage and scope

Our Principles of Accounting textbook adheres to the scope and sequence requirements of accounting courses nationwide. We have endeavored to make the core concepts and practical applications of accounting engaging, relevant, and accessible to students.

Principles of Accounting, Volume 1: Financial Accounting

Chapter 1: The Role of Accounting in Society

Chapter 2: Introduction to Financial Statements

Chapter 3: Analyzing and Recording Transactions

Chapter 4: The Adjustment Process

Chapter 5: Completing the Accounting Cycle

Chapter 6: Merchandising Transactions

Chapter 7: Accounting Information Systems

Chapter 8: Fraud, Internal Controls, and Cash

Chapter 9: Accounting for Receivables

Chapter 10: Inventory

Chapter 11: Long-Term Assets

Chapter 12: Current Liabilities

Chapter 13: Long-Term Liabilities

Chapter 14: Corporation Accounting

Chapter 15: Partnership Accounting

Chapter 16: Statement of Cash Flows

Principles of Accounting, Volume 2: Managerial Accounting

Chapter 1: Accounting as a Tool for Managers

Chapter 2: Building Blocks of Managerial Accounting

Chapter 3: Cost-Volume-Profit Analysis

Chapter 4: Job Order Costing

Chapter 5: Process Costing

Chapter 6: Activity-Based, Variable, and Absorption Costing

Chapter 7: Budgeting

Chapter 8: Standard Costs and Variances

Chapter 9: Responsibility Accounting and Decentralization

Chapter 10: Short-Term Decision-Making

Chapter 11: Capital Budgeting Decisions

Chapter 12: Balanced Scorecard and Other Performance Measures

Chapter 13: Sustainability Reporting

Engaging feature boxes

Throughout Principles of Accounting, you will find features that engage students by taking selected topics a step further.

- Your Turn. This feature provides students an opportunity to apply covered concepts.

- Concepts in Practice. This feature takes students beyond mechanics and illustrates the utility of a given concept for accountants and non-accountants. We encourage instructors to reference these as part of their in-class lectures and assessments to provide easily relatable applications.

- Think It Through. This scenario-based feature puts students in the role of decision-maker. With topics ranging from ethical dilemmas to conflicting analytical results, the purpose of this feature is to teach students that in the real world not every question has just one answer.

- Continuing Application at Work. This feature follows an individual company or segment of an industry and examines how businesspeople conduct the decision-making process in different situations. It allows students to see how concepts build on each other.

- Ethical Considerations. This feature illustrates the ethical implication of decisions, how accounting concepts are applied to real-life examples, and how financial and managerial decisions can impact many stakeholders.

- IFRS Connection. This feature presents the differences and similarities between U.S. GAAP and IFRS, helping students understand how accounting concepts and rules between countries may vary and thus affect financial reporting and decision-making.

- Link to Learning. This feature provides a very brief introduction to online resources and videos that are pertinent to students’ exploration of the topic at hand.

Pedagogical features that reinforce key concepts

- Learning Objectives. Each chapter is organized into sections based on clear and comprehensive learning objectives that help guide students on what they can expect to learn. After completing the modules and assessments, students should be able to demonstrate mastery of the learning objectives.

- Summaries. Designed to support both students and instructors, section summaries distill the information in each module down to key, concise points.

- Key Terms. Key terms are bolded the first time that they are used and are followed by a definition in context. Definitions of key terms are also listed in the glossary, which appears at the end of the chapter.

Assessments to test comprehension and practice skills

An assortment of assessment types are provided in this text to allow for practice and self-assessment throughout the course of study.

- Multiple Choice. are basic review questions that test comprehension.

- Questions include brief, open-response questions to test comprehension.

- Exercises (Sets A and B) are application Application questions that require a combination of quantitative and analytical skills.

- Problems (Sets A and B) are advanced Advanced activities that allow students to demonstrate learning and application of multiple learning objectives and skills concurrently in one set of facts. Problems are designed to assess higher levels of Bloom’s taxonomy.

- Thought Provokers are open-ended questions, often with more than one acceptable response, designed to stretch students intellectually.

Effective art program

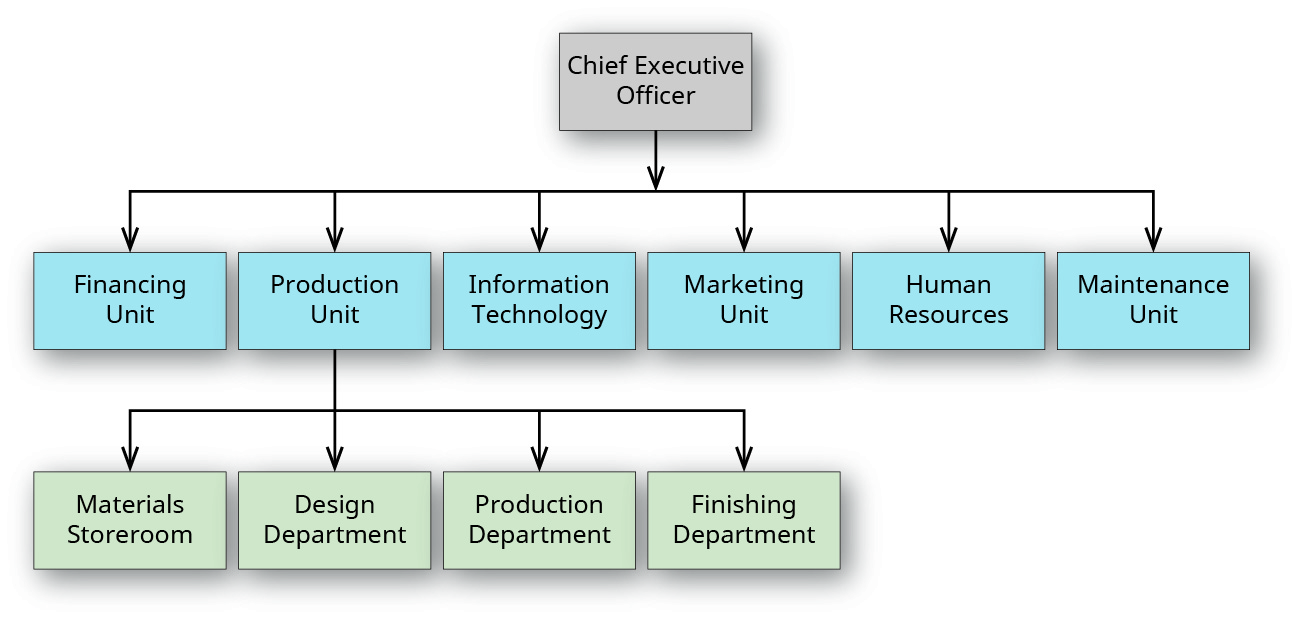

Our art program is designed to enhance students’ understanding of concepts through clear and effective presentations of financial materials and diagrams.

Additional resources

Student and instructor resources

We’ve compiled additional resources for both students and instructors, including Getting Started Guides, an instructor solution guide, and companion presentation slides. Instructor resources require a verified instructor account, which you can apply for when you log in or create your account on openstax.org. Instructor and student resources are typically available within a few months after the book’s initial publication. Take advantage of these resources to supplement your OpenStax book.

Community Hubs

OpenStax partners with the Institute for the Study of Knowledge Management in Education (ISKME) to offer Community Hubs on OER Commons—a platform for instructors to share community-created resources that support OpenStax books, free of charge. Through our Community Hubs, instructors can upload their own materials or download resources to use in their own courses, including additional ancillaries, teaching material, multimedia, and relevant course content. We encourage instructors to join the hubs for the subjects most relevant to your teaching and research as an opportunity both to enrich your courses and to engage with other faculty.

To reach the Community Hubs, visit www.oercommons.org/hubs/OpenStax.

Technology partners

As allies in making high-quality learning materials accessible, our technology partners offer optional low-cost tools that are integrated with OpenStax books. To access the technology options for your text, visit your book page on openstax.org.

About the authors

Senior contributing authors

Mitchell Franklin, Le Moyne College (Financial Accounting)

Mitchell Franklin (PhD, CPA) is an Associate Professor and Director of Undergraduate and Graduate Accounting Programs at Le Moyne College’s Madden School of Business. His research interests include the impact of tax law on policy, and innovative education in both financial accounting and taxation, with articles published in journals including Issues in Accounting Education, Advances in Accounting Education, Tax Notes, Journal of Taxation, and The CPA Journal and Tax Adviser. He teaches introductory and advanced courses in individual and corporate taxation as well as financial accounting. Prior to joining Le Moyne College, he served on the faculty at Syracuse University.

Patty Graybeal, University of Michigan-Dearborn (Managerial Accounting)

Patty Graybeal received her BBA from Radford University and her MACCT and PhD from Virginia Tech. She teaches undergraduate and graduate courses in financial, managerial, governmental, and international accounting. She has published scholarly articles on performance plans and compensation structures, as well as bankruptcy prediction, and she currently focuses on pedagogical issues related to instructional methods and resources that enhance student academic success. Prior to UM-Dearborn, she was on the faculty at Wake Forest University, George Mason University, and Virginia Tech. She brings significant real-world experience to the classroom from her prior work in healthcare administration and her current work with the auto industry.

Dixon Cooper, Ouachita Baptist University

Dixon Cooper received his BBA in Accounting and MS in Taxation from the University of North Texas. He has taught undergraduate and graduate courses in accounting, finance, and economics. In addition to his academic activities, he served for approximately fifteen years as an author/editor for the AICPA’s continuing education program and maintained a tax compliance and financial services practice. He also has several years of experience in public accounting and consulting. Prior to teaching at Ouachita Baptist University, he was a faculty member at the University of North Texas, Texas Christian University Austin College, and the University of Arkansas.

Contributing authors

LuAnn Bean, Florida Institute of Technology

Ian Burt, Niagara University

Shana Carr, San Diego City College

David T. Collins, Bellarmine University

Shawna Coram, Florida State College at Jacksonville

Kenneth Creech, Briar Cliff University

Alan Czyzewski, Indiana State University

Michael Gauci, Florida Atlantic University

Cindy Greenman, Embry-Riddle Aeronautical University

Michael Haselkorn, Bentley University

Christine Irujo, Westfield State University

Cynthia Johnson, University of Arkansas at Little Rock

Cynthia Khanlarian, North Carolina Agricultural and Technical State University

Terri Lukshaitis, Ferris State University

Debra Luna, Southwest University

Bill Nantz, Houston Community College

Tatyana Pashnyak, Bainbridge State College

Brian Pusateri, University of Scranton

Ellen Rackas, Muhlenberg College

Marianne Rexer, Wilkes University

Roslyn Roberts, California State University, Sacramento

Rebecca Rosner, Long Island University

Jeffrey J. Sabolish, University of Michigan-Flint

Jason E. Swartzlander, Bluffton University

Diane Tanner, University of North Florida

Mark M. Ulrich, Queensborough Community College

Janis Weber, University of Louisiana Monroe

Linda Williams, Tidewater Community College

Darryl Woolley, University of Idaho

Reviewers

Janice Akao, Butler Community College

Chandra D. Arthur, Cuyahoga Community College

Kwadwo Asare, Bryant University

Dereck Barr-Pulliam, University of Wisconsin–Madison

John Bedient, Albion College

Debra Benson, Kennesaw State University

Amy Bourne, Oregon State University

Stacy Boyer-Davis, Northern Michigan University

Dena Breece, Methodist University

Lawrence Chui, University of St. Thomas, Minnesota

Sandra Cohen, Columbia College Chicago

Bryan Coleman, Assumption College

Sue Cooper, Salisbury University

Constance Crawford, Ramapo College of New Jersey

Cori O. Crews, Valdosta State University

Annette Davis, Glendale Community College

Ronald de Ramon, Rockland Community College

Julie Dilling, Moraine Park Technical College

Terry Elliott, Morehead State University

Jim Emig, Villanova University

Darius Fatemi, Northern Kentucky University

Rhonda Gilreath, Tiffin University

Alan Glazer, Franklin & Marshall College

Marina Grau, Houston Community College

Amber Gray, Adrian College

Jeffry Haber, Iona College

Michelle Hagadorn, Roanoke College

Regina Ivory Butts, Fort Valley State University

Simone Keize, Broward College

Christine Kloezeman, California State University, Los Angeles

Lauri L. Kremer, Lycoming College

W. Eric Lee, University of Northern Iowa

Julie G. Lindsey, University of Phoenix

Jennifer Mack, Lindenwood University

Suneel Maheshwari, Indiana University of Pennsylvania

Richard Mandau, Piedmont Technical College

Josephine Mathias, Mercer County Community College

Ermira Mazziotta, Muhlenberg College

Karen B. McCarron, Georgia Gwinnett College

Michelle A. McFeaters, Grove City College

Britton McKay, Georgia Southern University

Christopher McNamara, Finger Lakes Community College

Glenn McQueary, Houston Community College

Tammy Metzke, Milwaukee Area Technical College

Stacey Mirinaviciene, Keuka College

Eleonor Moore, Kirtland Community College

Hassan Niazi, Northern State University

Felicia Olagbemi, Colorado State University-Global Campus

Suzanne Owens, Colorado Mesa University

Jenice Prather-Kinsey, University of Alabama at Birmingham

Tom Prieto, College of the Canyons

Atul Rai, Wichita State University

Kevin Raiford, College of Southern Nevada

Dave Repp, Strayer University

Patrick Rogan, Cosumnes River College

John Rossi, Moravian College

Angela Seidel, Saint Francis University

Margaret Shackell, Cornell University

Debra Sinclair, University of South Florida St. Petersburg

Mohsen Souissi, Fayetteville State University

Zivia Sweeney, University of Southern California

Tim Swenson, Sullivan University

Hai Ta, Niagara University

Andress Walker, Ventura County Community College District

Teresa Walker, Greensboro College

Roland Warfield, Seton Hill University

Michael Wiggins, Georgia Southern University

Joseph Winter, Niagara University

David Ziebart, University of Kentucky

- Open Stax at Rice University © Dec 9, 2020 OpenStax. Textbook content produced by Open Stax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License 4.0 .

- You can access the original version of this textbook here: Principles of Accounting Volume 1 – Financial Accounting: OpenStax

- Download for free at https://openstax.org/details/books/principles-financial-accounting BC Campus Open Publishing

- July 23, 2016 Open Stax textbook imported into Pressbooks by BC Campus Open Publishing. Updated February 10, 2021. Licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License 4.0 .

- South Puget Sound Community College 2021 – Adapted the BC Campus Pressbooks version of the textbook as follows:

- Formatting reapplied/adjusted

- Initial financial statements example converted from sole proprietorship to corporation

- Non-essential information deleted to shorten textbook

- Some content reorganized to ease students into learning (to lower the initial hurdles)

- Deleted end-of-chapter practice/application activities.

- Licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License 4.0 .